When the co-founders of HCL (then Hindustan Computers Ltd) quit their jobs at DCM Data Products in the mid-1970s to start a computer company, they didn't have a lot of cash or even a licence. "You needed a licence to sell computers in those days," says Ajai Chowdhry.

HarperBusiness; Rs 599.

HarperBusiness; Rs 599.The six HCL co-founders (Chowdhry, along with Shiv Nadar, Arjun Malhotra, Yogesh Vaidya, Subhash Arora and D.S. Puri) took many steps that will be familiar to startup founders today - quitting their jobs in a market where jobs were hard to come by was risky, of course. But staying the course also took determination and ingenuity - to generate cash, they marketed calculators till they got a licence to sell more powerful machines (Chowdhry doesn't like the word jugaad which he says implies cutting corners). Once the licence came through, they did "roadshows", taking their computers to several cities and towns. Here, they would set up four tables to demo the product and close the deal. For their first customers, the co-founders targeted shopkeepers and panwaris, because big companies typically wanted to deal with other big companies and already had many suitors.

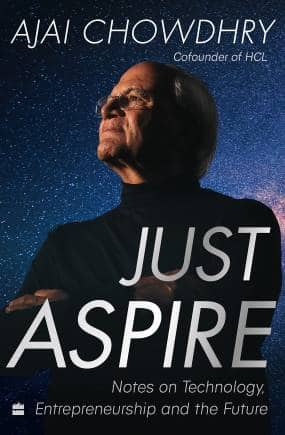

Nearly 47 years on, Chowdhry is now an investor in and mentor to startups in segments from quick-service restaurants to space tech. He is also the author of Just Aspire: Notes on Technology, Entrepreneurship and the Future, which launched at Delhi's India Habitat Centre on March 14. In a conversation at his Sundar Nagar home office, on an unusually pleasant Delhi afternoon, we talk about his book, why the next big thing in tech will be in the hardware space, lessons he can share with startup founder from his own journey, and the eye-catching timepiece he has on, among other things. Edited excerpts from the conversation:

That's a nice-looking watch you're wearing. Do you collect?I have a guy who recommended it. And once I saw it, that was it. It (a Bovet) is reversible for when I want a more muted look. Yes, I like the older watch brands.

You have experience with startups, both as a co-founder and an investor. What are the sectors that you think are super exciting in the next five to 10 years?If I look at the next eight or 10 years, I think there is going to be a huge opportunity in hardware. Reason, and that's something that I've written in my book too, I think there is a great opportunity for India to replace China in product.

Till yesterday, if you wanted to create a tablet or a computer, you just went to China - to one of their design houses - got the product designed. And then you went to a manufacturer, you got it manufactured. You brought it back to your country, put a label on it. And it's happening to the whole world today. They have become dependent on the product factory of China.

Because of the last three years of geopolitical situation, COVID and the serious problem of supply chain, everybody all over the world wants to diversify. And that's where lies the opportunity. We (India) should become the design factory to the world, we should become the product factory to the world. And that's where startups come in... Let's seize this opportunity and make India a product nation.

Our advantage is that we are damn good at software as well. So what we need to do is combine our design-engineering capability with software capability. And all products today, whether you look at automobiles, or you look at air conditioner, or you look at a washing machine, any product, has a great combination of software - everywhere you will find AI (artificial intelligence) ML (machine learning) integrated into hardware.

Startups can seize that opportunity. Start to create products. Just take few product examples: drones, shoes. Because India has banned import of drones from China. And we should design our own components for phones today - what all the phone companies are doing (today), they're importing all the components still from China and Sri Lanka. No, no, no, that's not the way to go. We need to create our own designs.

Big things are happening in space, I believe. I invested in a company called Dhruva. Fantastic work. They launched two satellites a few months ago. So drones, space, med tech... we need high-quality, cheaper products (medical devices) in this country to be able to serve the smallest city, smallest village.

The other areas I think are going to be huge are genetics and biotechnology. India should look at what we should be 30 years later. Let's say you want to get into any of these areas which are new spaces, bio hardware, unique patient data is not well recorded, it's also not sorted. The government has to look at it in a different way. They need to take a view that these eight or 10 areas, we will create a fund of funds, which will then fund the VCs, who can then fund the startups. But they should also have direct models.

There's lots of money sitting around with insurance companies, pension funds, etc. Look at the Canadian special pension fund to invest into startups... In India, there's a lot of money sitting there, we must get domestic money to support these startups.

Given the rate of failure of startups, wouldn't you be worried about losing that pension money?Look, somewhere you have to take that risk. And if you, say, invest in a VC and then the VC in the investor, that's the way you take care of that risk. The other part is that there's a lot of global money sloshing around and a lot of money with Indians abroad, who would like to invest in startups here. Why don't they invest? They don't invest because of capital gains taxes... I have very strong belief that the next 30 years belong to startups. And all the new areas that we need to create in terms of technology, startups will play (account for) at least the 30-40 percent; the rest will be by medium-sized companies and large companies. Also, it's not that they (medium and large businesses) will stay away from innovation, but you know, innovation really happens in small companies. In the big company, nobody takes risk.

What do you think is the biggest startup killer?I think startups getting their hands on easy money is the worst thing that can happen. I've seen it with my own eyes. See, I'm part of Indian Angel Network. I've invested in about 70-odd companies personally. And I mentor some of them. I was mentoring this beautiful edtech company about a 10 years ago, brilliant company, brilliant guy from IIT Kanpur, great technology, everything was great. And he was doing well with angel money...he was growing. And he was one of the earliest people to get into examination area, which is a big deal today. He was far ahead of time. And then what happens is that he got VC money. He started spending like crazy on marketing, he spent he blew up all his money in one year. And that was the end of the company. Because there's no way I could help him to recover. I kept telling him don't do this. But then the guys, the VC guys were saying no, no, we want to see growth. This grow, grow, grow, grow business, which has been there for the last 10-15 years, is a disaster. Now everybody's understood that profits are more important. Cash flow is more important. I always teach sales, you know, startups, don't worry even about profits, control your cash flow. If you control your cash flow, profits will happen.

And remain very vigilant about expenditure. The day they (founders) get VC money, everything changes. Let me tell you what happens: from a Toyota car, they go to a Mercedes; from staying in ordinary hotels, they go and start staying in very fancy hotels; from travelling economy, start going into business, these three things kill startups. They just don't value money. And valuing money is the most important thing in any business. If you really know how to use money well, you can be successful. And that is the biggest challenge today. Startups are different in the last 10 years. And now everybody's talking about profitability. So it's all changing.

You see it as a problem with the VC culture?You need to grow at a pace that you can manage. If you have the right skills, you have the right management team, you have the right people who can help you grow, it's a different ballgame. So there are companies who have grown very well very fast, but they created a structure of management teams that could take it. If you don't have that structure and you're still growing, then you're actually chasing your tail over time.

To come back to HCL, you mentioned previously that a lot of the culture of the organization really comes from the promoters; whether there is corporate governance, or ethics, or appreciation of talent, a lot of that is sort of percolating down from the founding team, from the promoter, etc. How do you see the time when you started vis-a-vis today? And what were some of the things that you thought you absolutely must have in place for HCL when you started out?When we were starting out, there's no time to think beyond the point. So it was like a race that we were running, because we were trying to create the market. And it's a tough job, but we did it in a great way. But as we started to grow, we realized that alone passion and aspiration does not work. When you start to scale your company, you need to bring in a series of processes to run the company. And that is where a change needs to take place. You need to bring in people into the organization who understand process, you need to train people to follow processes. And that is what makes the difference -it's critical to balance passion and process. And as your company starts to grow, you don't even know the name of your employees after a while. So it's tough. But you need to still create some kind of an intrapreneur culture within the organization. In my company, I used to do it in a slightly different way. Every business has its own P&L (profit and loss) and the leader and the team were rewarded based on profit. Even the accountant got a percentage of the profit if that unit made a profit. So we broke through the profit culture from top to bottom.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.