Krishna KarwaMoneycontrol Research

Of late, technical textile stocks have been gradually capturing investors’ attention. In the past, we initiated coverage on Fiberweb (India) Ltd (FIL), a 100 percent export-oriented company with zero debt in its books. The company's numbers in the quarter gone by were impressive, and apparently, it looks set to deliver a better performance in the years to come.

With back-to-back noteworthy quarterly results, does an investor still have some valuation comfort in store?

Typically, Q1 tends to be weak for FIL since most orders received from the US importers are executed in the second half of the financial year. Despite gaining good momentum in the top-line and bottom-line year on year, the margins were noticeably subdued at the consolidated level, as the result includes trading income from a relatively low-margin Dubai-based subsidiary. One can expect some turnaround as the year progresses.

Peak capex completion in FY18

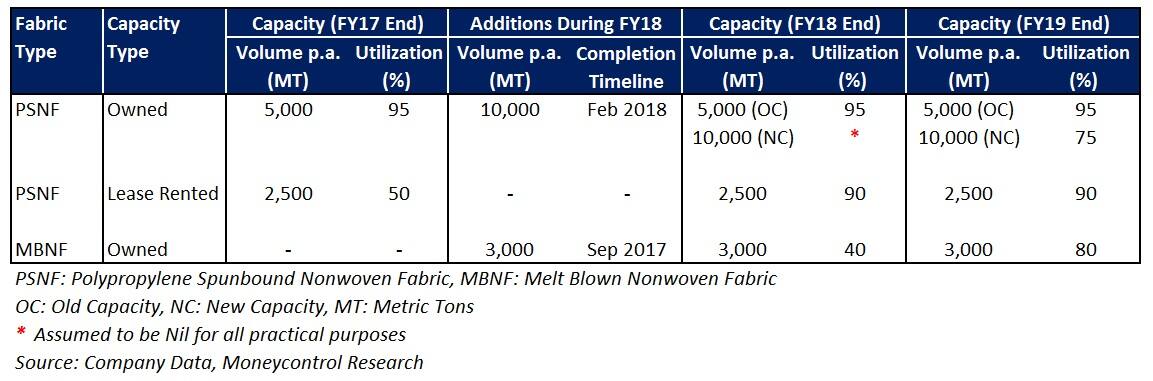

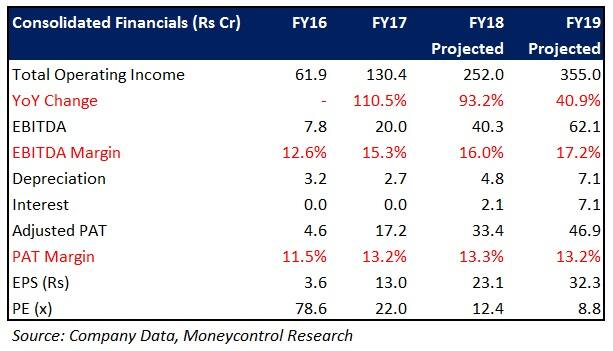

FIL is likely to register sales growth largely on account of capacity expansion undertaken and greater impetus towards value-added products. Completion of most of the capex activity in the ongoing fiscal will enable the company to generate adequate cash flows in the subsequent years.

We highlighted FIL's capex plans in our earlier recommendation on the stock. While there has been a minor change in the schedule of the Polypropylene Spunbound Nonwoven Fabric (PSNF) facility set up (the delay is unlikely to have a considerable effect on earnings in FY18), the additional capacity in Melt Blown Nonwoven Fabric (MBNF) makes us revise our estimates upwards.

With MBNF capacities coming on board, FIL will become the only player in India to manufacture a fabric of this nature, which is commonly used in areas such as industrial filteration, petroleum refining, water treatment, and waste water management, among others. Presently, the company already has confirmed orders to manufacture and supply MBNF products (that will involve utilisation of 2000 MTs of the total capacity) in its kitty. Favourable MBNF demand conditions have led to additional requisitions and enquiries from more international clientele too.

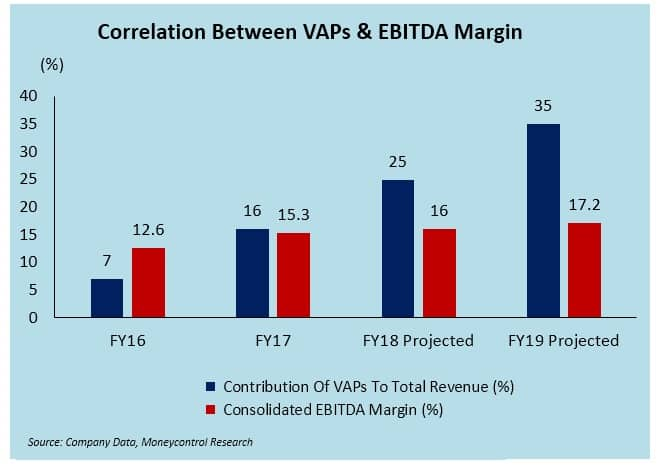

Shift towards value-added products (VAPs)

Tax benefits, minimal finance costs, and a gradual decrease in depreciation (as the peak capital expenditure cycle concludes by FY18-end) should support FIL’s bottom line in the long-run. The degree of emphasis on VAPs, that command superior realisations and are simultaneously margin-accretive, will also play a pivotal role in driving earnings visibility, going forward.

Growing order book

On the back of traction in demand from various industries across the globe, FIL executed three orders for US-based distributors totalling Rs 519 million during the quarter gone by. With the addition of eight American clients to its list and a strong order book of Rs 147 crore at the moment, the company is comfortably placed in terms of revenue accruals for the remaining 9 months of the fiscal.

Steady raw material supply contract

Exxon Mobil, FIL’s key raw material (polypropylene) supplier, has been associated with the company for nearly two decades. From FIL’s perspective, Exxon’s supplies are not only competitively priced but also better in quality compared to Indian suppliers. Therefore, barring material fluctuations in crude prices, FIL faces no major risk or volatility on this front.

Valuations

FIL's underperformance in recent times makes its valuation attractive. At our current estimates, the stock trades at 9 times FY19 projected earnings, which is reasonable for investors with a long-term horizon.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.