Indian customers want to buy life insurance, but also also want insurers to pay back their premiums at the end of the policy term, a study by industry body Assocham and IndiaFirst Life Insurance revealed.

This preference comes to light at a time when life insurers have shifted focus to protection products. These are pure-term insurance products in which customers do not get premiums back if they survive the policy term.

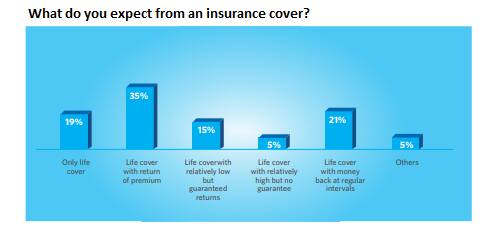

According to the study, about 35 percent of the respondents wanted insurers to offer a product that provided a life cover and returned the premium at the end of the policy term.

Only 19 percent of the respondents said they would prefer a plain vanilla product that offered only life cover.

Large insurers, including ICICI Prudential Life Insurance, SBI Life Insurance and HDFC Life Insurance, are focused on sale of pure-term insurance products.

While the average ticket-size in pure-term insurance is low, these products offer higher margins.

The persistency for pure-term products is also higher than that for unit-linked insurance products (Uli ps), which are a combination of savings and investments.

Insurance executives are of the view that pure-term insurance is not preferred because customers are not paid their premiums back. If the policyholder dies during the term, the sum assured is paid to the family.

To attract customers, life insurance companies have also launched pure-term products with a return-of-premium feature. However, the premium payable on these products is higher than that on a regular-term plan.

The study also revealed that life insurance is the most preferred investment instrument to achieve financial goals for almost two-thirds (70 percent) of millennials, closely followed by mutual funds (69 percent), and fixed/recurring deposits (64 percent).

It showed that higher cover at lower premium rates, simplified buying process aided by quick customer service, and easy documentation makes life insurance a preferred financial asset.

While nearly 60 percent of the respondents have at least one life insurance policy and another eight percent are planning to purchase one in the coming year, only 7 percent do not consider insurance as a potential savings option.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.