Ruchi AgrawalMoneycontrol Research

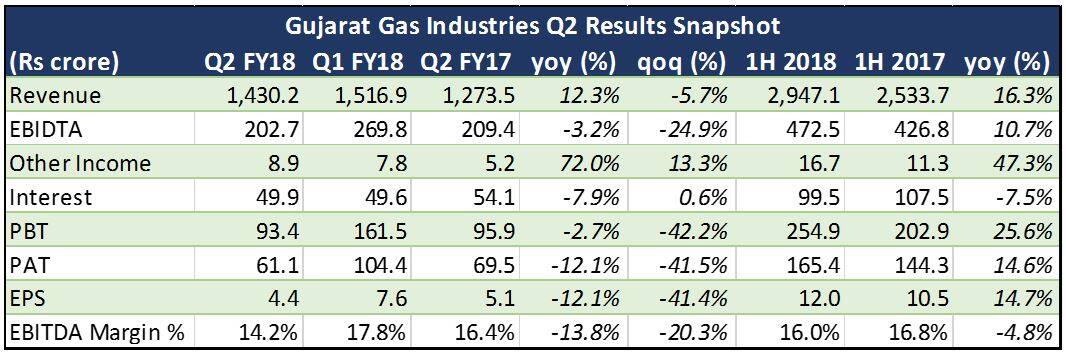

Gujarat Gas’s second quarter earnings performance was subdued, with volumes contracting and margins under pressure. Quarterly revenues rose 12 percent year-on-year, but declined 6 percent over the first quarter to Rs 1430 crore. The quarter-on-quarter decline in operating profits and net profit was even sharper, at 24 percent and 41 percent, respectively. (See table for details).

The weak performance could be attributed to 1) industrial disruptions with around 10 days lost in strikes on account of GST implementation 2) non-inclusion of gas in GST 3) lower offtake by industries due to flood in Gujarat. Contraction in sales negatively impacted the overall cost of raw material during Q2 due to lower pass-over of the expensive LNG costs.

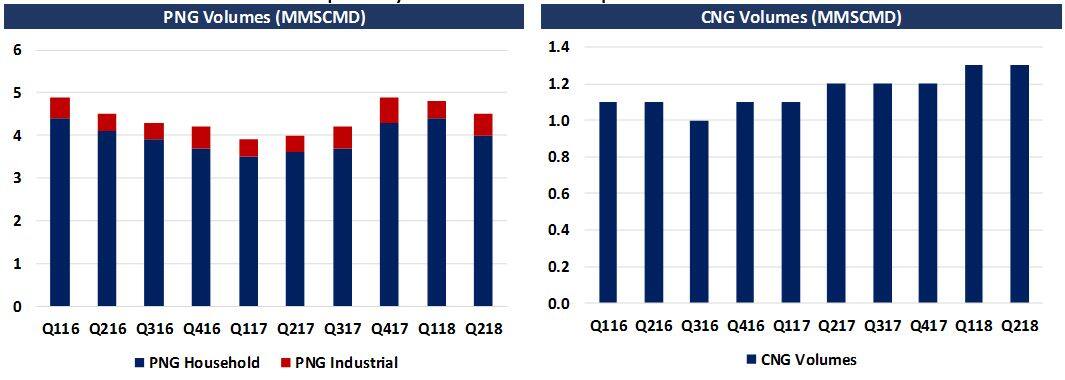

Volumes contraction

Volumes in the industrial LNG segment declined 9 percent QoQ (+14 percent YoY) and CNG volumes fell 1 percent QoQ (+8 percent YoY). Residential demand improved with volumes up 4 percent QoQ (+14 percent YoY). The contraction in industrial volumes seems to be temporary with revival expected soon.

Foray into new territories brings scope for volume revival

The company is aggressively looking for new territories and has a Rs 50 crore capex plan annually. Having bagged the new city gas distribution project, volumes are expected to improve. Recently commissioned areas like Jamnagar and Bhavnagar can potentially generate 3-3.5mmscmd over 3-5 years. The new contracts in Thane and Dadra and Nagar Haveli will provide additional volumes in the medium to long term.

The company could be a potential beneficiary of the government’s inclination towards moving to cleaner fuels and incentives for quicker implementation of city gas distribution.

Going forward, the company might gain from the hike in CNG prices since October. However, a parallel increase in the spot LNG feedstock prices could neutralise the gains. The stock could also be impacted from new players entering Gujarat post the expiry of the exclusivity term in the state.

For more research articles, visit our Moneycontrol Research Page.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.