BUSINESS

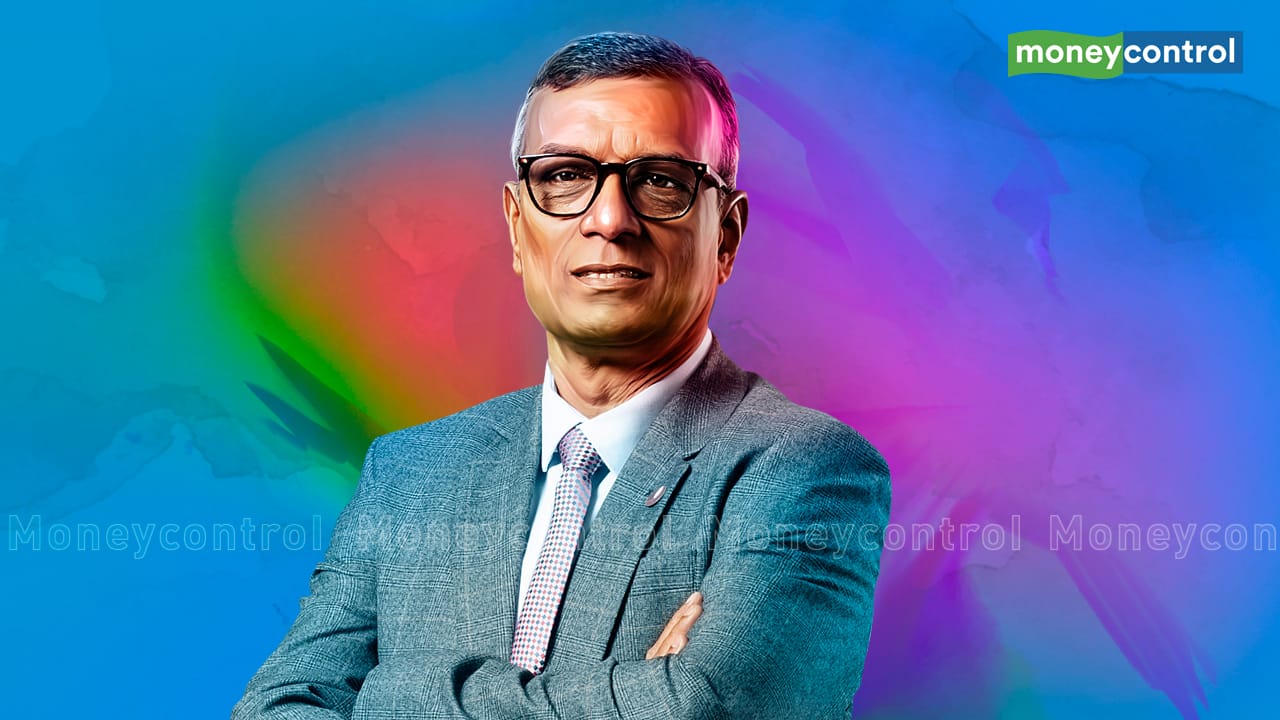

MC Interview | Expecting RBI to clear new MD and CEO by next month: South Indian Bank's Murali Ramakrishnan

South Indian Bank has reported a net profit of Rs 202.3 crore for the April-June quarter.

BUSINESS

Bandhan Bank open to explore RBI's CBDC pilot, says MD Chandra Shekhar Ghosh

Bandhan Bank is open to exploring RBI's CBDC pilot and is examining the opportunities it presents for the bank, MD and CEO Chandra Shekhar Ghosh tells Moneycontrol

BUSINESS

FSIB recommends 16 candidates for ED position in public sector banks

The bureau has interviewed 72 candidates from various public sector banks this month.

BUSINESS

Nabard’s Rs 3,000-5,000 crore green bond issue likely by March 2024: Chairman Shaji KV

Demand for green bonds in the domestic market has been low in the last two years due to the small investor base for this product.

BUSINESS

No public sector bank privatisation till 2024 general election: top government official

Bank privatisation has been on the anvil for successive governments but the plan hasn’t progressed due to stiff opposition from trade unions.

BUSINESS

Want to work in a bank? Check your CIBIL score first

IBPS makes a minimum CIBIL score of 650 as one of the conditions for the selection of bank employees.

BUSINESS

Rajnish Kumar dismisses Ashneer Grover's attack, asserts chairman role at SBI

"Over the period of time, banks will become fintech and fintech will become bank," says Rajnish Kumar, Chairman, BharatPe.

BUSINESS

MC Explains | RBI rejects 3 more SFB licence applications; all you need to know

The applications were rejected as the central bank had found the applicants unsuitable to set up a small finance bank. Other applications are still being scrutinised by the RBI.

BUSINESS

Bank lending rises to 41% for NBFCs as market borrowing gets tougher

Experts said another decent source of credit supply to NBFCs was the external commercial borrowing (ECB) route, which too has become less attractive to NBFCs due to taxation and higher hedging costs

BUSINESS

MC Exclusive: Shailendra Ajmera to submit revised Go First revival plan to DCGA today

Following presentation of the plan, the DGCA will begin inspection of Go First’s fleet, which could take a week. If the fleet is found airworthy, the ban would be lifted and Go First could get back into business.

BUSINESS

Interview | Fino plans to almost triple deposits to Rs 3,500 crore by 2026

Fino is working on plans to become a small finance bank, although it hasn’t set a timeline, chief financial officer Ketan Merchant said.

BUSINESS

RBI Bulletin: Average ticket size of transactions through credit cards 3 times more than UPI in May

The UPI is expected to account for 90 percent share of retail digital transactions volume in the next five years

BUSINESS

Go First stops pilots’ retention allowance from July 1

Sources say that the airline’s senior management has asked pilots to stay with the company as it was hopeful of starting operations from July.

BUSINESS

Finmin asks IBA to look at bank retirees' demands within seven days

The FM has given a very serious type of consideration of our issues, said the All India Bank Pensioners & Retirees Confederation president.

BUSINESS

Exim Bank sees loan growth of 14-15% for FY24: Tarun Sharma

The Exim Bank deputy managing director is planning to raise $4 billion in foreign currency in FY24.

BUSINESS

South Indian Bank has received Rs 888 crore worth of Rs 2,000 notes

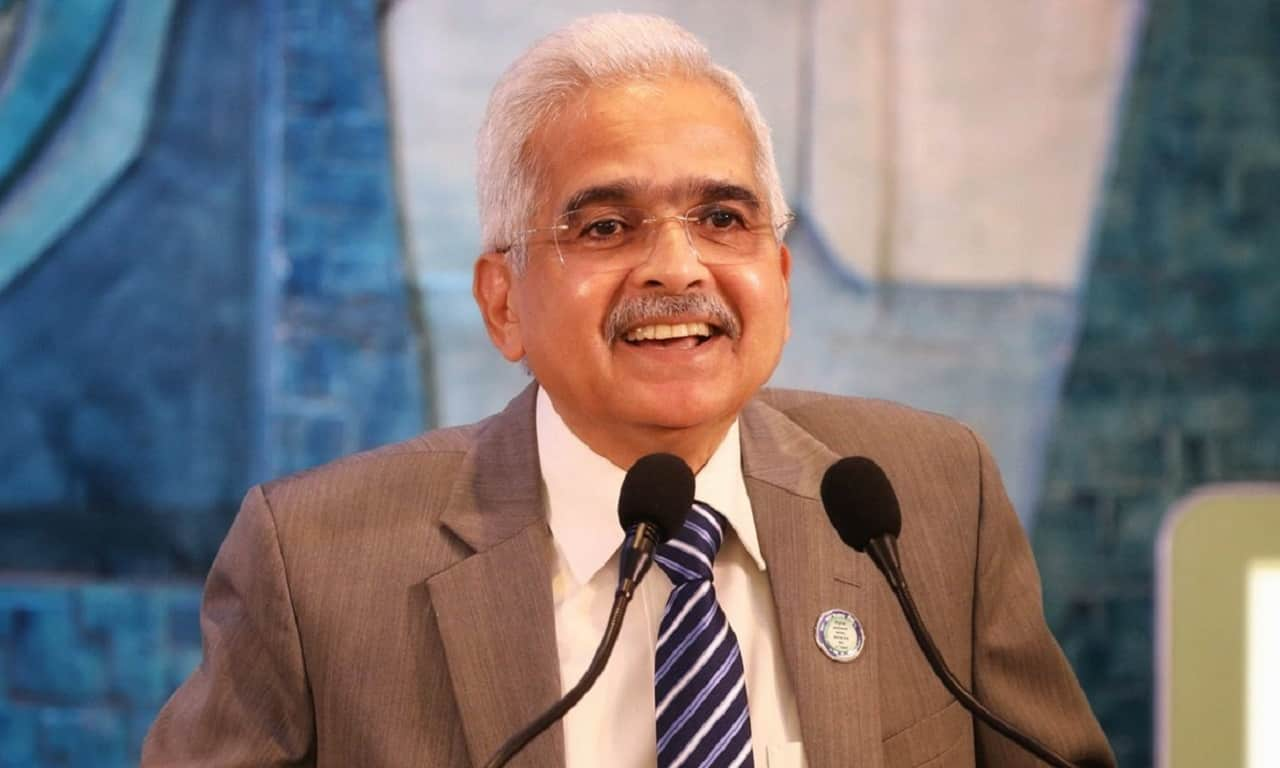

RBI Governor Shaktikanta Das said on June 8 that the central bank received Rs 1.8 lakh crore worth of Rs 2,000 notes, which was 50 percent of the notes in circulation

BUSINESS

Exclusive: Banks, LIC appoint SBI Capital Markets as merchant banker for stake sale in UTI mutual fund, say sources

The shareholding pattern of UTI mutual fund as on March 31 shows that PNB has a 15.22 percent stake, and Bank of Baroda, SBI and LIC hold 9.97 percent each

BUSINESS

Cyclone Biparjoy: FM Sitharaman meets top officials of banks, insurance firms to review preparedness

The cyclone is expected to make landfall near Jakhau port on June 15.

BUSINESS

RBI’s wilful defaulter loan settlement move: Trade unions see red, bankers welcome framework

On June 8, the RBI issued a circular which said that regulated entities may undertake compromise settlements of accounts categorised as wilful defaulters, without prejudice to the criminal proceedings against them. While some bankers say it will help to recover money faster, unions argue it will promote fraudsters.

BUSINESS

Interview | RBI likely to hold rates at least till December: IDFC First Bank economist Gaura Sengupta

The maximum impact of liquidity is likely to be in the month of June, with liquidity expected to reduce from July onwards as the currency leakage picks up, said Gaura Sengupta.

BUSINESS

MC Exclusive: Go First lenders open to extending fresh loans to revive airline’s operations

On June 1, Moneycontrol exclusively reported that GoFirst approached some of its lenders for fresh loans of up to Rs 225 crore.

BUSINESS

Bank of Baroda received Rs 10,000 cr in Rs 2,000 notes, 90% in deposits: Sources

Earlier, the RBI Governor had said that about 50 percent of the Rs 2,000 notes have been returned

BUSINESS

RBI MPC Meeting: Central bank looks to expand reach of RuPay cards

Monetary Policy Meet; RBI governor Shaktikanta Das has also said that banks will be allowed to issue RuPay prepaid forex cards for use at ATMs and PoS machines

BUSINESS

RBI Monetary Policy: Coming soon, regulatory framework for default-loss guarantee arrangement in digital lending

Monetary Policy Meet: The guidelines will further facilitate the development of the digital lending ecosystem, RBI governor Shaktikanta Das has said