The Presidents of Argentina and Brazil are considering the introduction of a common currency for members of the Community of Latin American and Caribbean States (CELAC). This primer discusses the common currency project in the CELAC community and why it might be best that this idea is limited to discussion.

What is CELAC?

CELAC is an intergovernmental body comprising Latin America and Caribbean states. The body currently has 33 member-countries.

The purpose of CELAC is to offer a common forum where member countries can engage in dialogue on varied matters such as politics, economics, development, regional integration and so on. CELAC is like the other regional integration platforms such as ASEAN for South East Asian nations, SAARC for South Asian nations and the European Union for European nations.

CELAC was established in 2010. Before CELAC, Latin American and Caribbean countries were part of the Rio Group, which was instituted in 1986 and which was modified and expanded into CELAC in 2010.

What is the CELAC Common currency project?

One of the major purposes of any regional forum is to promote regional economic integration. The member-countries of such forums typically establish free-trade agreements, resource sharing agreements and so on. One can further regional economic integration by establishing a common currency of member-countries so that one need not worry about transactions in multiple exchange rates and avoid volatility of the exchange rates.

The current Presidency of CELAC is with Argentina and the group is meeting in Buenos Aires on January 23, 2023. In the follow-up to the summit meeting, Argentine president Alberto Fernández and his Brazilian counterpart Luiz Inácio Lula da Silva have expressed their desire to create a common currency in a jointly written op-ed.The media is speculating that the common currency might be named as ‘South’.

What is the economics of common currency areas?

According to Canadian economist Robert Mundell, who won the Nobel Prize in economics in 1999 for his work on common currency areas, the key benefits of such agreements come from lower transaction costs in trade and less uncertainty about relative prices.

Mundell identified two preconditions for establishing a common currency area. First, the region should have common business cycles. This is because common business cycles will ensure policies are consistent for the region. Second, in case the first is missing as is most likely to be the case, there should be free labour mobility between the member-countries. So if a member country suffers from an economic shock, people can move to countries which do not suffer from the same shock. Later, other researchers extended Mundell’s ideas to additional prerequisites such as capital mobility, regional specialization and a common tax and transfer system.

Mundell’s ideas were at the centre while creating the Euro, the common currency of select European countries.

What lessons can one draw from Euro?

The member European countries did not have a common business cycle given the different economic profile of the countries. What is even more interesting is that the member-countries did not even fit the second condition. Given language and other community barriers, Europeans could not migrate freely from one country to another.

European leaders ignored Mundell’s advice on the currency area as they were in a rush to counter the US dollar. The authorities instead decided that countries which wanted to be part of the common currency should achieve criteria of macroeconomic convergence. The member economies had to converge to threshold levels of inflation, deficit and debt levels. Even here, the member-countries either ignored the macroeconomic criteria and still became a member (like Italy) or falsified their books to show better numbers than was the case (such as Greece).

One key feature of a currency union is that members have to give up monetary policy to a new central bank. The new central bank makes monetary policy based on the entire region. In case of the Euro, the new central bank was the European Central Bank (ECB). Thus, in case of an economic shock in a particular member-country, the central bank cannot make policies for the particular country. This puts the onus of macroeconomic stabilization on fiscal policy, which also means that inflation, debt and deficits have to be under control.

The 2008 global financial crisis and 2010 European debt crisis exposed the macroeconomic architecture of the Euro currency. The crisis impacted some economies such as Greece and Italy more severely compared to other members such as Germany and the Netherlands. The ECB could not design monetary policies to help the affected countries. The fiscal policy in these economies was already broken as the debt and deficit levels were way higher than threshold levels. There were discussions on the breakdown of the Euro, but the Union survived as it would have been a bigger crisis if they were made to go back to their currencies. The ECB also found ways to support the affected economies by buying their bonds, which met with opposition from Germany, but still prevailed.

The Euro project can be seen either as a glass half full or as a glass half empty. Despite the problems with the Euro highlighted above, the number of member-countries has only grown. Before the 2008 crisis, there were 13 member-countries and the membership has increased to 20 countries today. Croatia adopted the Euro in 2023. The small economies from East Europe see large benefits from adopting the common currency. As the Eastern European countries mainly trade with Western Europe, a common currency helps minimize transaction costs. A common currency also safeguards them from any volatility in their own currencies.

The Euro crisis also led to another thread of discussion. Economists argued that countries should build a fiscal union which means having a common Finance Ministry before having a currency/monetary union. This is because a common Finance Ministry can provide financial help to the needy states more effectively than a common central bank. The economists pointed to how the United States built a fiscal union along with a monetary union. So for building a United States of Europe, the European leader should follow a similar path.

What does all this mean for CELAC’s common currency?

CELAC common currency is based on similar goals as Euro: higher economic integration and countering hegemony of the US dollar.

When we look at Mundell’s two prerequisites for currency area, the region looks better placed than Europe. Research shows that there is a higher synchronization of business cycles in Latin American countries. This is because most of them are dependent on commodities for their growth. Prices of different commodities typically rise and fall together, which leads business cycles to also rise and fall together. Research also shows labour mobility in the region has increased over the years. However, just like Europe, there are multiple languages in the CELAC region and achieving higher labour mobility will always remain a challenge.

The major problem which plagues the region has been macroeconomic instability, particularly in Latin American countries (Mexico, Brazil, Argentina etc). There is an old joke which goes that whenever the US gets a cold, Mexico gets pneumonia. This joke can be easily extended to the entire Latin American region and to any major economic crisis in the world. A crisis may happen anywhere, but eventually it has its worst outcomes in Latin America. In the 1980s when the US increased interest rates there was a highly severe impact on Latin America. In 1997, the South East Asian crisis soon led to a crisis in Latin American countries; in 2008, after the global financial crisis hit, the region survived a serious crisis and so on.

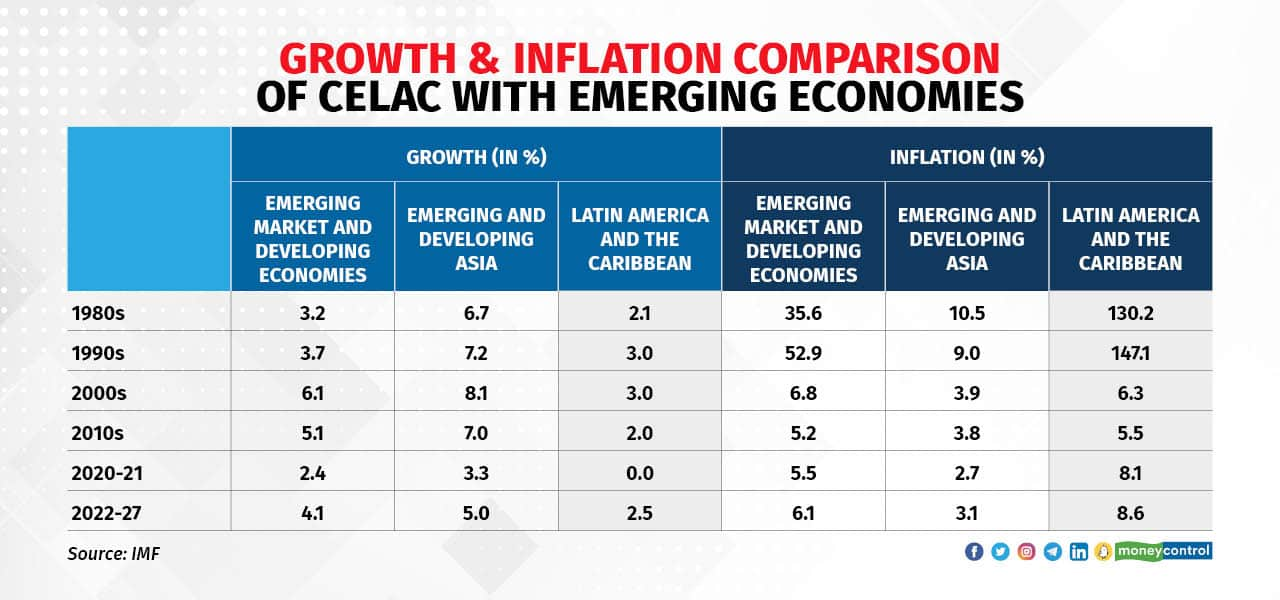

The below table shows how Latin America has consistently produced lower growth and higher inflation than Emerging Asia and overall Emerging economies.

The ECB and Euro were modelled on Germany’s central bank and the German currency, Deutsche Mark This way the member economies will benefit from the low inflation of Germany. There is no such role model in the case of CELAC

Another major problem of the region has been its electoral cycle, which is also quite synchronous in producing populist leaders which only lead to poor economic outcomes. The poor economic outcomes lead to the emergence of populist leaders who make all kinds of promises throwing macroeconomic stability out of the window.

Given this broad brush of economic and political history, it is remarkable to see the leaders of the two biggest countries of the CELAC forum, Argentina and Brazil, mention starting a currency union.

South American leaders also need to introspect and learn from the Euro currency. The leaders of European project engaged in economic integration for 5 decades before adopting the common currency.

They did not have a fiscal union but had unions of most other economic areas. Despite all these efforts, the Euro project is always called out for falling short of its actual potential. CELAC will have to engage in economic integration and achieve macroeconomic stability for a long time before thinking of a common currency.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.