Krishna KarwaMoneycontrol Research

The Nirav Modi-Gitanjali Gems fraud case may have a lasting impact on the financial system, but another big relatively-unnoticed fallout from this event is the perception about the so-called “authentic diamond” in the minds of jewellery buyers.

Undoubtedly, it would be shocking for any buyer to learn that the priced diamond bought by him or her is worth much less in reality. While women’s love for diamonds is unlikely to wane as a result of this episode, buyers will be forced to think hard about where they want to buy their diamonds from.

For a high-value purchase like a diamond, paying a marginal premium to ensure what you're buying is authentic and trustworthy is not a big deal. So in the aftermath of the recent fraud, brands that have had a long history of being very trustworthy are highly likely to benefit. Here’s why -

Product characteristics: Though it’s fairly easy to obtain gold jewellery from informal channels, the same is not true in case of diamonds, given their expensive nature and a high degree of technicalities involved in sourcing and quality assessment.

Brand value: Customers commonly link authenticity of jewellery products with the brand name under which it is sold. The trust factor and quality reliability in this regard could encourage customers to prioritise genuine purchases from well-known names, even if they end up paying more for it.

GST transition: Post-GST, the unorganised jewellery businesses, which constitutes nearly 80 percent of the overall industry size, will lose its pricing advantage to organised counterparts. Moreover, with increasing awareness, the demand for unbranded jewellery may gradually decline.

Robust network: A widespread store presence pan-India, besides enabling jewellery majors to tap market share in the previously underserved/unserved geographies, would strengthen brand visibility. Additionally, outlets across the country may help gauge preferences better.

Better governance: The quality and competence of a company’s management, more often than not, speaks volumes as to how effective the company's internal controls are. For example, Titan, run by the reputed Tata Group, is one of India’s most trusted brands because of its emphasis on bonafide practices.

Where should you invest?

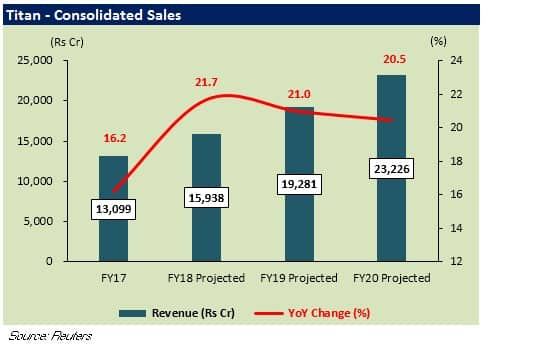

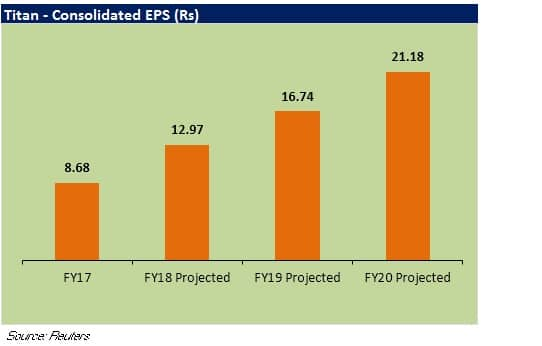

Prima facie, we expect Titan to be the key beneficiary of this shift. Apart from the positives stated above, tailwinds such as steady fundamentals, asset-light network expansion, impetus on diamond and studded jewellery, extensive marketing, and a favourable demand scenario could augur well for the company.

At 39.2x FY20 projected earnings, considering the stock’s steep valuation, accumulation on dips is recommended.

For more research articles, visit our Moneycontrol Research Page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.