For anyone watching the Indian Manufacturing story, it's time to cheer. India is now ranked second, after overtaking the US, on the Cushman & Wakefield Global Manufacturing Risk Index(2). This index assesses the most advantageous locations for global manufacturing among 47 countries in Europe, the Americas and the Asia Pacific.

There are many factors that have led to India's improved position as a manufacturing hub. GOI's Make In India scheme has provided impetus to 15 key areas by opening up FDI, increased digitisation, reforms to licensing and clearance processes, overall decrease in paperwork, and improvements in physical infrastructure. Other initiatives that have directly impacted manufacturing are Skill India which aims to skill 10 million Indians annually in various sectors, PLI Schemes that incentivise growth, Startup India which aims at creating an ecosystem that fosters growth, Sagarmala which aims at developing ports and promoting port-led development, AGNII which is an innovation accelerator, and of course, the Gati Shakti program that will provide a significant boost to transport, warehousing and production infrastructure overall.

According to the Cushman & Wakefield report "India could benefit from plant relocations from China to other parts of Asia due to its already established base in pharmaceuticals, chemicals and engineering, sectors that continue to be the focus of U.S.-China trade tensions."

And the numbers show it. FDI in the manufacturing sector increased by 25% to $16.3 billion (3) in 2021. The government allocated ₹2,403 Crore(3) for the promotion of Electronics and IT Hardware Manufacturing in this year's budget. Manufacturing Sector IIP (Index of Industrial Production) has been rising steadily over the years, and exports of manufactured goods increased by 38%(3).

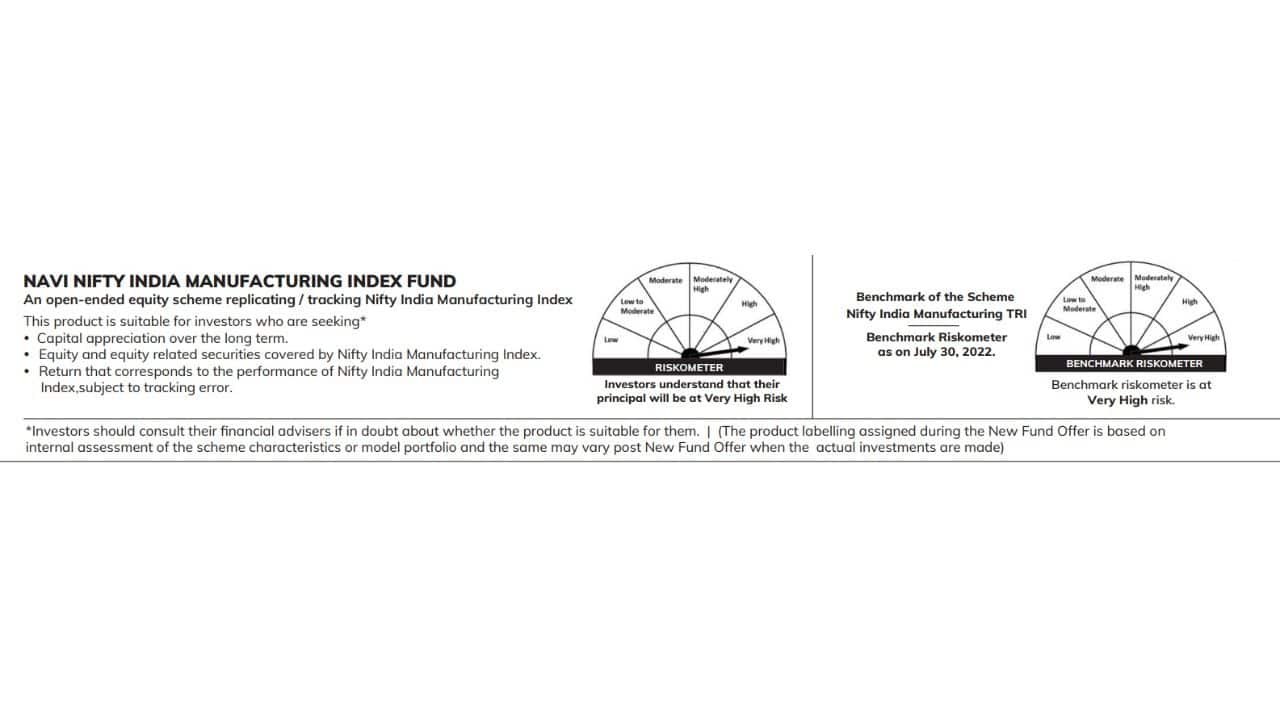

For investors looking to be part of India's manufacturing growth story, this provides a unique opportunity. Navi Mutual Fund has launched the Navi Nifty India Manufacturing Index Fund, which tracks the performance of a constituent list of 79 companies in India. As India’s first manufacturing index fund, it offers a highly diversified investment opportunity, at low cost**.

The Navi Nifty India Manufacturing Index Fund has four key USPs:

- Balanced representation: The top 10 stocks of the Nifty India Manufacturing Index constitute ~37% of the index(4).

- Attractive returns: Nifty India Manufacturing Index has provided 8.9%, 24.5%, 9.6%, 14.5% and 14.3% CAGR over the last 1, 3, 5, 10 years respectively(4)**

- Diversification and Potential: Well diversified across sectors and market caps. The fund has the potential to benefit from sectors like Automobile and Auto Components, Capital Goods, etc.

- Low cost: With a proposed Total Expense Ratio of 0.15% for direct plans, this is the lowest cost fund tracking the manufacturing index. For context, according to SEBI, the TER allowed for Index Funds is capped at 1%*

Navi Mutual Fund’s NFO opened on 12 August and closes on 23 August. The fund will be managed by fund manager, Mr. Aditya Mulki.

(1)

(2)https://www.cushmanwakefield.com/en/insights/global-manufacturing-risk-index 19th Aug, 2022.

(3)https://www.navimutualfund.com/navi-nifty-india-manufacturing-index-fund 19th Aug, 2022.

(4)https://www.navimutualfund.com/navi-nifty-india-manufacturing-index-fund 19th Aug, 2022.

*This TER is not permanent and is subject to change from time to time as per changes in market conditions and other factors within the overall limit of 1%.

**Past performance may or may not be sustained in the future.

As with all investments, investing in a new fund offer should be done in consultation with one's financial advisor(s).

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Moneycontrol journalists were not involved in the creation of the article

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!