Though the market rebounded nearly 400 points from the low of last week, it is expected to be rangebound and volatile in the coming truncated week, experts said, adding the key hurdle on the higher side is expected to be 22,300 and the crucial support is likely to be 21,700 on the Nifty 50. The breaking of either side of the range can give firm direction to the market, while the monthly F&O expiry-led volatility is also likely to be seen.

On March 22, the BSE Sensex climbed 191 points to 72,832, while the Nifty 50 gained 85 points at 22,097 and formed a bullish candlestick pattern on the daily charts with above-average volumes, while on the weekly scale, the index formed a small bullish candle with the long lower shadow, which resembles Hammer kind of pattern (not a classic one). The index rose 0.3 percent during the week.

"The recent pullback from the lows of 21,710 appears to be overlapping and hence we conclude that it is a retracement of the fall and not the beginning of a new leg of up move," Jatin Gedia, technical research analyst at Sharekhan by BNP Paribas said.

He feels the Nifty is likely to consolidate in the range of 22,300-21,700 in the absence of any near-term triggers ahead of the quarterly results announcement, which starts during the third week of April.

Shilpa Rout, AVP - Derivatives Research at Prabhudas Lilladher also agreed with Jatin, saying the support for Nifty now stands around 21,700 and the resistance is very strongly placed around 22,300. "Until we breach either side of the range, the same kind of volatility might continue."

The volatility dropped for the third consecutive session, making the bulls more comfortable. India VIX, the fear index, declined 2.34 percent to 12.22 from 12.51 levels, while the Nifty Midcap 100 and Smallcap 100 indices gained six tenths of a percent each.

We have collated 15 data points to help you spot profitable trades:

Key support and resistance levels on Nifty

The pivot point calculator indicates that the Nifty 50 may face resistance at 22,124 followed by 22,237 and 22,351 levels. On the lower side, the index may take immediate support at 21,940 followed by 21,870 and 21,756.

On March 22, the Bank Nifty formed a bullish candlestick pattern on the daily charts after several days of tug-of-war between bulls and bears, as the index gained 179 points at 46,864.

"The 20-day SMA (simple moving average) or 47,000 could be the immediate trigger level. Above 47,000, it could rally till 47,250-47,500," Jatin Gedia said.

On the flip side, below 46,500 or a 50-day SMA uptrend would be vulnerable, he feels.

According to the pivot point calculator, the Bank Nifty index may see resistance at 46,901 followed by 47,053 and 47,209. On the lower side, it is expected to take support at 46,646 followed by 46,550 and 46,394.

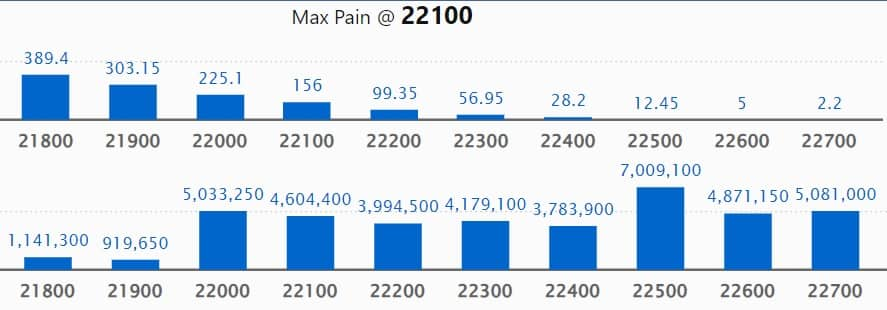

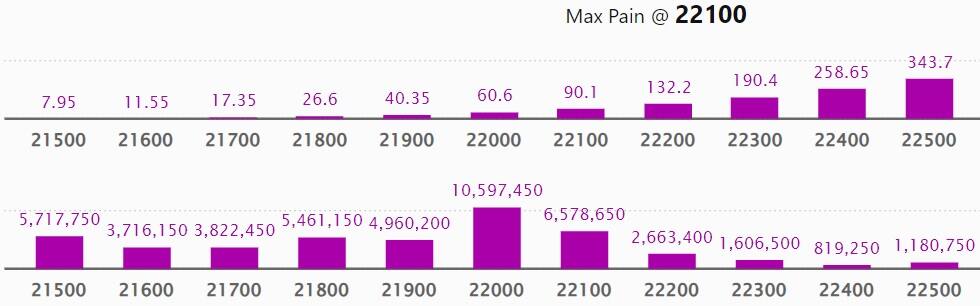

As per the monthly options data, the 23,000 strike owned the maximum Call open interest with 84.16 lakh contracts, which can act as a key resistance level for the Nifty in the short term. It was followed by the 22,500 strike, which had 70.09 lakh contracts, while the 22,700 strike had 50.81 lakh contracts.

Meaningful Call writing was seen at the 22,500 strike, which added 26.29 lakh contracts followed by 22,600 strike and 23,000 strike, which added 23.54 lakh and 21.74 lakh contracts, respectively.

The maximum Call unwinding was at the 22,000 strike, which shed 2.32 lakh contracts followed by 21,900 and 21,800 strikes, which shed 90,600 contracts and 26,450 contracts, respectively.

On the Put side, the maximum open interest was visible at 22,000 strike, which can act as a key support level for the Nifty with 1.05 crore contracts. It was followed by the 21,000 strike comprising 84.28 lakh contracts and then the 22,100 strike with 65.78 lakh contracts.

Meaningful Put writing was at the 22,100 strike, which added 36.79 lakh contracts followed by the 22,000 strike and 21,900 strike adding 31.92 lakh and 24.15 lakh contracts, respectively.

Put unwinding was seen at 22,500 strike, which shed 31,900 contracts followed by 23,000 and 22,900 strikes, which shed 20,950 and 1,400 contracts, respectively.

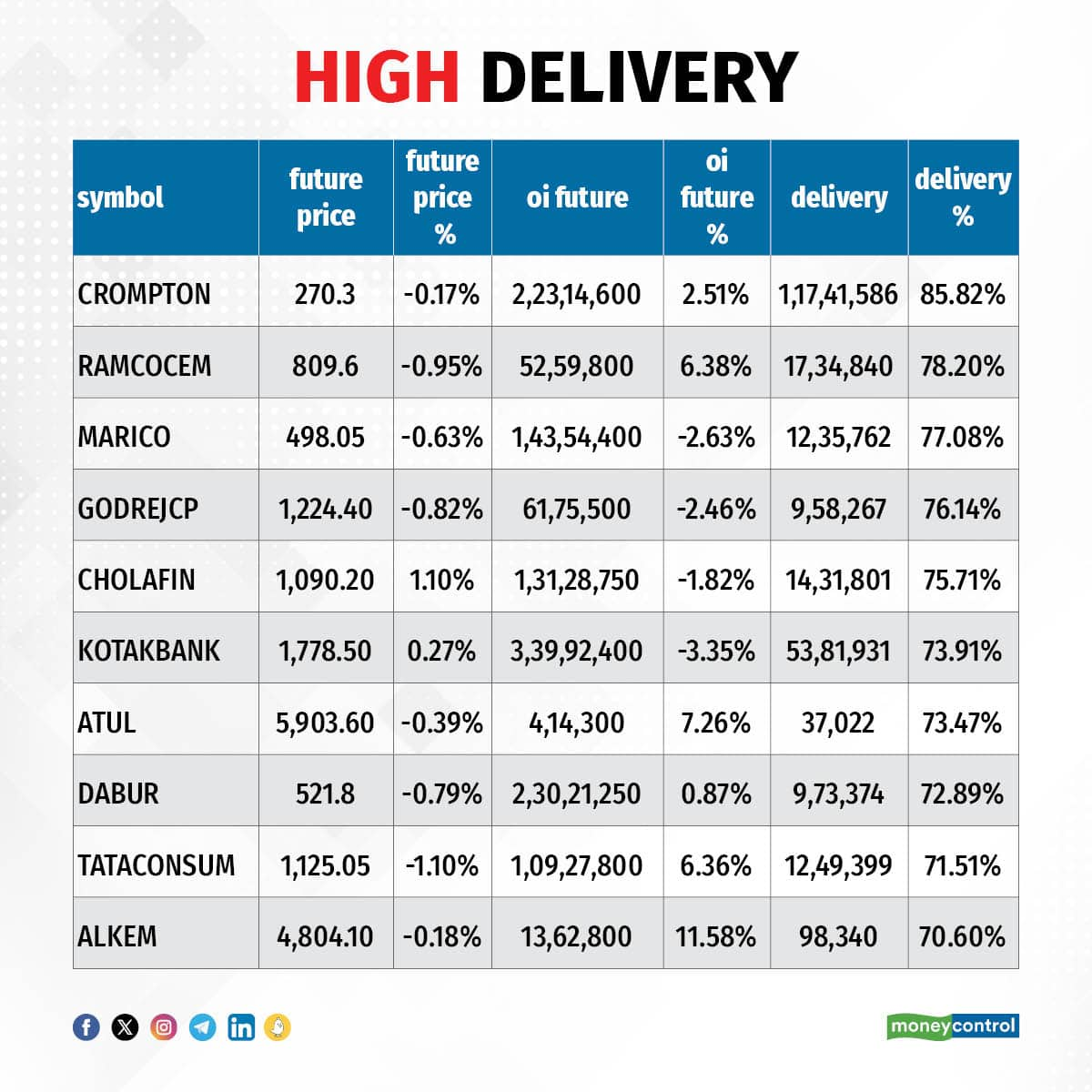

Stocks with high delivery percentage

A high delivery percentage suggests that investors are showing interest in the stock. Crompton Greaves Consumer Electricals, Ramco Cements, Marico, Godrej Consumer Products, and Cholamandalam Investment & Finance saw the highest delivery among the F&O stocks.

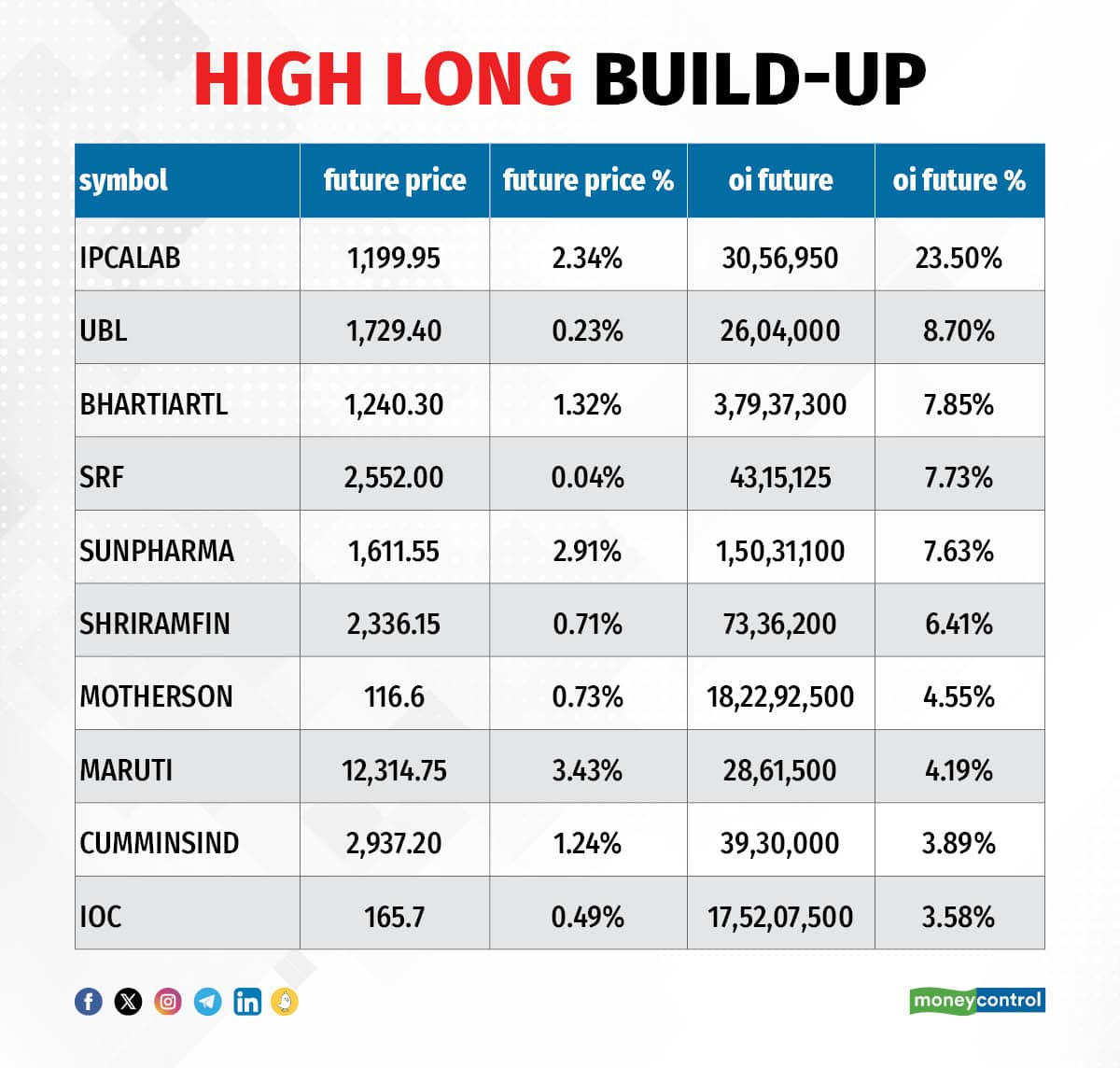

A long build-up was seen in 34 stocks, which were Ipca Laboratories, United Breweries, Bharti Airtel, SRF and Sun Pharmaceutical Industries. An increase in open interest (OI) and price indicates a build-up of long positions.

Based on the OI percentage, 30 stocks saw long unwinding, which were Muthoot Finance, Astral, Polycab India, Gujarat Gas and Mphasis. A decline in OI and price indicates long unwinding.

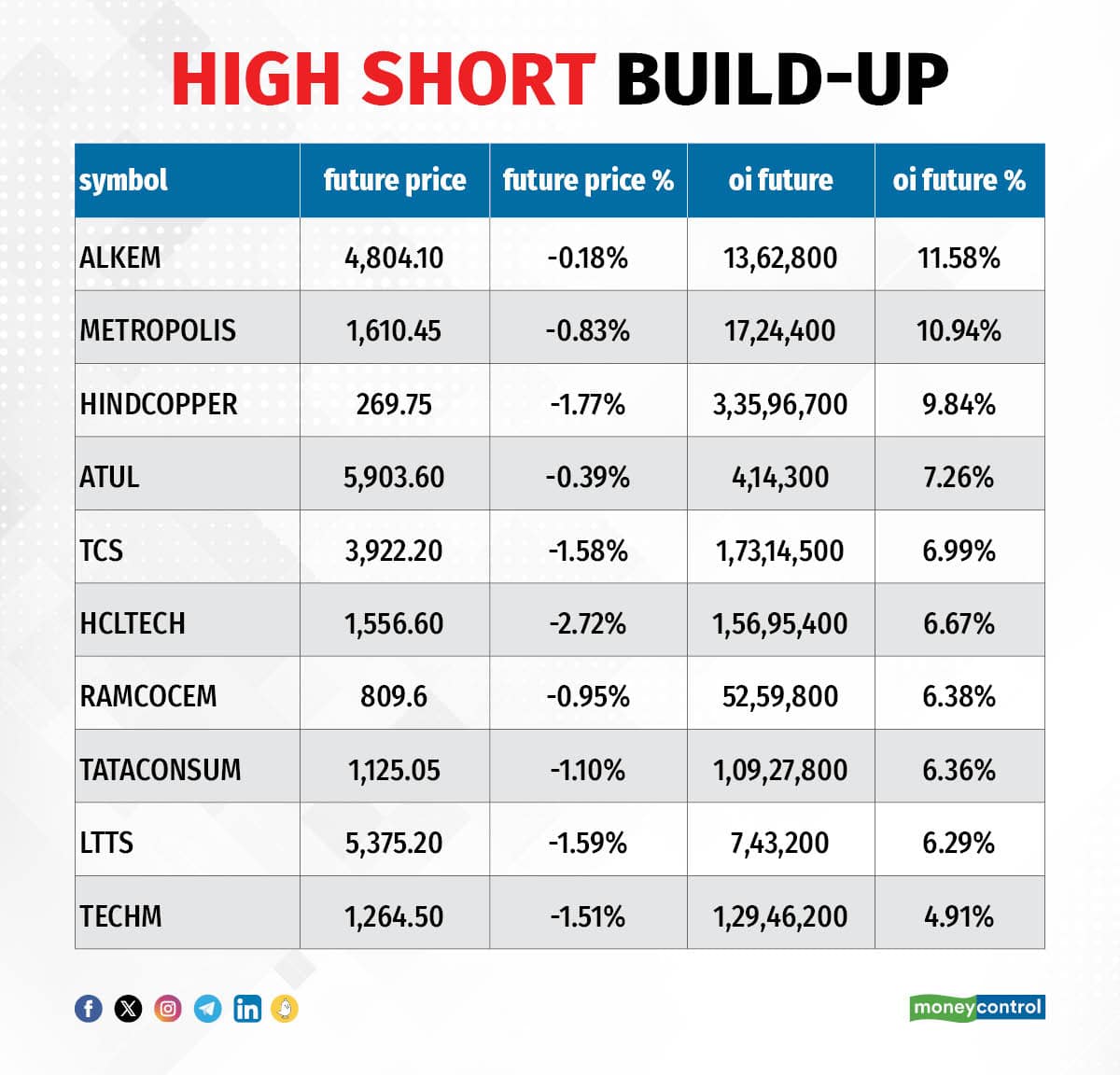

36 stocks see a short build-up

A short build-up was seen in 36 stocks, including Alkem Laboratories, Metropolis Healthcare, Hindustan Copper, Atul and Tata Consultancy Services. An increase in OI along with a fall in price points to a build-up of short positions.

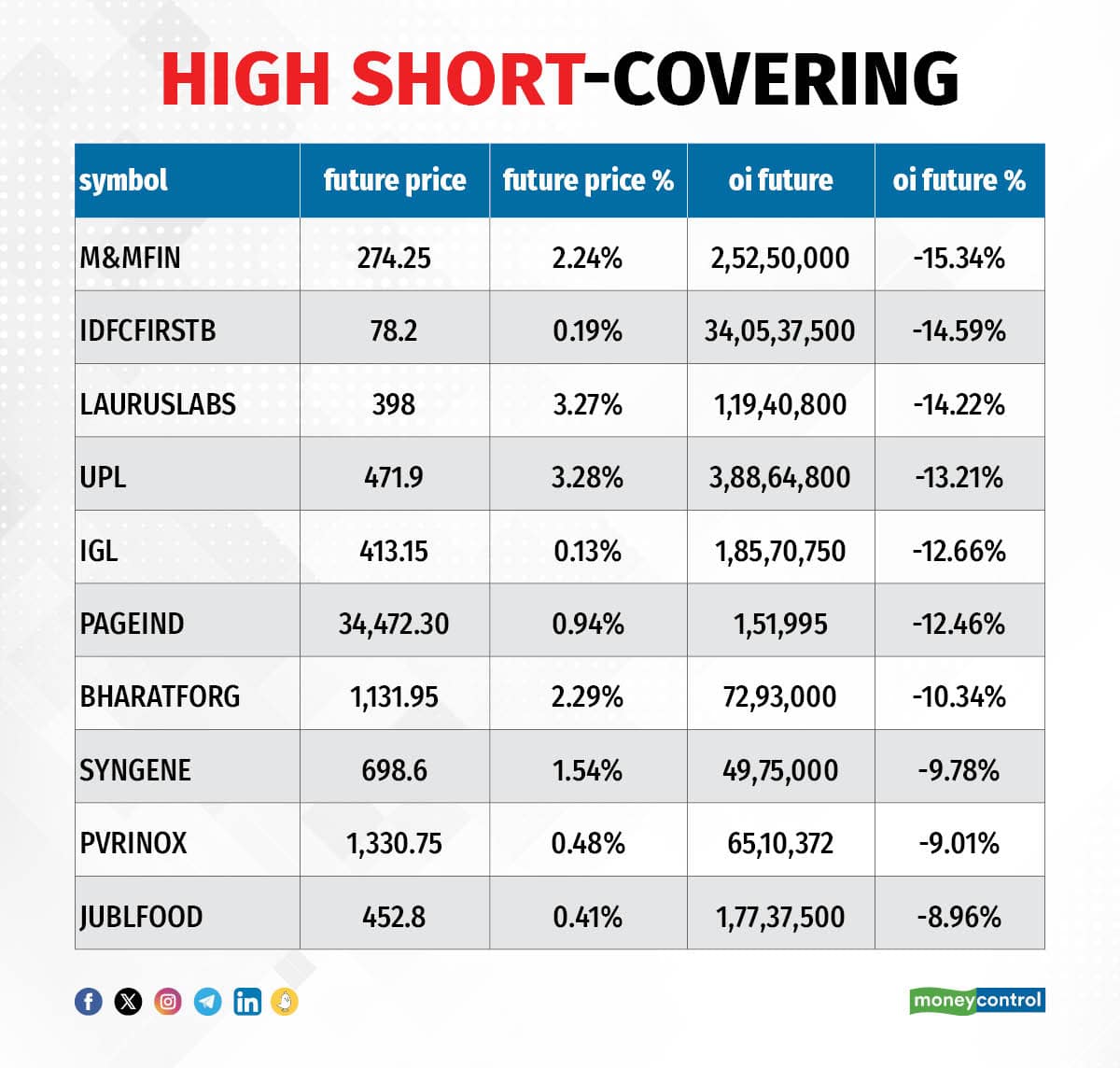

86 stocks see a short covering

Based on the OI percentage, a total of 86 stocks were on the short-covering list. These included M&M Financial Services, IDFC First Bank, Laurus Labs, UPL, and Indraprastha Gas. A decrease in OI along with a price increase is an indication of short-covering.

Analysts and Investors Meeting

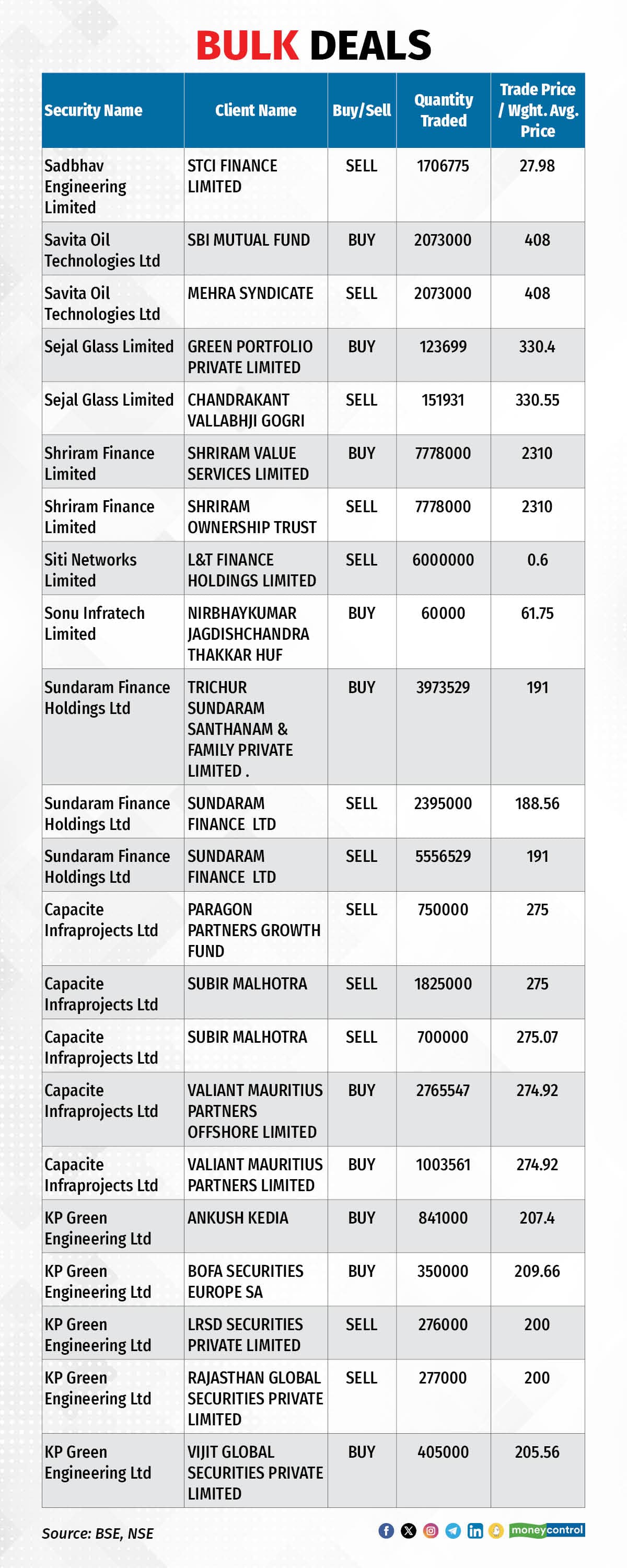

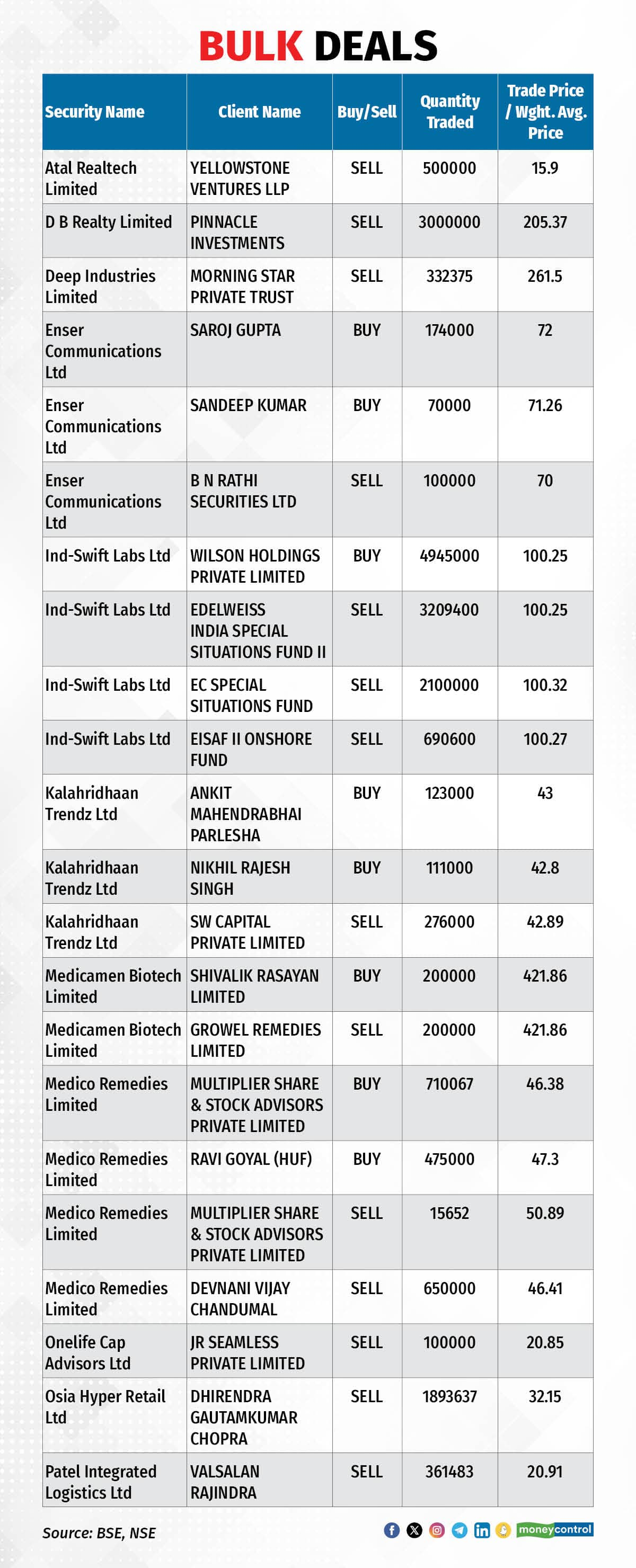

For more bulk deals, click here

Stocks in the news

Reliance Industries: The billionaire Mukesh Ambani-owned company has received board approval for the acquisition of 100 percent equity shares of MSKVY Nineteenth Solar SPV and MSKVY Twenty-second Solar SPV, from MSEB Solar Agro Power. The acquisition move is in line with the terms of the tender awarded to Reliance for setting up of aggregate solar capacity of 128 MW spread across various locations in Maharashtra under the Mukhyamantri Saur Krushi Vahini Yojana 2.0.

ICICI Securities: The Securities and Exchange Board of India (SEBI) has issued an administrative warning to ICICI Securities after the inspection of books and records for the merchant banking activities of the company conducted in December 2023.

Hinduja Global Solutions: The IT services management company has entered into an agreement to sell its optical fibre assets to Indusind Media and Communications (IMCL), a subsidiary of the company, for Rs 208.04 crore.

Lupin: The company plans to carve out, its trade generics business in India, as a going concern, on a slump sale basis, to subsidiary Lupin Life Sciences (LLSL) for Rs 100-120 crore.

Dr Reddy’s Laboratories: The pharma major has entered into a license agreement with US-based biopharmaceutical company Pharmazz Inc to commercialise Centhaquine in India. Centhaquine, developed by Pharmazz, is a resuscitative agent, indicated for the treatment of hypovolemic shock.

Funds Flow (Rs crore)

Foreign institutional investors (FIIs) net sold shares worth Rs 3,309.76 crore, while domestic institutional investors (DIIs) bought Rs 3,764.87 crore worth of stocks on March 22, provisional data from the NSE showed.

Stock under F&O ban on NSE

The NSE has retained Biocon, SAIL, Tata Chemicals and Zee Entertainment Enterprises to the F&O ban list for March 26. Balrampur Chini Mills, Indus Towers, and Piramal Enterprises were removed from the said list.

Securities banned under the F&O segment include companies where derivative contracts cross 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

Disclosure: Moneycontrol is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.