BUSINESS

Page Industries: Robust earnings growth to continue

The management is planning to gain market share by aggressively enhancing the distribution presence as well as filling product gaps

BUSINESS

Nykaa: Strong growth prospects, but profitability improvement key to re-rating

While Nykaa has a strong brand image and increasing number of active users on the platform, margin pressure in the near term would limit any scope for re-rating

BUSINESS

Indian Hotels Company: Best is yet to come

With the industry uptrend, strong market positioning and margin improvement, IHCL is on course to deliver better earnings, going ahead

BUSINESS

Titan Company: Will the shiny outlook continue?

Titan, with a strong brand as well as parentage, has a huge runway for growth

BUSINESS

Lemon Tree Hotels: Will the stock continue its upward journey?

With strong earnings growth, favourable industry dynamics as well as attractive valuations, the stock would continue to re-rate

BUSINESS

Devyani International: On track to deliver strong earnings growth

With robust new store additions, menu innovation and margin improvement, DIL is poised to deliver strong earnings growth in the medium term

BUSINESS

Dhanuka Agritech: Volumes to pick up but margin pressure to sustain

The stock valuation offers little margin of safety for investors. Earnings drivers such as margin improvement as well as the benefits of backward integration with the commissioning of the Dahej plant would be available only in the next fiscal

BUSINESS

Metro Brands: Good fit for your portfolio

With aggressive store expansion and robust same-store sales growth (SSSG), owing to the focus on premiumisation, MBL is on track for a strong growth, going ahead.

BUSINESS

Jubilant FoodWorks: On a healthy, profitable growth path

JFL is enhancing its core Domino’s brand in India by opening new stores and would also scale up new businesses. Despite inflationary pressures and the split-store strategy, JFL has broadly maintained EBITDA margins over the past two quarters

BUSINESS

Larsen & Toubro: Robust growth across verticals to support higher earnings

L&T results beat expectations, and the strong performance on execution, order inflows as well as margins set the ground for higher earnings visibility

BUSINESS

Sharda Cropchem: Earnings pressure to sustain in near term

Given the earnings concerns in the near term, coupled with close to historical valuations, the stock provides no margin of safety for investors. Hence, we recommend investors to book profits

BUSINESS

Rallis India: Can this agrochemical stock re-rate?

The stock has corrected by 27 percent, in the past three months, hugely underperforming our agrochemical universe. Post the correction, the valuations have turned comfortable. With earnings expected to improve, the stock can re-rate hereon

BUSINESS

Thangamayil Jewellery: Strong start to FY23; growth momentum to sustain

With greenfield and brownfield store expansion, expected increase in farm income on the back of a projected normal rainfall, and the shift towards the organised segment, TMJL expects to sustain robust double-digit growth

BUSINESS

D-Mart: Results flex muscles; better placed in tough times

As indicated by the Q1FY23 performance, we expect D-Mart’s earnings growth trajectory to accelerate in the current fiscal as business conditions have almost normalised

BUSINESS

Titan Company: The Q1 shine just got brighter

Titan, one of the largest organised jewellery players, is seen to be a key beneficiary of hallmarking regulations

BUSINESS

Take note of this QSR scrip, post steep correction

The stock is currently trading at 13.5 times its FY24 EV/EBIDTA estimates. This is at a significant discount to other major QSR players. Current valuations adequately factor near term headwinds in Sri Lankan operations.

BUSINESS

PI Industries: Will it outperform domestic agrochemical players?

PIND expects margins to improve in the current fiscal, led by better product mix, operating leverage and manufacturing process improvement

BUSINESS

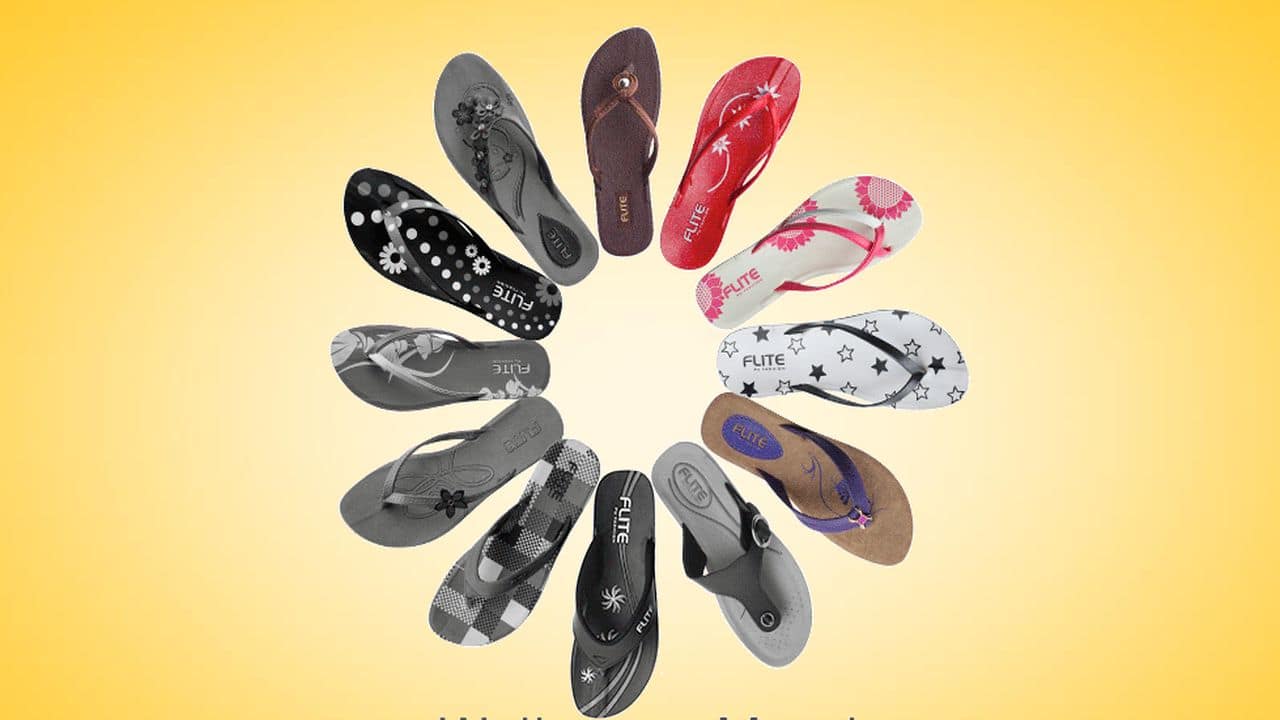

Relaxo Footwears: Is it a worthy fit for your portfolio?

With mobility increasing, post the drop in COVID-19 cases and channel partners restocking inventory (as the old GST rate inventory is liquidated), we expect volume growth in FY23.

BUSINESS

Construction sector: Better placed in current market scenario; prefer select stocks

With the revenue visibility over the medium term, and no material affect on the margins, construction space should deliver better earnings performance

BUSINESS

Retail sector: Long term looks sunny despite near-term woes

While there are near term headwinds in the form of subdued demand owing to increased prices, the long term outlook for the retail sector is bright. Market weakness should be used to add quality stocks in the portfolio

BUSINESS

Metro Brands: Stepping on to a high growth curve

Metro Brands has one of the best financial and operating metrices in the footwear industry. Driven by a robust store expansion and enhancement of online channel, the company is on track for a strong earnings growth

BUSINESS

Lemon Tree Hotels: Set to ride the industry upcycle

Corporate demand, which is the key for LMNT, has picked up significantly, with business events and conferences in full swing

BUSINESS

Restaurant Brands Asia: Set to emerge stronger, post COVID-19

We expect RBA to emerge as a much stronger quick service restaurant (QSR) player in the post COVID-19 scenario

BUSINESS

Jubilant FoodWorks: Poised for re-rating

Jubilant is looking for expansion of core Domino's brand with focus on profitability as well. The announcement of new CEO removes key leadership overhang the stock had been facing