Aadhaar-based digital payments or AePS, used by a large segment of the migrant population in the country, has been either stagnant or sees a marginal decline over the last three years.

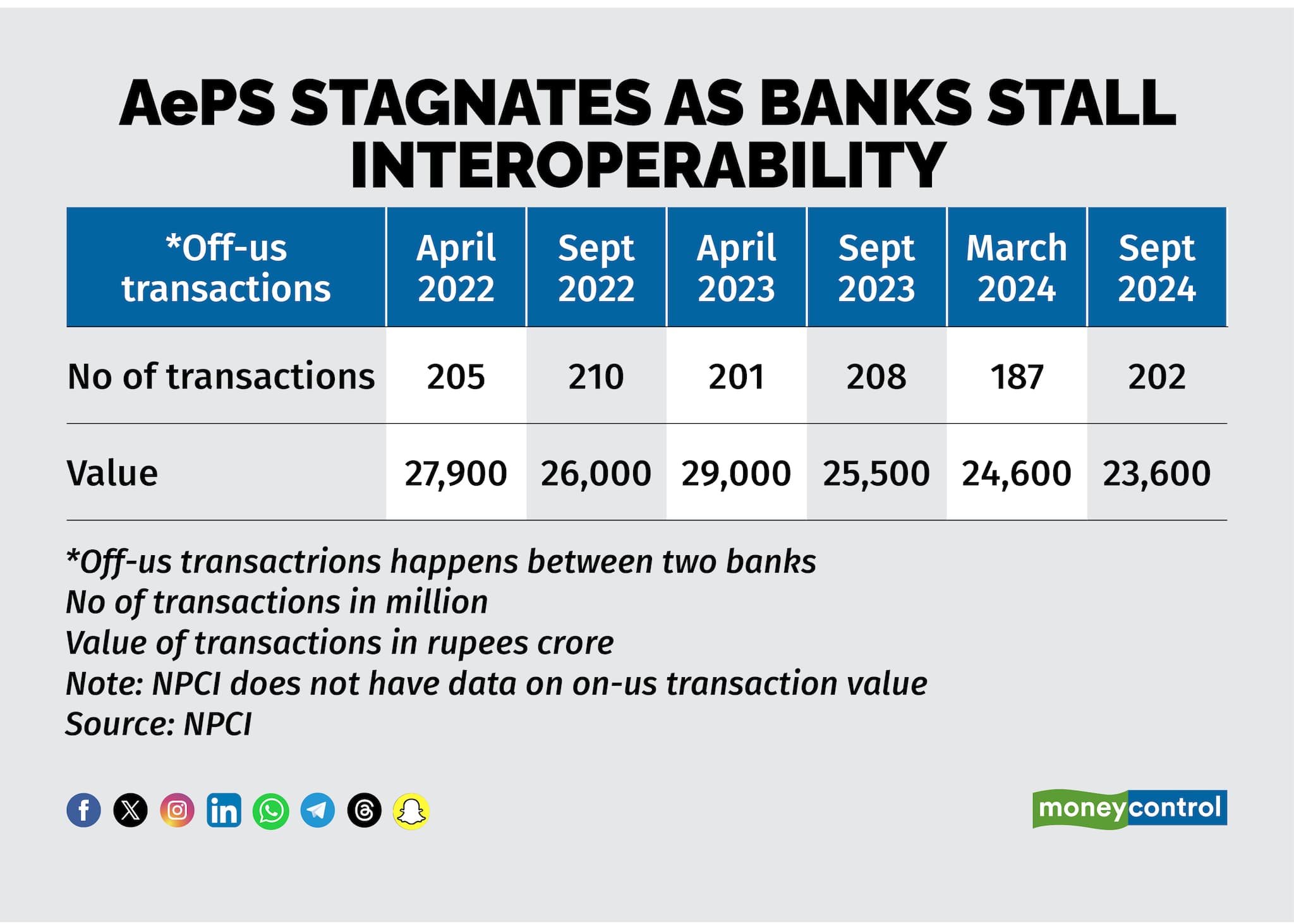

From around Rs 27,900 crore in April 2022, the value of AePS transactions has declined to Rs 23,600 crore in September, according to data with the National Payments Corporation of India (NPCI). The number of transactions fluctuated from 205 million recorded in April 2022 and stood at 202 million in September 2024.

Aadhaar-enabled Payment System (AePS) allows bank customers to use Aadhaar-based authentication – mostly fingerprint verification – to do basic banking functions such as balance enquiry, cash deposit, cash withdrawal and remittances through a business correspondent (BC). A business correspondent is an agent of banks, authorised to perform most banking functions for customers on behalf of banks.

While multiple factors are at play here, there are three major reasons why a product that has a financial inclusion element is languishing.

AePS was developed by the NPCI and hence operates the system. But the last mile implementation is done by banks and BCs. Emails sent to the RBI and the NPCI did not elicit any response till the time of publishing the story.

AePS stagnates as banks stall interoperability

AePS stagnates as banks stall interoperability

In some months when government subsidies are credited to the beneficiary accounts, the number of transactions and their value go up dramatically. However, that is not a reflection of customer transactions.

Interoperability

“Over the last two years, several banks, especially public sector lenders, have been declining transactions originating from its customers visiting other bank BCs. While RBI regulations say that BCs should facilitate interbank transfers, this is being flouted with impunity,” said a senior executive with a bank.

There were also concerns about money laundering through AePS a couple of years ago and the regulator made it mandatory for BCs to verify themselves with fingerprints for every single transaction.

While this has brought down the recurrence of fraudulent transactions, several banks started using this as a pretext to decline inter-bank transfers, citing that they don't know the accountholder. They insisted that the accountholders go to their respective branches and give specific consent for doing such transactions.

“Interbank AePS is disabled by default for accountholders citing the fraud issues. Banks have taken advantage of this and customers have to go to the bank branch to enable transactions across banks,” said a senior banker who works with BCs.

However, the number of BCs deployed by some of these banks is far less, which often causes heavy inconvenience to customers seeking cash deposits and withdrawals. “The practice certainly impacts customer convenience and AePS user-friendliness. The same has been discussed at various meetings with the NPCI, but the issuer side’s clout is such that they are able to navigate out of this,” said a spokesperson for Fino Payments Bank.

A fairly large player in the AePS segment, the programme contributed to 6 percent of the company’s overall revenue during `the first half of this fiscal.

For many payment banks, AePS, along with Domestic Money Transfer (DMT), are the hook products that get customer footfalls at its merchant network for transactions, customer acquisition and monetisation strategy, some of whom turn into accountholders later. Overall remittance contributes to 30 percent of Fino’s revenue.

Another large player, Airtel Payments Bank, did not respond to Moneycointrol’s queries on AePS.

The real reason though was that the public sector banks would have to pay commissions to the BCs acquired by the other banks. That brings to the next issue of incentive structure for BCs and the interchanges that banks need to pay.

Incentive structure

Most of the AePS transactions are either cash deposits or cash withdrawals. Take the case of a migrant worker in Bengaluru depositing the money at a BC outlet to be transferred to his family in Assam. The money is deposited in his bank account. Now, his family in Assam needs to visit a BC outlet and withdraw the cash.

Both these transactions are cash transactions and the acquiring bank (the bank that acquired the BC) earns a 0.5 percent commission on the value of the transaction with a maximum limit of Rs 15, or interchange in industry parlance.

If the migrant worker’s account is with SBI and goes to a BC who is an agent of HDFC, SBI will pay HDFC this interchange. Similarly, if the worker’s family has an account with Indian Bank but goes to a BC managed by ICICI Bank, then Indian Bank pays ICICI Bank the commission.

This means that when the customer goes to a third-party bank BC, the bank hosting the customer account could lose up to Rs 15 per transaction. So, these financial institutions insist that customers go to their BCs, instead of other banks.

Only intra-bank transactions

The AePS transaction figures are for off-us transactions, where the money flow happens between two banks when it moves through NPCI’s settlement channel. Since AePS uses the NPCI technology, when banks carry out any transactions on the network, it pass through the NPCI network, but the value of such transactions is not known to the NPCI.

Over the last three years, because of the banks' reluctance to let customers go to third-party BCs, instead of off-us transactions, on-us transactions have increased. Here, both the sender and receiver use the same bank network, or rather are forced to do so by the lenders. The number of on-us transactions has more than doubled over the last two and half years from around 170 million to 313 million.

Parity with ATM

BCs have been requesting the RBI to raise the interchange for AePS as many of them do not find it remunerative to offer this service. They are demanding parity with ATMs, where a flat Rs 17 fee per transaction is allowed by the regulator.

“The interchange around the BC channel has remained unchanged for more than a decade now while the ATM commercials were revised in the interim. With the additional compliance cost of graduating to better devices, this is slowly becoming less viable. There are multiple representations to various regulatory or quasi-regulatory authorities to look into this and increase the interchange or at least provide parity with the ATM interchange,” said a spokesperson of Fino Payments Bank.

However, any parity with ATM charges could quite aggravate the interoperability issue. “Just because this will aggravate, we cannot regularise an activity which is non-compliant and misleading. This is also causing huge inconvenience to customers who are often forced to find BCs who are probably away from them. And reaching those BCs might be expensive and a big hassle for the underprivileged, whom this service is meant for,” said a senior banker who works with the BC industry.

Regulatory changes

A couple of other regulatory mandates could make the whole BC industry unremunerative for banks or agents. According to RBI, financial institutions should inspect all the BC premises once a year for verification. It has also mandated that all BCs should undergo certification.

However, according to the sources mentioned previously in the story, these guidelines are not adhered to across the ecosystem. Following these guidelines would add to the financial burden of the financial institutions and make the model unviable, especially for those who built the robust BC ecosystem in the country.

Some of the shopkeepers, who act as BCs for payment banks are not well educated and to get them to do the certification would be painful for these financial institutions.

Some banks have suggested that the verification could be done digitally as in the case of digital KYC. However, the regulator is yet to comment on this, said a senior executive with a bank that has a large deployment of BCs.

The irony of hesitancy

Many of the money transfers through AePS are part of the government's Direct Benefit Transfer subsidies. The accounts are Jan Dhan accounts created with the public sector banks.

There is an estimated Rs 2.2 lakh crore deposited in such accounts every year and they don't earn more than 3-4 percent interest. While the PSBs on average lend at around 9-11 percent interest.

“This means that PSBs earn a profit of around Rs 15,000 crore from these accounts, whereas the financial inclusion cost is nowhere near this. The least they could do for these account holders is to facilitate AePS at third-party BCs,” said the senior banker who works with the BC industry, quoted above.

While some segments of the population who were earlier using AePS might have graduated to using UPI over the last couple of years, the programme still holds relevance to a large segment of the country.

“AePS (On-us or Off-us) is at the centre stage of the country’s financial inclusion agenda. Thanks to the JAM trinity, we were able to cope with the Covid pandemic and disburse cash in the remotest parts of the country. AePS will continue to play an important role in the foreseeable decade at least,” said Fino Payments Bank.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.