BUSINESS

Why banks don't want disclosure of inspection reports, defaulter list under RTI

SBI, HDFC Bank, Axis have moved Supreme Court against RBI disclosure of inspection reports under RTI. These petitions are likely to come up for hearing on 22 July at the apex court.

BUSINESS

Banking Central | HDFC Bank's Q1 numbers carry a worrying message about the state of banking industry

For HDFC Bank, a jump in NPAs may not pose an immediate concern as it has the ability to absorb the impact but that may not be the case for smaller banks.

BUSINESS

HDFC Bank Chairman expects India's economy to grow at 'fair clip' in the near term

Chakraborty said the Bank has created a new business segment of commercial (MSME) and rural banking to capture the next wave of growth.

BUSINESS

Assam's MFI relief scheme to support stressed borrowers; Rs 25,000 crore incentives for regular repayments

Under category 1, up to Rs 25,000 incentive will be given for regular repayment of loans and maintaining good credit discipline while, under category 2, the government will clear overdue amount if payment is overdue by 1-89 days, the state government tweeted.

BUSINESS

Analysis | Bandhan Bank's June quarter business update reflects Covid pain, local factors

Covid trajectory will prove to be decisive for Bandhan Bank. A third wave would adversely hit the banking sector as a whole

BUSINESS

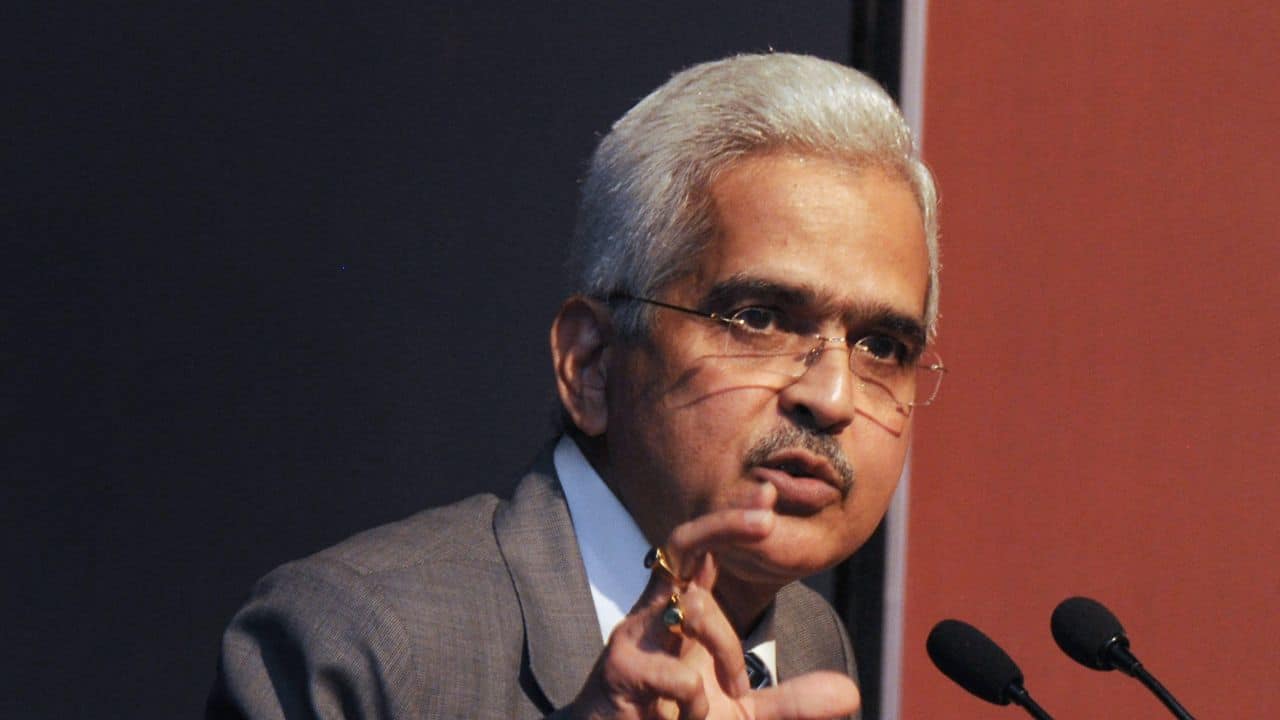

Stakeholders should be capable to address risks of mis-selling and cyber security, says RBI governor

Das' comments assume significance against the backdrop of rising instances of fraud in the banking sector including in the digital channels.

BUSINESS

RBI Bulletin: Near-term prospects of economy bright with tapering of second wave, aggressive vaccination

While several high frequency indicators of activity are recovering, a solid increase in aggregate demand is yet to take shape, the Bulletin said.

BUSINESS

RBI bars Mastercard from onboarding new domestic customers: 8 key questions answered

RBI, the banking regulator, said the card company had failed to comply with a requirement to store all data related to domestic customers and transactions within the country.

BUSINESS

RBI bars Mastercard from onboarding new domestic customers from July 22

Notwithstanding lapse of considerable time and adequate opportunities being given, the entity has been found to be non-compliant with the directions on Storage of Payment System Data, the RBI said.

BUSINESS

Sambandh Finserve: Office assets on sale, CEO arrested. How a scam led to the MFI’s collapse

Sambandh Finserve, once a prominent NBFC-MFI in Odisha, is now facing the regulator’s wrath. The RBI has issued a show cause notice to cancel the firm’s licence.

MCMINIS

Who regulates MFIs?

BUSINESS

MFI Industry mulls creation of a benchmark to assess household income, indebtedness of borrowers

This is likely to be part of the suggestions by the industry in response to the consultative paper. The RBI has given time till July 31 to banks, NBFCs including NBFC-MFIs, industry associations and other stakeholders to give the comments on the proposed rule changes.

BUSINESS

June CPI at 6.26%: Higher inflation adds to MPC’s woes, but growth focus will continue, say economists

The RBI had revised the inflation forecasts for FY22 to 5.1 percent during 2021-22 in the June policy. But the general consensus among economists is that inflation may average above that level in FY22.

BUSINESS

Banking Central| From the 'regulator' to the 'regulated', rules are meant to...

The Reserve Bank of India is a well-respected institution that cannot afford to dilute rules on after-retirement assignments and make mistakes. It is time for a reset.

BUSINESS

LIBOR Transition: What it means for Indian banks

It is widely expected that Secured Overnight Financing Rate will be accepted as the new benchmark rate. SOFR is linked to US treasury market transactions and is an identified replacement for USD LIBOR, which will be phased out at the end of 2021

BUSINESS

Can Carlyle-Aditya Puri combine pass the Sebi hurdle on PNB Housing deal?

SAT’s ruling in this case will be crucial to decide the fate of Carlyle’s Rs 4000-crore proposal in PNB Housing. If the deal doesn’t go through, it will be a big setback for Puri in his second innings.

BUSINESS

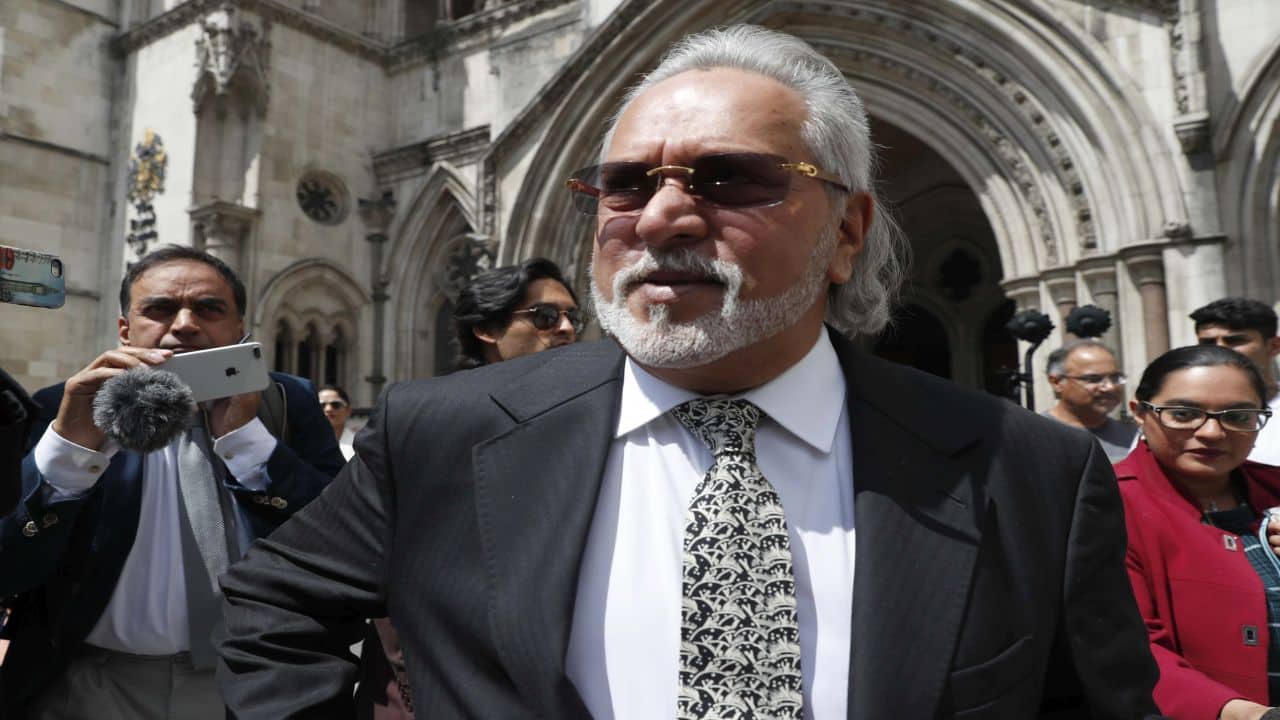

What next for banks post the Kingfisher loan recovery?

In fact, the recovery in the Kingfisher-Vijay Mallya case may be the best deal Indian banks may have got in a long time, with lenders recovering almost the entire principal amount by selling Mallya's shares.

BUSINESS

Analysis | Under Sashidhar Jagdishan, HDFC Bank is fighting two enemies simultaneously

At this point, the country's biggest private bank is fighting two battles — the COVID-19 impact and its own internal issues, under the new team headed by Sashidhar Jagdishan. The approaching quarters will tell us how successful the outcome will be.

BUSINESS

Interview | Employment generation is receiving alarmingly-little concerted policy attention: Crisil’s D K Joshi

Reforms have not benefitted the agriculture sector much, even as a disproportionate share of population continues to depend on it. Share of agriculture in GDP has nosedived from 35% in fiscal 1991 to 15% in fiscal 2020, yet the sector continues to employ over 40% of the population.

BUSINESS

Banking Central | Are 'haircuts' turning too costly for bankers?

While IBC cannot guarantee the quantum of recovery for banks but it can ensure that the platform is not misused by influential promoters to get back control of their companies through the backdoor.

BUSINESS

Pew Research: Devoted "all our attention and resources” for India religion survey

Worked with Indian survey companies and their interviewing teams to conduct interviews, says US-based PEW Research after doubts raised about methodology.

BUSINESS

RBI FSR Report | COVID second wave impact on financial institutions less than projected before: RBI Governor Shaktikanta Das

Capital and liquidity buffers are reasonably resilient to withstand future shocks for Indian banks, the RBI report said.

BUSINESS

Exclusive Interview: Pew survey bias in non-US countries cannot be ruled out, says former chief statistician Pronab Sen

For any national survey in India, there needs to be a sample size of minimum 70,000. For a survey that talks about states, sample size needs to be 1,20,000 and for district level surveys, sample needs to be 5.5 lakh to 6 lakh, Sen has said.

BUSINESS

30 years of economic reforms | Bottom 10% of population still do not live a dignified life: Senior economist Madan Sabnavis

This, unfortunately, is the result of market economics or economic Darwinism. The governments have worked to give freebies but have not been able to provide a sustainable living for them, he says.