Having turned around sharply in FY17, the growth momentum continued for paper companies as witnessed in Q2 earnings reported by most players.

With the paper sector poised for a big leap forward in sync with the economic growth, we look at the factors behind the current growth in the sector, outline future drivers and identify the stocks that are likely to emerge as winners.

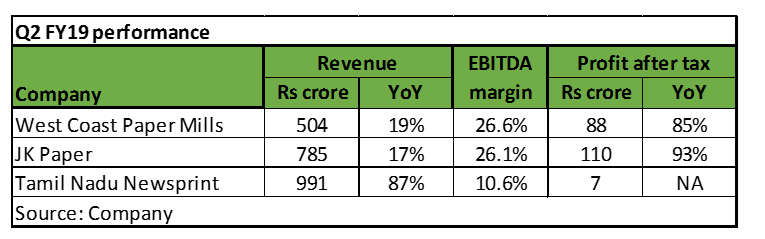

Quarterly performance of key paper companiesThe sustained improvement in financials was visible for most paper companies in Q2 except for Tamil Nadu Newsprint and Paper (TNPL). This was on the back of one or combination of factor positive industry dynamics (i.e. demand-supply equation), improvement in operating margins on better realisations, reduced raw material costs coupled with a change in the product mix with expansion in the high margin segment.

TNPL’s topline growth was very strong as capacity utilisation increased significantly at both of its plants. Its writing and printing paper (WPP) plant ran at more than 100 percent capacity and multi-layer double coated paperboard (MCBP) plant also improved utilisation to more than 90 percent. However, margins declined on a sequential basis due to higher raw material prices and currency depreciation resulting in a muted performance.

West Coast Paper Mills’ improved performance continued in Q2 FY19 as well with net profit surging by 85 percent YoY and EBITDA margins at 27 percent. It is worth noting that the company also manufactures optical fiber cables and own windmills. While overall EBITDA margin looks good, margins for paper business is a tad below 20 percent, relatively weak compared to peers.

JK Paper reported superior performance. Revenue growth was muted as production was negatively impacted due to plant shutdown following strike by workers. Its margin improved further to 26.1 percent in Q2 FY19 (FY18: 21 percent, FY17: 19.5 percent, FY16: 16.5 percent) on the back of improving realisations, reducing raw material costs and improving operating efficiencies. Read: JK Paper: High earnings growth with potential upside trigger; buyThe strong performance of paper companies was mainly driven by 2 factors.

- Positive demand-supply dynamicsIndia remains the fastest growing market for paper globally and has grown from 9.3 million tonnes in FY08 to 17.1 million tonnes in FY18 witnessing a CAGR of 6.3 percent. Going ahead also, paper demand is likely to remain buoyant due to increased demand from FMCG and packaged food segment as well as rapidly growing e-commerce (likes of Amazon and Flipkart). At the same time, supply remains constrained following the closure of stressed domestic capacities (Ballarpur Industries). Paper companies continue to reap the benefit of this favourable demand-supply scenario.

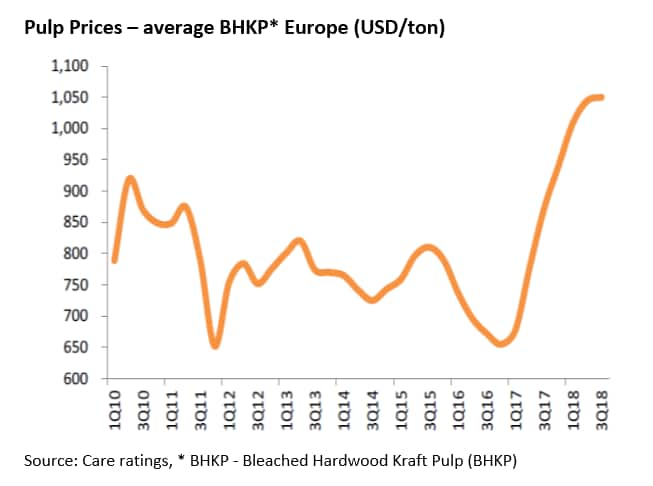

Improved performance of the paper companies is also attributed to better realisations driven by high input cost. International pulp prices, key raw material continued to inch up till September end pushing up the paper prices. While there has been mild moderation in October, the global pulp prices are expected to remain firm in near to medium term on the back of varied reasons.

One of the factors that is expected to keep global pulp prices elevated is the environmental restrictions by the Chinese government on imports of low grade recovered paper. China, the largest importer of waste paper globally, announced a ban on certain grades of waste paper in July last year which came into force in January 2018. The move led to increased demand for pulp pushing up the global pulp prices. As global pulp prices increased, so did the global paper prices.

The performance of the paper companies has been good so far. But the moot question is what will help sustain and improve earnings going forward? We believe the timely expansion of the existing capacity and relative advantage in sourcing input are the key differentiators that will drive the future profitability of paper companies.

- Capacity expansionThe paper industry has not added any significant capacities over the last three to four years following the shortage of its key raw material i.e. pulpwood and rising prices of local waste paper. Most paper companies are currently operating at around 85 percent to 90 percent capacity utilisation level, while the larger companies are operating close to or more than 100 percent capacity utilisation.

Consequently, significant investments have been lined up for expansion in production capacity. A bulk of the capacity additions are in the packaging paper & board segment as high growth rate is anticipated in this segment.

A majority of the recently-announced capacity expenditure (capex) plans are scheduled for completion after April 2020.

JK Paper is expected to see a meaningful increase in production resulting from the acquisition of Sirpur Paper Mills. A part of Sirpur’s total capacity of around 138,000 tonne per annum (tpa) is expected to come on stream much before 2020 on completion of the refurbishment of the existing plant. This will give JK paper relative advantage vis-a-vis peers.

West coast paper too has capex plans. The company’s attempt to acquire Sirpur Paper Mills through NCLT was unsuccessful as there was a default in one of the group companies. Constrained for inorganic growth, West coast paper has to rely on organic growth route only which will take time.

TNPL is planning a large capacity expansion (costing about Rs 2,500 crore) for setting up a captive pulping unit and a WPP manufacturing unit, capex for which is expected to be incurred from FY20 onwards. Environmental clearance is awaited for the project.

- Strong raw material sourcing capabilitiesGoing forward, the integrated player with sufficiency in all major inputs – raw material, water and power will be able to sustain and improve margins. Availability of power is not a big differentiator as most paper companies have self –sufficiency on power requirement through captive power plants or have long-term supply tie-ups.

JK Paper clearly is best positioned as it sources more than 80 percent of its wood requirements from captive farm forestry. Due to lower dependence on import, JK has not been adversely affected by global pulp prices that have been on a rising trajectory in the past five years. In fact, the rising pulp prices have increased paper prices improving realisations for JK paper. Additionally, adequate water is available at both of its units – Gujarat and Orissa and it has also achieved self-sufficiency in power with its 80 MW capacity.

West coast paper imports around 40-50 percent of its input requirement. Though the proximity of the Goa port gives it an edge over other mills located in the interiors, the profitability of the company remains vulnerable to due to global price movements and exchange rates.

TNPL’s input costs are extremely volatile as it has a sizeable dependence on imported pulp for its MCBP unit. It is also facing some shortage in sourcing of bagasse and is dependent on government auctions for its wood requirements. In past, water availability has been an issue for TNPL.

Outlook and viewWe continue to remain upbeat on the prospects of the paper sector and expect paper companies to hold onto their healthy operating margins.

Thanks to improved financials and strong earnings growth, most paper stocks have outperformed. While some part of valuation re-rating seems to have played out, more can follow from the planned capacity additions for JK paper. In the case of TNPL, there is ample scope of margin improvement from 11 percent currently to 20 percent in the medium term if input prices reduce.

JK Paper remains our top pick followed by TNPL for which potential upside to earnings can be huge on margin improvement. We suggest investors consider both these stocks to participate in the growth of India’s paper sector.

Follow @nehadave01For more research articles, visit our Moneycontrol Research pageDiscover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!