Neha Dave

Moneycontrol Research

We have been upbeat on the prospects of paper sector ever since we published our first note on the sector in May. Read: Profitability of paper companies on an uptrend; JK Paper a worthy contender

Within the sector, JK Paper continues to be our top pick. While many midcap and smallcap stocks have lost their sheen, the stock is up 31 percent year to date, generating staggering returns for investors in an otherwise falling market.

Its stellar performance isn’t a surprise, given the improved financials and strong earnings growth reported by the company. Performance has been good so far, but the question that arises is should investors look at the stock incrementally in light of its strong outperformance in recent times? Yes, in our view.

We believe that story for JK Paper is far from over. Just last week, we recommended JK Paper as a Diwali pick. Read: Diwali 2018 picks: Top 12 bets to light up your portfolio

While some part of the valuation re-rating seems to have played out, more can follow from the company’s planned capacity expansion and recent acquisition of Sirpur Paper Mills.

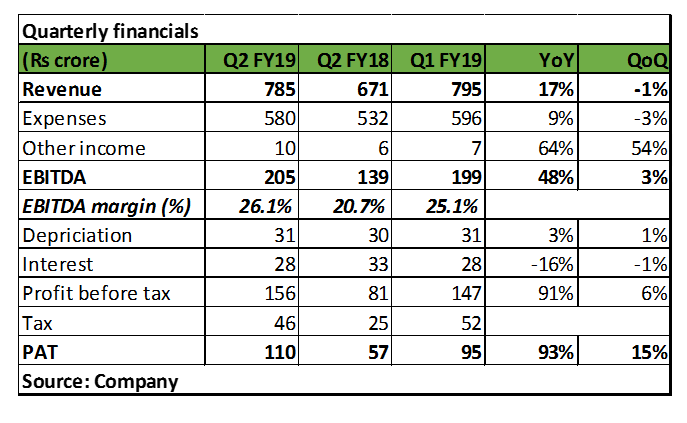

Quarter at a glance

With an installed annual capacity of 455,000 tonne per annum (TPA) of paper and paper boards, JK Paper reported robust Q2 earnings, with net profit almost doubling year-on-year (YoY) to Rs 110 crore driven by strong revenue growth and margin expansion. Revenue remained flat on a sequential basis as production was impacted due to plant shutdown in Rayagada, Odisha following a strike by workers for 8 to 10 days in Q2.

Strong volume growth

The company is operating at more than full capacity. The paper industry has not added significant capacities over the last three-to-four years. Closure of stressed domestic capacities (Ballarpur Industries) led to supply constraints. At the same time, domestic paper demand has held up well. JK Paper continues to reap benefit of ths favourable demand-supply scenario.

Margin improvement continues

Margin improved further to 26.1 percent in Q2 (FY18: 21 percent, FY17: 19.5 percent, FY16: 16.5 percent) on the back of improving realisations, reducing raw material costs and improving operating efficiencies.

1. Better realisations

A significant increase in global pulp prices and a resultant increase in global paper prices has improved realisations for JK Paper. The company increased prices by 2-6 percent in various segments in FY18. As a consequence, actual blended paper realisation has been Rs 57,350 per tonne in FY18 against expectations of Rs 56,525 per tonne.

We see paper realisations sustaining at current levels, given the positive demand-supply outlook, though some instances of rising imports at predatory prices from surplus countries was witnessed.

To address this concern, the Directorate General of Anti-Dumping and Allied Duties (DGAD) earlier this month recommended imposition of anti-dumping duty, difference between the landed value and $855 per tonne, on imports of uncoated paper from Indonesia, Thailand and Singapore for a period of three years from date of notification. This move is set to protect domestic players by supporting margins. A final notification is awaited from the Ministry of Finance.

2. Reduced input costs

It is worth highlighting that while global pulp prices have been on a rising trajectory in the past five years, lower dependence on import, agroforestry initiatives and usage of captive wood has resulted in JK Paper being not affected by rising prices.

Prices of domestic wood stabilised in FY15 after almost doubling during FY12-14 due to short supply. Thereafter, domestic wood prices continued to decline gradually because of improved availability and stable demand in the absence of major capacity additions.

Softening hardwood prices along with the continued management efforts towards farm forestry (increasing tree plantations) have led to increased availability of wood near manufacturing plants, thereby reducing average wood procurement costs for mills. For instance, JK Paper increased proportion of hardwood procured from within a 200 km radius of its manufacturing facilities to 71 percent in 2017-18 from 41 percent in 2015-16.

3. Operational efficiencies

In addition to input prices, improvement in margin on account of lower inputs used per tonne of paper produced is a durable source of advantage. With higher volumes due to ramping up of production at its Odisha unit commissioned in FY14, operating leverage kicked in and improved JK Paper’s EBITDA margin to 26.1 percent in Q2 from a degrowth of 0.1 percent YoY.

We expect EBITDA margin to remain robust, with both realisations and cost scenarios likely to remain favourable in the near term.

Acquisition to boost future volumes

Since operating at full capacity, JK Paper intends to increase capacity to achieve meaningful volume growth. It announced brownfield investment of Rs 1,450 crore for setting up additional capacity up to 200,000 TPA of packaging board (including pulping facility of up to 160,000 TPA).

Though commercialisation of new capacity addition is likely to take more than 24- 30 months, acquisition of Sirpur Paper Mills is a near term positive. JK Paper acquired Telengana-based Sirpur Paper Mill for Rs 371 crore through the National Company Law Tribunal (NCLT) process. This acquisition will help add capacity of 138,300 TPA, with total investment of around Rs 780 crore by JK Paper, including incremental capex towards modernisation.

Comfortable leverage

It is heartening to see JK Paper utilising cash generated from better efficiencies and buoyant paper realisations to deleverage faster-than-expected. The company’s balance sheet has strengthened, with reduced leverage, due to repayments and full conversion of its foreign currency convertible bonds into equity.

Capex, both planned organic and inorganic, expansion would lead to an increase in leverage, especially over FY20 and FY21. However, the staggered nature of the capex, with favourable industry fundamentals, mitigates the risk to some extent.

Valuations reasonable despite the run up in the stock priceJK Paper is well positioned due to its strong market position with a presence in high quality paper segments, cost leadership and integrated production capacities. The stock currently trades at 5.5 times FY20 estimated enterprise value-to-EBITDA which is reasonable considering its high earnings growth potential.

With potential upside triggers arising from ramping up of additional capacity (Sirpur Paper Mills) and strong earnings visibility, JK paper is a stock worth acquiring at current levels.

For more research articles, visit our Moneycontrol Research page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.