BUSINESS

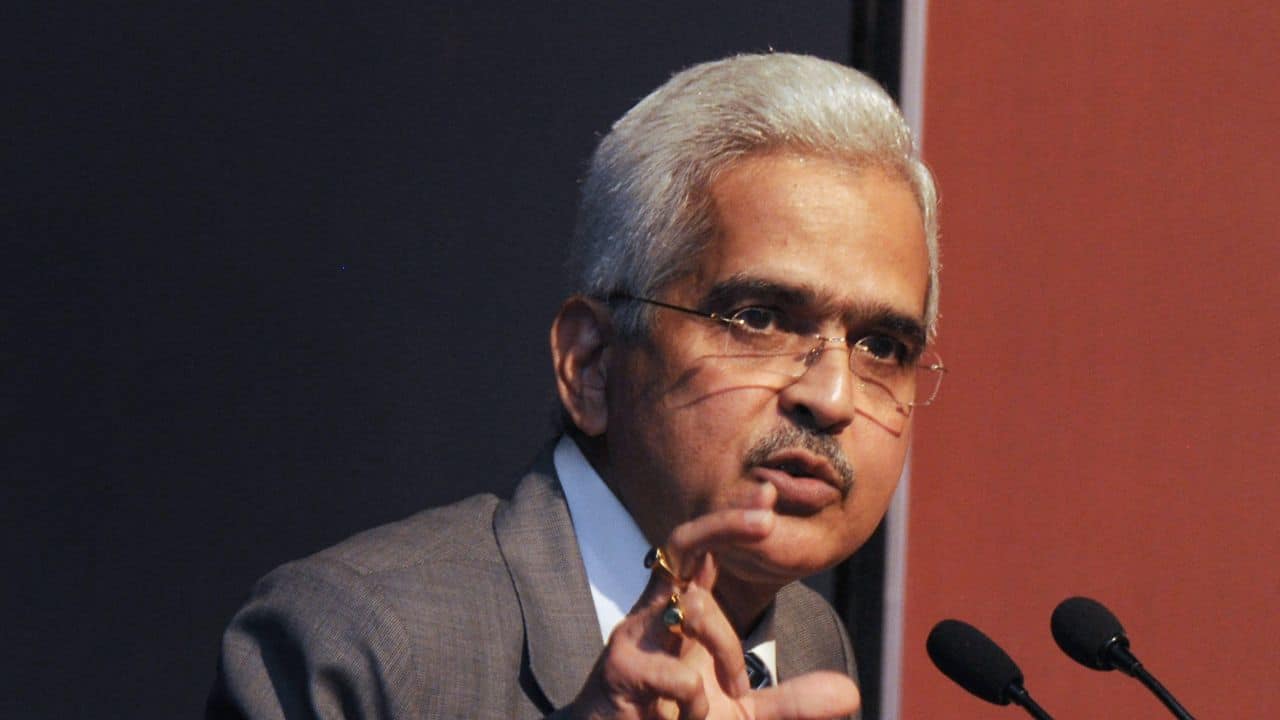

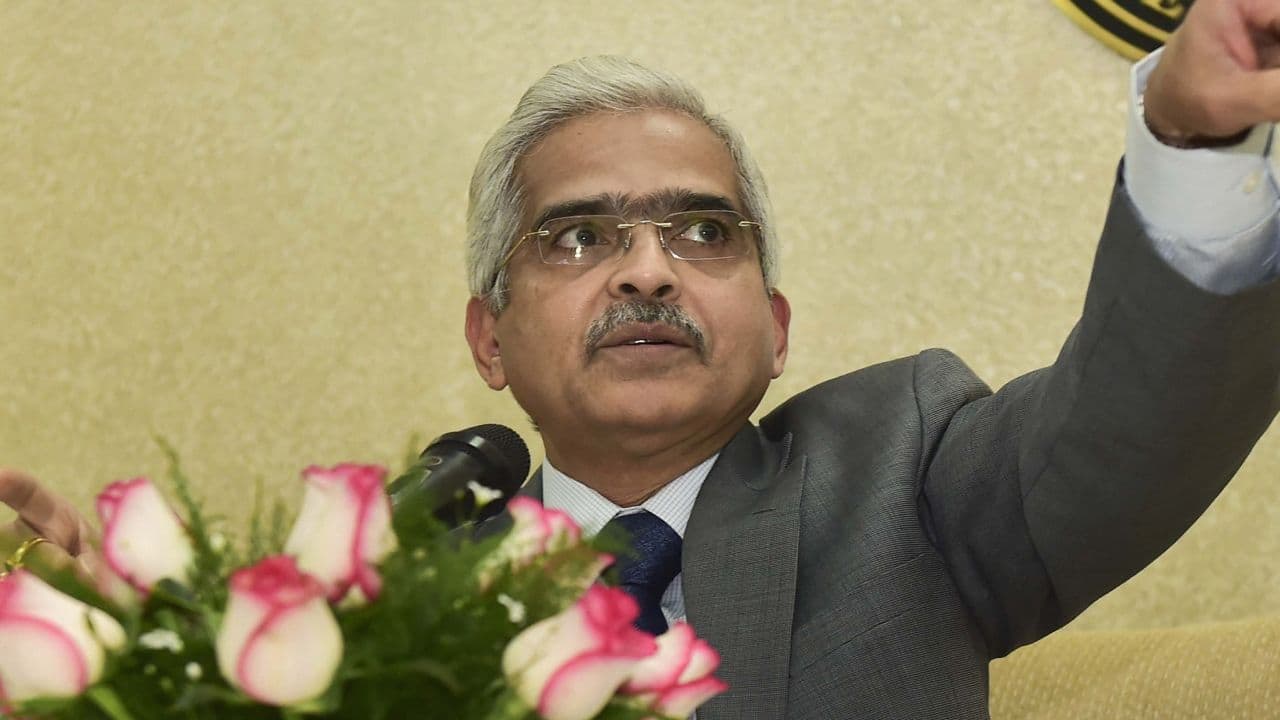

Banking Central | Debate on RBI’s ‘forward guidance’ continues

MPC members like Jayanth Varma, had questioned the efficacy of RBI’s forward guidance in the previous policy review meetings

BUSINESS

Exclusive Interview | This once-in-a-century public health shock has no playbook to follow, says Axis Bank Chief Economist Saugata Bhattacharya

RBI’s response since March 2020 has been exceptionally dynamic and proactive, using large surplus system liquidity levels as a significant instrument to anchor short term rates at low levels.

BUSINESS

Analysis | It's crystal clear now - RBI doesn't endorse cryptocurrencies

RBI's repeated caution and reiteration that the central bank has concerns on cryptocurrencies is a strong message to investors about the high risk of dealing in crypto assets in the absence of clear regulations.

BUSINESS

HDFC Bank withdraws its communication on cryptocurrency caution post RBI clarification

The bank had sent emails dated May 28, 2021 to some of the customers with the subject 'Caution Advice for dealing in virtual currency' probably due to the high-risk involved in such transactions.

TRENDS

Analysis | Why Deposit Insurance is a ray of hope for co-op bank customers amid RBI crackdown

Under DICGC scheme, on liquidation, every depositor would be entitled to receive deposit insurance claim amount of up to Rs five lakhs from the DICGC Act, 1961.

BUSINESS

IndusInd Bank shares take a beating after year-old report of Cayman Islands cancelling Hinduja Bank permit resurfaces

Shares down 6% intra-day. In May, 2020 last year, Cayman Islands cancelled licence of Hinduja Bank for various rule violations

BUSINESS

Analysis | RBI policy: No rate action likely, but watch out for FY22 GDP growth estimate

The concerns raised by the MPC in the last policy review on the growth-front remain broadly the same. Hence, a rate action is unlikely.

BUSINESS

Will Aditya Puri, Carlyle group entry be a game changer for PNB HFL?

The Puri brand and Carlyle’s deep-pockets will give an edge to the PNB HFL but it will be long before the HFC can challenge its bigger competitors.

BUSINESS

Analysis | Has RBI really endorsed crypto transactions in India?

The RBI has only asked banks not to shoot from its shoulder. The language indicates high caution. Banks will not have the backing of the regulator and will have to deal in crypto at their own risk.

BUSINESS

RBI clarifies on 2018 cryptocurrency circular, asks banks to carry out customer due diligence

This RBI circular came shortly after major Indian banks started warning customers against using their services to trade in cryptocurrencies.

BUSINESS

Banking Central: How helpful is the tweaked ECLGS scheme for COVID hit borrowers?

Considering the impact of Covid second wave lockdowns on the industries, especially small businesses, both the RBI and government will have to think beyond merely tweaking of ECLGS schemes.

BUSINESS

HDFC Bank penalty: What is RBI's message to India's largest private lender?

RBI probe and subsequent penalty confirms allegations of misselling and rule violations in HDFC Bank's auto loan division

BUSINESS

Exclusive | Timely resolution as per RBI’s package and vaccination key monitorable, says IDBI Bank DMD Suresh Khatanhar

Sectors like Hospitality, Restaurant and aviation are largely impacted apart from self-employed, Micro and Small units/business in containments zones

BUSINESS

Mehul Choksi’s rise and fall from a celebrity Diamond King to a fugitive wilful defaulter on the run

Choksi once controlled an empire with a claimed annual turnover of $ 2.5 billion, to which he couldn’t hold onto for long; the Gitanjali empire collapsed when Choksi’s role in PNB fraud was made public.

BUSINESS

RBI Annual Report: Stress tests indicate banks have sufficient capital even in severe scenario

Bank-wise as well as system-wide supervisory stress testing provide clues for a forward-looking identifi cation of vulnerable areas, the RBI said in the report.

BUSINESS

More promoters move to make aggressive bids to regain control of their bankrupt companies

From the IDBI-Sivasankaran deal to Kapil Wadhawan’s offer for DHFL and Manoj Gaur settlement plan for Jaypee Group, old promoters are offering lenders payment propositions to take back control of their companies. What does this mean for the banking industry?

BUSINESS

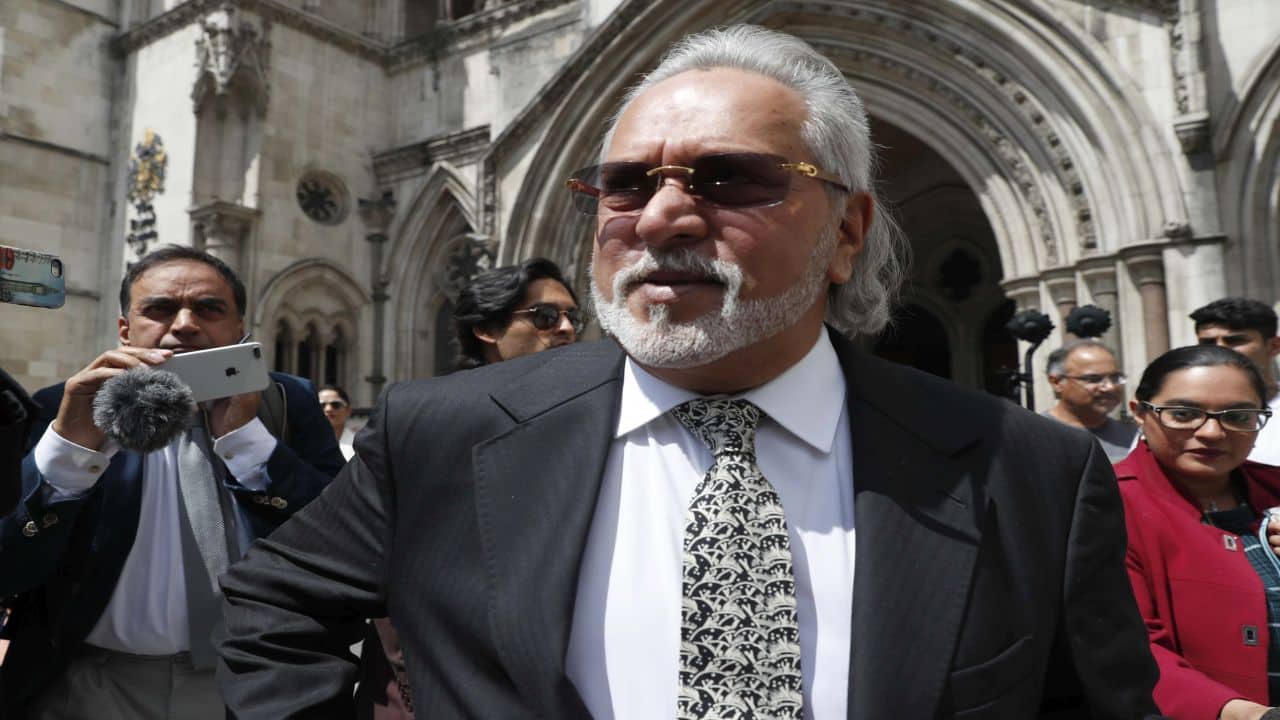

Five years since liquor King Vijay Mallya flew to UK: Four mistakes banks made in the Kingfisher case

Banks made the mistake of acting late in the Kingfisher case and paid the price for the laxity.

BUSINESS

DHFL administrator moves tribunal challenging NCLT order on Wadhawan offer; lenders may follow suit

DHFL’s lenders too are likely to move NCLAT challenging order to consider payment plan by former promoter Kapil Wadhwan.

BUSINESS

Banking Central | Is Section 29A being abused, hobbling IBC?

Recent developments show promoters still have the option to make a claim for their companies admitted under IBC. Doesn't that weaken the spirit of the law that intends to keep former promoters away from the bidding process?

BUSINESS

Why RBI surplus has gone up sharply this year?

Higher income from forex operations, expansion of G-Sec holdings due to large OMOs, TLTROs could have contributed to the spike in income, say economists.

BUSINESS

Why government shouldn’t delay cryptocurrency regulations

Cryptocurrencies, with no underlying asset, pose high risk to investors. According to data from crypto exchanges, there are approximately 1.5 crore Indians who have invested in cryptocurrencies holding Rs 15,000 crore. There are 350 startups who operate in blockchain and crypto.

BUSINESS

SC empowers banks to chase defaulting promoters invoking personal guarantees: 5 questions answered

With this ruling, the SC has affirmed the November 2019, notification issued under the Insolvency and Bankruptcy Code (IBC) that permitted lenders to invoke personal insolvency proceedings against promoter guarantors

BUSINESS

Elon Musk’s ‘Diamond’ tweet on Bitcoin revives memories of Rana Kapoor’s YES Bank share sale

Rana Kapoor, the co-founder of YES Bank, had once equated his promoter shares in the bank to Diamonds, only to sell most of the shares a year later, shocking retail shareholders.

BUSINESS

Siva group-IDBI Bank deal divides bankers, triggers debate on weakening bankruptcy law

Under the agreed one-time settlement with Sivasankaran’s SIHL, banks will get 10 percent of their money owed which they say is better than liquidation value. Some eperts say defaulting promoters could use this way to take back control of their companies at a pittance.