Global actuarial services provider Milliman said that the Indian life insurance companies’ stock prices seem to be out of line against its Asian peers. In a research report analysing the Value of New Business (VNB) margin, it said that unless insurers are able to maintain future new business growth and profitability, the high embedded value multiple currently enjoyed by insurers would not be sustained.

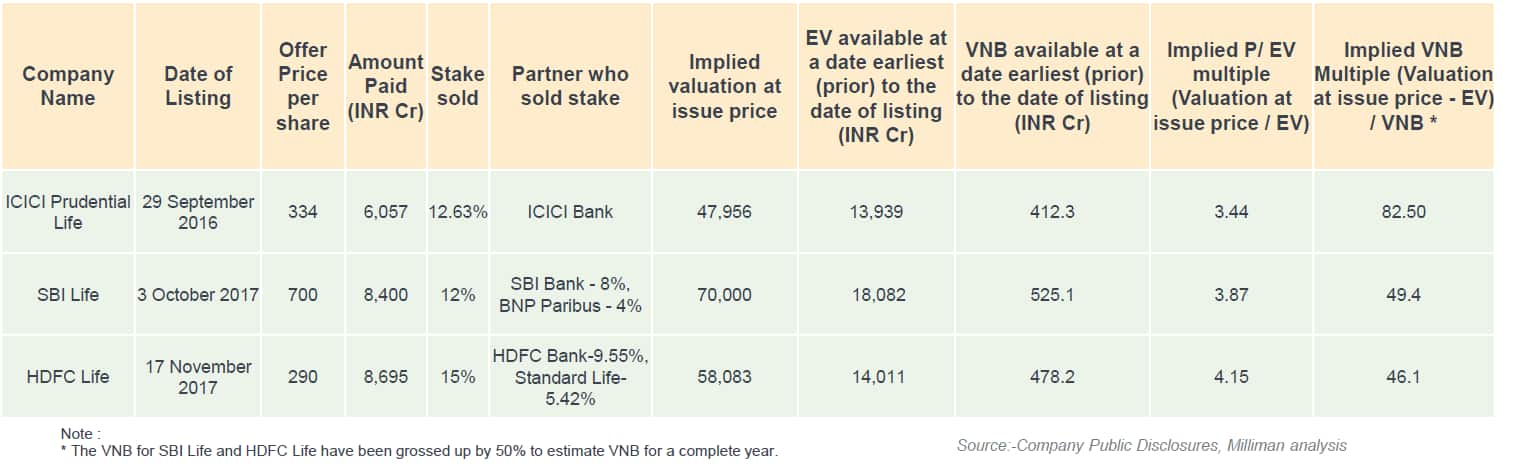

The top 3 life insurance companies (ICICI Prudential, SBI Life, HDFC Life) are directly listed on the exchanges whereas Max Life has an indirect listing through Max Financial Services.

Milliman research said that it is important to monitor how the EV changes from year to year. It added that high operating variances would adversely impact investor confidence in life insurance stocks.

In 2016, reported Asian life insurance EV grew by 15.3 percent on a comparable basis to USD 339 billion from USD 294 billion. Their research said that India's 16 percent EV growth is purely based on ICICI Prudential, which was the only company to disclose FY17 results by their cut-off date (May 3, 2017).

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.