Stocks in the energy-rich Gulf have been left out of the latest rally in emerging markets, as falling oil prices, a weaker dollar and China’s reopening send investors hunting for deals elsewhere.

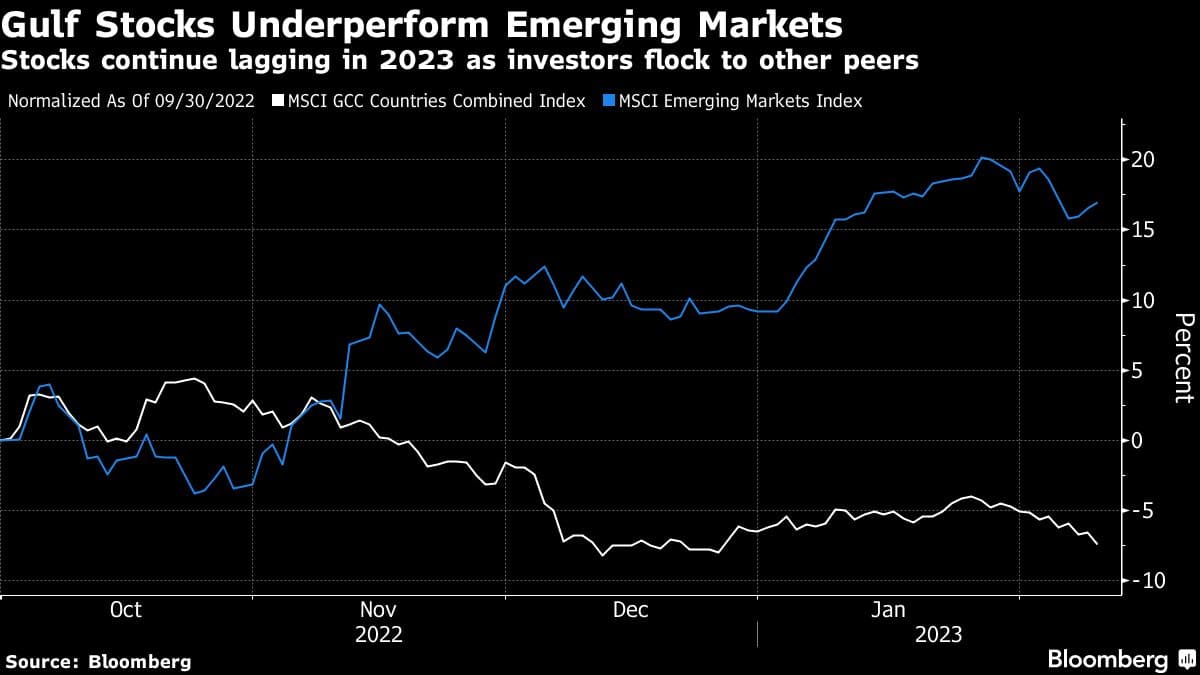

Gulf stocks diverged when their emerging-market peers began to take off in November, with the MSCI Emerging-Market Index rising 20% as of Monday. The MSCI GCC Countries Combined Index lost 10% over the same period.

That’s a stark reversal from the two preceding years, when the Gulf index soared nearly 50% as emerging markets slumped. Banks in Saudi Arabia, the region’s largest market, are among sectors lagging in 2023, weighing on the benchmark Tadawul All Share Index, where financial firms make up nearly 40% of the gauge.

“The broad shift of emerging-markets portfolios out of commodity exporters into China, the decline in oil prices and the US dollar, along with the underperformance in Abu Dhabi stocks related to Adani, have all held back equity markets in Gulf nations so far this year,” said Hasnain Malik, a strategist at Tellimer in Dubai.

Faisal Hasan, chief investment officer at Al Mal Capital in Dubai, expects the malaise to persist throughout the first quarter. He attributes some of the rally in broader emerging markets to a weaker dollar, which makes little difference in the Gulf, where currencies are pegged.

A gauge of emerging-market currencies is up 7% since November. Over the same period, Qatar’s QE All Share Index is down 16%, the world’s steepest decline. It’s followed by the Russian index and then Saudi Arabia’s, which has dropped 11%.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.