BUSINESS

Everstone Group kickstarts prep to sell majority stake in Sahyadri Hospitals

In April 2019, Everstone had announced the buyout of a majority stake in Sahyadri Hospitals via a combination of primary and secondary capital with an intention to position it as the anchor asset of the former’s healthcare delivery platform.

BUSINESS

MC Exclusive | Promoters of Manipal Hospitals in talks to buy part stake from TPG; deal may value firm at Rs 18,000-Rs 20,000 crore

Bengaluru-based Manipal Hospitals which is targeting an IPO in the next two to three years is also backed by Singapore’s Temasek and quasi sovereign wealth fund National Investment and Infrastructure Fund (NIIF).

BUSINESS

Baring PE Asia emerges as front-runner for stake buy in Hyderabad’s AIG Hospitals

AIG, Hyderabad was set up in 1986 and is headed by Dr D Nageshwar Reddy. It has an 800-bed super-speciality hospital at Gachibowli and another 300-bed hospital in Somajiguda. Existing investor private equity firm Quadria Capital which holds a 30 percent stake in AIG Hospitals would exit the company as part of the proposed deal

BUSINESS

Sachin Bansal-led Navi Tech files papers for Rs 3,350-crore public offer

Navi has opted for the inorganic route in the past to enter segments and its businesses include lending, general insurance, mutual funds, and microfinance. The firm is awaiting approval from the RBI for a universal banking licence to build a bank from the ground up, utilising the technology stack built in-house. It also has a stockbroking licence from Sebi.

BUSINESS

Swiggy picks I-Sec, JP Morgan for blockbuster IPO; may raise over $1 billion

In January, Swiggy raised $700 million at a valuation of $10.7 billion, doubling its valuation in six months. The $700-million round was led by Invesco, with participation from new investors such as Baron Capital Group, Sumeru Venture, IIFL AMC Late Stage Tech Fund, Kotak, Axis Growth Avenues AIF- I, Sixteenth Street Capital, Ghisallo, Smile Group and Segantii Capital

BUSINESS

Exclusive | Mohit Burman: Plan to extend Eveready brand into new verticals, rejig board

The Burman family, the single largest shareholder of Eveready Industries, holding 19.85 per cent stake, has made an open offer to acquire an additional 26 percent share of the Khaitans-promoted company for Rs 604.76 crore.

BUSINESS

Sequoia & Flipkart Backed Wildcraft Kickstarts Trek To D-Street; Eyes 2022 IPO

According to its website, Wildcraft was incorporated in 1998 and is engaged in the manufacturing and distribution of head-to-toe products for trek-to-travel solutions and its founders include Dinesh KS, Gaurav Dublish and Siddharth Sood. In 2013, Wildcraft raised $11 mn from Sequoia Capital. Later in 2018, the firm saw investments from Flipkart Group ( providing it a distribution platform via Myntra) and Asia focused fund FidelisWorld ( which said it would leverage its global network to help the business grow in India and overseas)

BUSINESS

Vodafone to pare stake in Indus Towers; More deals in the works as Vi revival key

The promoters of the joint venture Indus Towers, Bharti Airtel and Vodafone Group, currently hold 41.73 percent and 28.12 percent stake in the company, respectively. Vodafone Idea (Vi), promoted by Vodafone Group and the Aditya Birla Group, desperately needs capital infusion to revive its operations

BUSINESS

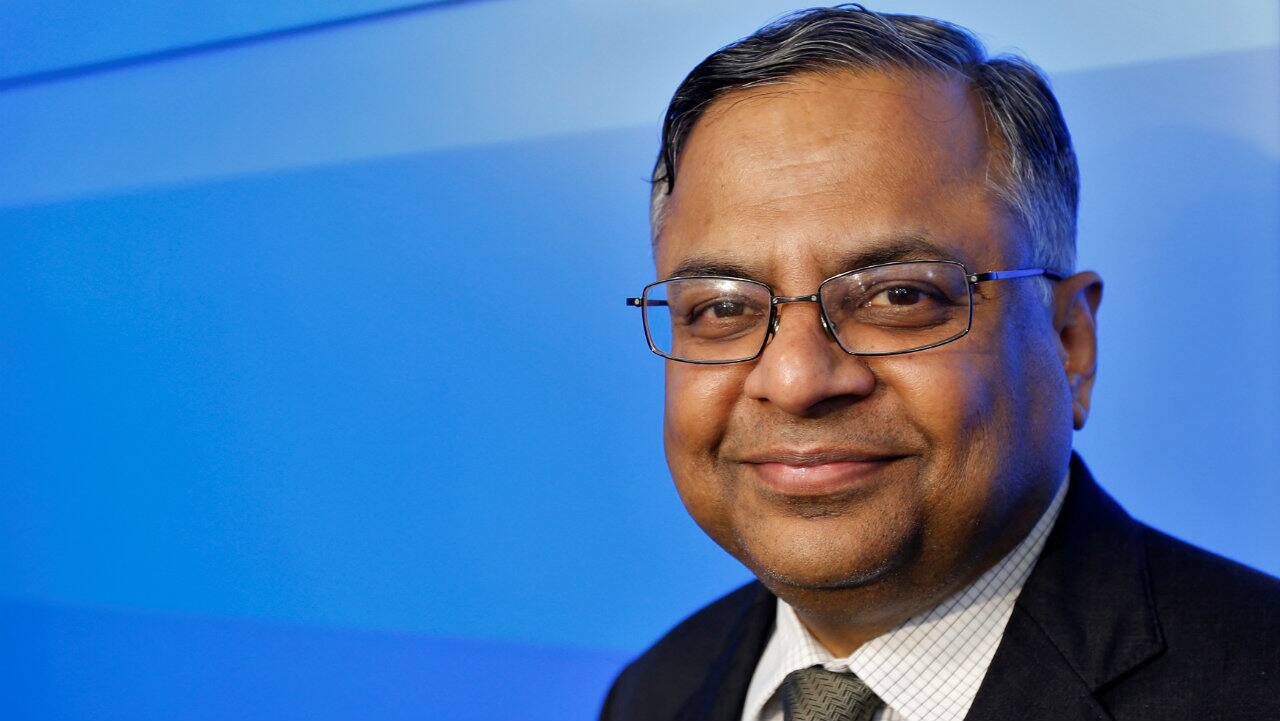

N Chandra gets extension as Tata Sons boss: Why are Deepak Parekh and Harsh Goenka bullish?

Moneycontrol caught up for a quick chat with India Inc veterans, Deepak Parekh, Chairman, HDFC Ltd, and Harsh Goenka, Chairman, RPG Enterprises on Chandra’s journey so far as the Tata Sons head honcho.

BUSINESS

Indigo co-founder stake sale: Five big questions on Rakesh Gangwal strategy

The move comes days after the other co-founder Rahul Bhatia, took over as the airlines’ Managing Director with immediate effect for a five-year term.

IPO

Softbank-backed FirstCry takes baby steps towards over $1-billion IPO, picks Kotak, Morgan Stanley

Pune-based FirstCry was founded in 2010 by Supam Maheshwari and Amitava Saha. It competes with Hopscotch and Kids Stop Press in the online segment and became a unicorn post raising around $296 million from largest shareholder Softbank in 2020.

BUSINESS

SBI MF selects 7 investment banks for $1-billion public listing

If the listing plans of SBI Mutual Fund fructify, it will become the fifth domestic mutual fund player to make a Dalal Street debut. HDFC Asset Management, UTI Asset Management Company, Nippon Life India Asset Management and Aditya Birla Sun Life AMC are the other listed peers. The last IPO from the SBI stable was from SBI Cards & Payment Services, which launched in March 2020, just before the outbreak of COVID-19 and raised around Rs 10,354 crore.

IPO

Macleods Pharma files papers for IPO, likely to be one of the biggest in sector

The Rs 6,480-crore IPO of Gland Pharma, which was launched in November 2020, holds the record for the biggest ever offering in the domestic pharma segment. In August 2021, Bain Capital-backed Emcure Pharma had filed papers with the regulator for a proposed Rs 4,500–Rs 5,000-crore IPO

BUSINESS

LIC IPO: Govt files draft papers with SEBI for mega listing; All eyes on March launch

LIC IPO: In Budget 2022, the government set a disinvestment target of Rs 65,000 crore for the next fiscal year. It also lowered the current fiscal year's target from Rs 1.75 lakh crore to Rs 78,000 crore. Back in July 2021, the Cabinet Committee on Economic Affairs had cleared the proposal for LIC's IPO.

BUSINESS

Big-bang sale of IDFC MF narrows down to 4-way race; winner likely by March-end

On September 17, 2021, the Board of Directors of IDFC Limited and IDFC Financial Holding Company Limited gave the nod to kickstart the divestment process for the mutual fund business subject to requisite regulatory approvals. Later, investment bank Citi was taken on board as the sell-side advisor for the deal.

BUSINESS

Budget 2022: Govt gives nod to new framework for cross-border insolvency cases

Budget 2022: Interestingly, the Economic Survey had pushed for a standardized framework for cross-border insolvency. It has also been highlighted in the report of the Insolvency Law Committee (ILC), which had recommended the adoption of the United Nations Commission On International Trade Law (UNCITRAL).

BUSINESS

Avendus Group in talks to acquire institutional equities biz of Spark Capital; may re-launch ECM practice

The decision follows a blitzkrieg of fund-raising by India Inc in 2021 with firms raising more than Rs 1 lakh crore via the IPO route, an all-time record for a calendar year.

BUSINESS

TPG-backed Evercare looking to exit Care Hospitals

In January 2016, Abraaj had purchased 72 per cent in Care Hospitals from Advent Capital for Rs 2,000 crore. Later, the Dubai-based fund collapsed following allegations of misappropriation and mismanagement of funds by its LPs (limited partners). In 2019, the reins were handed over to TPG backed Evercare Group, which revamped the leadership and initiated a clean-up act.

BUSINESS

I-Bank Jefferies plans major ECM push in India and S-E Asia; may onboard Jibi Jacob of Edelweiss

Christopher Wood, Ashish Agarwal and Mahesh Nandurkar are amongst senior executives of CLSA looking at equity strategy and research who had moved on earlier to join Jefferies. Jacob, a chartered accountant, has spent 14 years at Edelweiss Financial Services and had earlier worked as an associate at PwC.

BUSINESS

Race for Apollo Global’s BPO arm IGT Solutions: Who is in the shortlist?

New York headquartered Apollo Global had purchased IGT Solutions three years back from Indigo Airlines owner InterGlobe Enterprises. Other than travel and hospitality, it also operates in segments like land transportation, logistics, and cargo, e-commerce, and gaming.

BUSINESS

Jamil Khatri, KPMG India’s audit spearhead steps down

Khatri, who became partner at KPMG at the young age of 28, had founded the accounting advisory practice for India and was also the global head of the vertical

BUSINESS

Generali to hike stake and acquire control in both insurance JVs with Future Group

Private equity funds Premji Invest and True North amongst potential suitors for the residual stake sale plans of Future Group in both the general and life insurance joint ventures

BUSINESS

Fabindia files papers for 2022 listing, Premji Invest-backed firm joins apparel brand IPO party

On 10th January, Moneycontrol was the first to report that Delhi based Biba Apparels, which is backed by Warburg Pincus and Faering Capital, had shortlisted advisors for its proposed initial public offer. Sequoia Capital-backed women’s bottom-wear brand Go Colours raised Rs 1,014 crores via its IPO and made a stellar debut on the bourses in November, listing at a 90 percent premium to its issue price. Others like Manyavar owner Vedant Fashions ( backed by Kedaara Capital) are also preparing for an IPO

IPO

Adani Wilmar IPO likely to launch on January 27

The firm, which aims to be the largest food company in India by 2027, is trying to muscle its way in the fast-growing consumer segment and unlock value through the IPO. If the plans fructify, it will be the seventh firm to be listed from the diversified Adani group’s stable