When stock prices boom, as they have done in the past two years, firms issue more equity publicly, taking advantage of the reduced cost of capital to embark on new investment projects, said the Economic Survey.

This happened in the mid-2000s and again around 2010. In the last two years, especially in the first eight months of this year, there has once again been a pick-up in equity-raising activity.

Also read - Economic Survey 2018: Higher growth rate, possible revival in private capex among top 10 takeaways

The survey further highlighted that if current trends continue, the number of issues and their value could double the levels recorded in the previous six years.

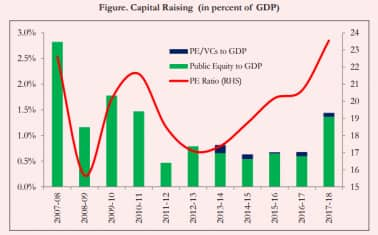

How do these magnitudes compare with the previous periods of stock market euphoria? The above figure illustrates total capital raised—through public and private placements—over the last decade as a percent of GDP to make the temporal comparison accurate.

The red line depicts the price-earnings ratio. The green bars show that capital raising this year has picked up substantially but remains below levels reached in 2007-08, highlighted the survey.

Economic Survey 2018: Catch all the updates live on Moneycontrol blog here

The peak of the previous boom despite the fact that the cost of capital is at similarly low levels. A price-earnings ratio of 25 implies equity costs of roughly 4 percent, said the Economic Survey document.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.