BUSINESS

Moneycontrol Pro Panorama | The gap between sentiment and data

In today’s edition of Moneycontrol Pro Panorama: Indian startups face headwinds, defiant Indian economy not yet out of the woods, high stake game between Airbus and Boeing, Sachin Pilot’s Hamletian dilemma, and more

BUSINESS

RBI’s pause is a pivot killer with the 4 percent inflation target

RBI governor Das's emphasis on getting retail inflation down to 4 percent will mean the policy rate will stay high for longer

BUSINESS

RBI seen to stay in pause mode, but markets will seek clues on pivot

While the RBI may keep policy rates unchanged, any alteration in the stance would be seen as dovish by the markets.

BUSINESS

Moneycontrol Pro Panorama | Regulating the economy temperature gauge

In today’s edition of Panorama: SEBI proposes tightening disclosure for offshore funds, MGNREGA demand rises sharply, receding recession fears good sign for Indian IT, risky bets in business makes for better future, and more

BUSINESS

MC Explains : LIC’s transfer of funds to shareholders’ fund – is it a one-off event?

The transfer of funds will make more money available for LIC to pay dividends and issue bonus shares.

BUSINESS

RBI’s latest warnings show India’s banks need helicopter parenting

Evergreening is more sinister now as banks are indulging in the practice despite having complete knowledge of the risks involved.

BUSINESS

Moneycontrol Pro Panorama | Dancing elephants and awkward valuations

In today’s edition of Moneycontrol Pro Panorama: Tata Motors dominates electric car segment, new AI-based supervision model for ‘shadow banks’, term premium on government bond shrinks considerably, China's slow recovery and its impact on India, and more

BUSINESS

Liquidity frictions need a simple extinguisher from the RBI

The variable repo rate auction is a simple tool that the RBI can use to douse the fire in short-term rates now before it begins to cause damage to productive credit deployment.

BUSINESS

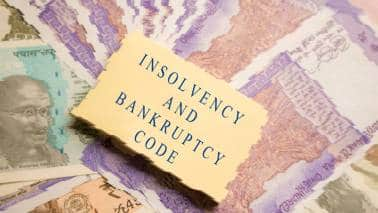

Beyond the dirty dozen, insolvency code resembles a scrap yard

While any new law is strengthened by arbitrations, having an abysmal track record on the speed of resolution even after seven years should not be taken lightly.

BUSINESS

Moneycontrol Pro Panorama | Inflation is easing, or is it?

In today’s edition of Moneycontrol Pro Panorama: Public sector banks end up on losing side, rise in rural consumption benefits consumer stocks, CA and CS now under PMLA ambit, business models need to be reviewed over time, and more

BUSINESS

The treacherous world of corporate loan pricing

Banks say the current wholesale loan rates do not fully reflect the risks involved and are hesitant on such loans due to potential mispricing.

BUSINESS

Expected credit loss provisioning could disrupt the PSU bank exuberance

Under ECL, banks will require to gauge the credit risk of the borrower and make anticipatory provisioning before a default has occurred unlike the current regime where banks provide once default has occurred.

BUSINESS

MC Exclusive: Canara Bank betting on retail & rural loan growth, says MD Raju

Although deposit growth was much lower than that of loans in FY23, Canara Bank does not need to raise capital for the next two years

BUSINESS

The Green Pivot: Indian banks aren’t doing enough green financing, quite the opposite

Bank credit to green industries has been growing faster than loan off take to traditional sectors in recent times. But lenders are far from being big financiers of green projects

BUSINESS

Chart of the Day: A dark decade for industrial credit

Part of this sharp deceleration was due to de-leveraging by corporates after undergoing massive stress on their balance sheets

BUSINESS

Mahindra Finance has fortified its book, but not enough for re-rating yet

The company’s biggest drawback has been its rather volatile track record on profitability. Delinquencies have been lumpy and so have provisions. But all that may be about to change

BUSINESS

Go First’s bankruptcy brings back questions about Indian banks’ lending acumen

At least four Indian banks now stand to lose interest income from their loans to Go First that owes a total of Rs 6521 crore to them. Bankruptcy proceedings would put a moratorium on loan repayments

BUSINESS

Uday Kotak’s curious mix of conservativeness and audacity

Kotak Mahindra Bank has been nibbling on unsecured loans since FY22 and now has taken big bites in this segment. It aims to increase the share of such loans from the current 10 percent to the mid-teens.

BUSINESS

Moneycontrol Pro Panorama | The irresistible world of credit cards

In today’s edition of Moneycontrol Pro Panorama: Investors may fall prey to NFOs, Karnataka could be staring at a hung Assembly, Nifty's complacency does not bode well, HUL's dipping price-led growth concerning, and more

BUSINESS

Life insurance stocks record renewed interest as investors shrug off growth concerns

Shares of the largest life insurer LIC have risen nearly 1 percent. ICICI Prudential Life Insurance Company's stock has gained nearly 2 percent, while Max Financial Services Ltd has gained roughly 1 percent. HDFC Life Insurance and SBI Life Insurance have gained more than 3 percent

BUSINESS

Is Bajaj Finance a prisoner of its own success?

Bajaj Finance’s ambition is to reach the 100 million customers mark. Will it succeed in a changing financial landscape rife with competition is the key question

BUSINESS

Why branch banking is making a comeback

Analysts at Elara Capital point out in their April 20 report that branches are critical to boosting a bank’s digital aspirations

BUSINESS

Moneycontrol Pro Panorama: Searching for a pivot amid a heat wave of inflation

In today’s edition of Moneycontrol Pro Panorama: Global uncertainty catches up with Indian markets, US drug shortages rekindle pharma recovery, India-US bond extends beyond politics, tough times ahead for Go First airlines, and more

BUSINESS

India’s consumers are hopeful, but holding back on big spends

Home loan enquiries volume shrank 1 percent in October-December, originations by 6 percent in a sign that potential borrowers are cautious and bankers even more so