As India braces itself for the upcoming elections and the interim budget, analysts are cautiously optimistic about a potential surge in consumption stocks.

Consumption stocks, widely regarded as defensive assets, are anticipated to regain favour and offer investors stability in the face of heightened market volatility ahead of the upcoming elections. The government is expected to realign focus on measures to stimulate consumer demand and spending, and rural development, which are lagging compared to urban markets.

Currently, India’s consumption story is limited and in need of a boost. In a population of 1.4 billion, demand is mostly spread across about 100 million people, according to Aamar Deo Singh, Senior VP, Research, of broking firm Angel One. He said, “Two-wheeler sales, a key indicator of mass consumption, continues to remain below the pre-pandemic peak, indicating the overall struggle in increasing consumption across the population.”

“Despite near-term weaknesses in urban sectors like IT, and startup funding challenges, the outlook on the longer-term prospects of discretionary consumption remains optimistic,” said Sheersham Gupta, Director and Senior Technical Analyst, Rupeezy, a brokerage.

Budget might spur rural demand

Thus, the interim budget is expected to be populist, as the government will likely attempt to boost the disposable income in the hands of citizens, which will boost spending.

One way of doing this would be by increasing farm income by increasing the MSP (minimum support price) of key crops, said Omkar Kamtekar, Research Analyst at Bonanza Portfolio, a stockbroking firm. Furthermore, taxpayers could be given some concessions or rebates, Kamtekar added.

“Apart from this, the strong push towards infrastructure will aid consumption in general,” said Vincent KA, Research Analyst, Geojit Financial Services. It's worth noting that during elections, the government and the political parties tends to spend substantial monies, which in turn, can boost consumer spending.

Also Read: Budget 2024 | Pre-budget positioning and tips for traders

However, boosting demand will come at a price. “The government has to manage the fiscal deficit as well, though right now that might not be the main concern of the government, ahead of the crucial elections,” said Singh. The fiscal deficit for the current financial year is expected to exceed 5.90 percent, perhaps even hitting the 6 percent mark.

However, since the interim budget will be presented during an election year, there exists a possibility that it will not include any major policy announcements. “Overall, the interim budget could be an uneventful one, as high-profile policies are unlikely to be announced,” said Kamtekar.

MGNREGA, GDP lift consumer spends

The likely focus on rural development and social schemes, farm credit, PM Awas Yojana (affordable housing), food security, and higher allocation to MGNREGA, can increase rural income, which will boost consumption, per analysts.

Studies have shown the positive impact of the Mahatma Gandhi National Rural Employment Guarantee Act (MGNREGA) on agricultural wages, consumption expenditure, energy intake, and asset accumulation.

Additionally, in October 2023, ICRIER, a policy and economic think-tank, suggested that the Pradhan Mantri Kisan Samman Nidhi (PM-KISAN) scheme, that helps farmers with income support (added) raise the amount from Rs 6,000 to Rs 10,000 per family, which has not been implemented yet. This would also help revive rural consumption.

Also Read: Budget 2024: Centre should increase FY25 capex by at least 20%, says CII

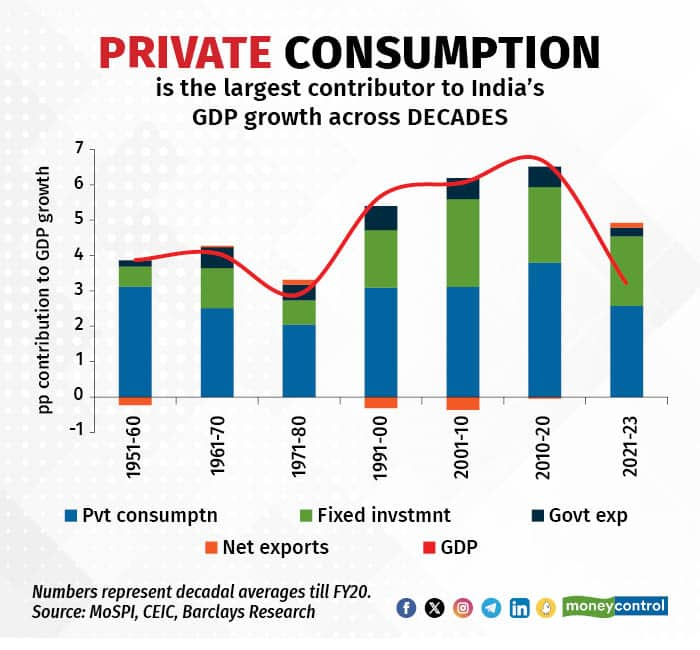

The GDP is closely linked to consumption according to Barclays. “India's private consumption expenditure has historically been the dominant driver of economic growth, generating an outsized 58 percent share of GDP in 2022,” said the international bank.

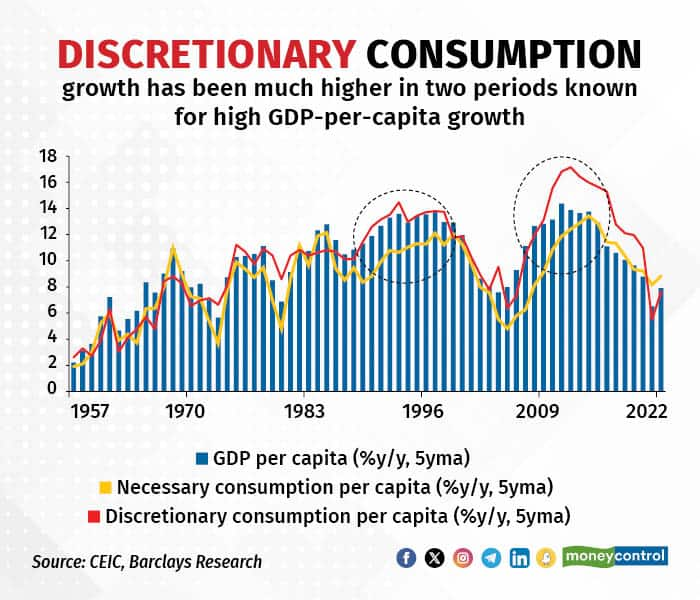

India's consumption profile has steadily increased its allocation towards discretionary items as the country’s GDP rose.

For Indian households, the change in preferences became starker in two periods: 1988-97 and 2005-11. Both periods saw double-digit increases in per-capita GDP for India

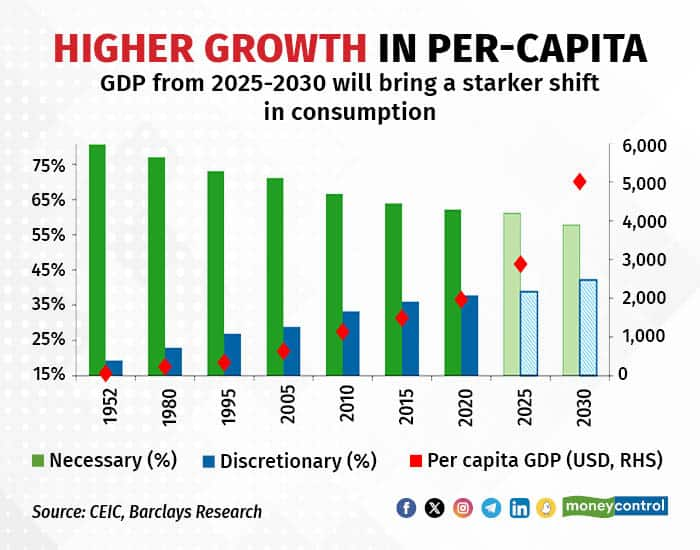

As the GDP and the per-capita income grows, Barclays predicted that there will be a stark shift towards more discretionary spending, compared to necessary spending.

Consumption stocks to gain?

The interim budget may give a hint of the incumbent party’s plans for its next term, if re-elected. Therefore, if the budget has positive signals for this sector, it might make consumption stocks go up, said Gupta.

Besides policies, economic indicators, employment rates, and overall economic growth also fuel the performance of consumption stocks, said Parth Nyati, founder, Tradingo, a discount brokerage. “Positive economic trends often translate into heightened consumer confidence and increased spending, benefiting companies within the sector,” explained Nyati.

He added that if the budget unveils favourable measures for the consumption sector, it could foster renewed interest and investment in consumption stocks.

According to Singh, the consumption space generated good returns for investors, with the Nifty India Consumption Index gaining almost 30 percent in a year. “Major heavyweights delivered a strong performance, with the exception of HUL, Marico, etc.,” he added.

The outlook

The long-term outlook for the consumption theme appears promising, owing to increasing incomes, a young population, and an expanding middle class, noted analysts.

Easing raw material prices, growing premiumisation across products, and higher ad spends are translating into volume growth, said Manish Chowdhury, Head of Research, StoxBox, a broking site..

“The optimism (for the consumption sector) stems from the fact that people tend to spend more on non-essential goods once the average income reaches a certain level,” said Gupta.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.