Kshitij AnandMoneycontrol News

Tata Consultancy Services (TCS), which is scheduled to report its results for the March quarter post market hours today, is likely to report 2 percent degrowth sequentially in profit at Rs 6,638 crore, according to a CNBC-TV18 poll.

The revenue in dollar terms is likely to rise 2.1 percent quarter-on-quarter to USD 4,479.5 million in Q4, supported by cross currency and continued recovery in BFSI & retail segments.

The stock, which slipped nearly 2 percent so far in 2017, may trend higher after the India’s largest exporter approved Rs 16,000-crore share buyback plan on Monday.

The buyback program, which was passed by a special resolution, saw 99.81 percent of the total number of valid votes being cast in favour of the proposal, the company said in a regulatory filing.

The whole of the IT sector delivered a muted performance so far in 2017 and, in the last 12 months, it was weighed down by a slowdown in global demand, rupee appreciation as well as rising concerns over visa issues.

The IT sector has been declining and the downtrend does not appear to be over from a medium-term point of view, suggest experts. Although TCS has reduced its dependency on work visas, but any policy change from the US government will impact margins of most IT companies including the Tata Group firm.

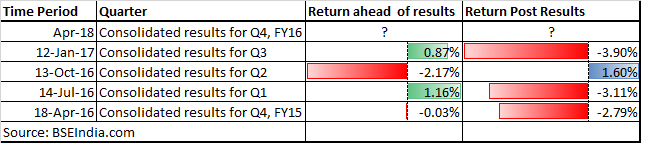

History suggests that TCS gave negative returns of up to 4 percent post quarterly results in three out of four occasions. The IT major fell 3.9 percent after it reported results for the December quarter in January.

“TCS has also declined with the rest of the sector and we expect it to go down to Rs 2,250 or even as far as 2015 as the next major support. The near-term resistance is placed at Rs 2,360 and any 1-2 day bounce to that level may be faced with selling pressure,” Rohit Srivastava, Fund Manager — PMS, Sharekhan by BNP Paribas told moneycontrol.

“Unlike Infosys, that often sees volatility contraction after its results, TCS does see trending moves. Both in Oct and Jan we have seen a continuation of the fall in prices after the results were announced in the next few days,” he said.

Analysts advise investors to hold their long positions on the stock as TCS still remains a strong structural story for long term investors. The immediate support can be seen around Rs 2,250, which is the 78.6 percent Fibonacci retracement level of the entire up move from Rs 2,153 to Rs 2,587.15.

“The monthly chart shows no clear trend, the weekly chart depicts a ‘higher top higher bottom’ formation and as per the ‘dow theory’, one should use intermediate corrections to go long if the medium-term chart structure indicates positive trend (i.e. higher top higher bottom),” Sameet Chavan, Chief Analyst - Technical & Derivatives, Angel Broking Pvt Ltd told moneycontrol.

“Traders or investors should look to initiate longs around the Rs 2,250-mark once the stock prices cool down immediately after the result announcement,” he said.

Going by the buzz on D-Street, we have collated views from different experts on how to trade TCS ahead of Q4 results:

Sameet Chavan, Chief Analyst - Technical & Derivatives, Angel Broking Pvt Ltd.

The broader degree chart structure still suggests a continuation of the outperformance as compared to its peers. The weekly chart depicts a ‘higher top higher bottom’ formation began in the second half of November 2016.

Thus, one should interpret recent fall as a corrective move of the larger degree uptrend as long as the crucial swing low of Rs 2,153 remains unbroken on a closing basis. Traders should look to initiate longs around the Rs 2,250 mark once the stock prices cool down immediately after the result announcement.

As mentioned, Rs 2,153 is seen as ‘trend deciding level’ and hence it is advisable to follow Rs 2,145 as a protective stop loss on a closing basis as the ‘higher top higher bottom’ structure would be negated below this crucial level.

Mazhar Mohammad, Chief Strategist – Technical Research & Trading Advisory, Chartviewindia.in

We are neutral on the scrip. For result day, we won’t recommend any strategy but traders/investors who already own this scrip can consider an options strategy called ‘collar’.

We believe that TCS will get stuck in the broader range of Rs 2,200-2,400 for a while. We suggest traders to sell call option with a strike price of Rs 2,450 and at the same time buy out of the money put with a strike price of Rs 2,200.

This will not only reduce the premium outflow on the option, but also take care of sudden downside risk, if any, owing to result day volatility.

Rakesh Tarway, Head - Research at Reliance Securities

There is no significant open interest (OI) built up in calls or puts to build a trading strategy now after a sharp decline of 4 percent in the past 2 days. One should wait for some bounce till Rs 2,370 levels to create a bear spread in case the stock rebounds.

The stock has underperformed correcting by an average of 3 percent in the last 5 quarters except for the second quarter results when it gained 1.6 percent. We believe the underperformance will continue for the current quarter.

Abnish Kumar Sudhanshu from Amrapali Aadya

IT software exporters were de-rated with the appreciation of rupee and change in the operating environment in US after strict visa norms force local hiring. As the stock is already downed on anticipation of a weaker number, we expect some relief buying post event.

From January 2016, the stock has traded between Rs 2,100-2,700; it found strong support around the lower range. The chart shows completion of a triple bottom formation. We advised investors to hold their longs on the stock as the stock formed triple bottom which shows a slowdown in the selling pressure.

Disclaimer: The views and investment tips expressed by investment experts on moneycontrol.com are their own, and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.