Direct-to-digital movie releases are a product of the coronavirus pandemic that gave producers the choice to look beyond a theatrical release to monetise their content.

With many films still releasing directly on streaming platforms, the question is whether a theatrical release is more profitable than a release on an Over-The-Top (OTT) platform.

Some producers say profitability is limited on OTTs. Others say it is a safe bet for small films.

In the last two years, OTTs offered producers 80-100 percent premiums (OTT platforms paid 80-100 percent more over the cost of production) to showcase their movies.

With theatres reopening and content supply going back to pre-COVID levels, streaming platforms have cut the premium by 30-40 percent, said Divya Dixit, who has worked with OTTs like ALT Balaji and ZEE5.

Direct-to-digital

In the last two years, film content was scarce and OTTs were looking for ready content to drive subscriptions at a time when viewership was at an all-time high on streaming platforms, Dixit said.

"So, OTTs paid what producers asked but now it has become a buyer’s market and premiums are currently half of what was given," she added.

On the other hand, star power on the big screen has faded and a change in content consumption has resulted in many flops at the box office, including films like Aamir Khan’s Laal Singh Chaddha and Akshay Kumar starrer Raksha Bandhan.

"Except for the few big names, a majority of the producers do not have the choice of medium for release. Releasing in theatres carries an extra cost of what is called publicity and advertisements (P&A) in the range of Rs 5-6 crore for small and medium-budget films. Therefore, independent producers do not have the bandwidth to release films in theatres on their own, even if the film deserves a theatrical release," said producer Sanjeev Kumar who has produced films like Madaari and Daas Dev.

This is why producers of many small- and medium-size films are directly going to OTT despite the reopening of theatres.

Such producers also struggle to get a sufficient number of screens and also suffer due to the poor scheduling of their films in cinemas.

"Niche films end up losing a lot of money in theatres. Producers of films like Monica O My Darling, Forensic, Plan A Plan B were right in going to OTT directly," said Sanjay Chabbria, producer and founder of Everest Entertainment.

Dixit said that for smaller films it is easier to go to OTT platforms because it means pre-booking revenue and a relatively safe bet.

But even on OTTs, many smaller films are unable to strike a deal as streaming platforms don't want to spend Rs. 3-4 crore on marketing.

Hence, OTT operators want to buy movies after their release in theatres, which has been the case for films like Jahnvi Kapoor-starrer Mili, and Sonakshi Sinha and Huma Qureshi’s Double XL.

Returns on OTT platforms

Direct-to-OTT releases don’t offer significant profitability, said producer Kumar.

"If you go to the OTT platforms after you have produced the film on your own, you will have to mostly get satisfied if you have been able to recover the cost. In case of pre-approved projects, the margin is generally in the range of 8-10 percent of the cost of production, if you have been successful in delivering the final copy at the pre-agreed cost of production," he added.

Producer Mansi Bagla who produced the recent venture Forensic, available on ZEE5 and starring Radhika Apte, said that on OTT platforms, there is a commissioning route and an acquisition route.

"The profit margins are different in both structures and can range from 10 to 100 percent. Also, it depends if you package the satellite (rights) with OTT or are selling separately," Bagla said.

Producers get 3-5x returns for a direct-to-digital release, said Utpaal Acharya, CEO, Content Engineers, a film studio.

But Kumar said the recovery of the cost with a slender margin is considered a win-win situation for producers in case of a majority of the films set for a direct-to-digital release.

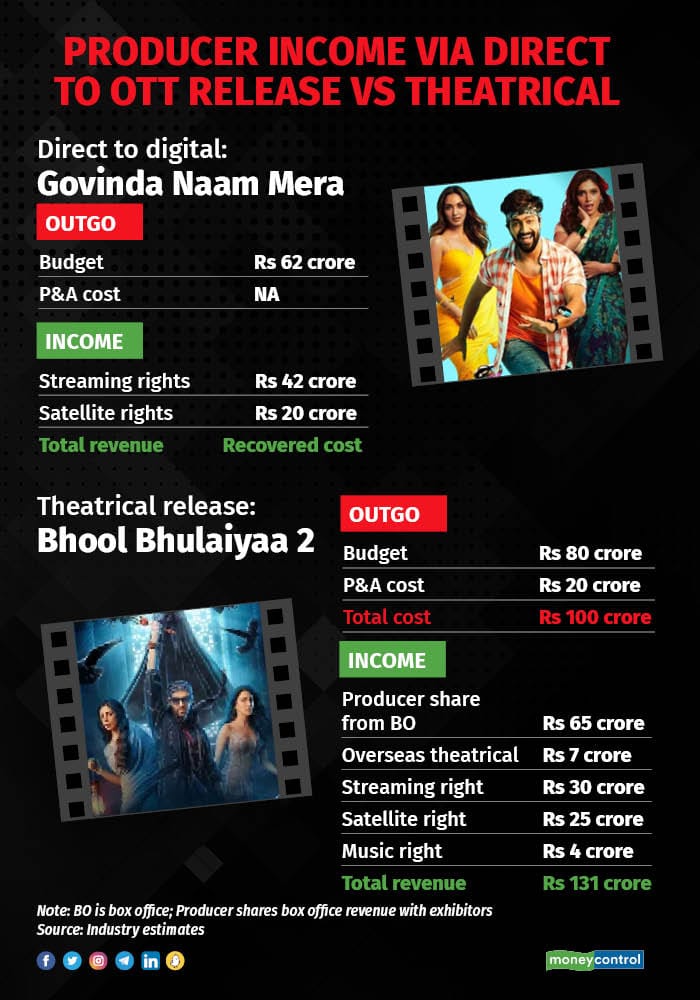

"Producers mostly get one-time value for a film released directly on streaming platforms and they are not part of any upside in terms of profitability. In case of a theatrical release, the possibility of earning is unlimited as well as the risks. And once a film does well at the box office, its value on OTT and satellite platforms get significantly enhanced," he added.

Box-office profits

The income structure of a theatrical release is variable, which means the more business done by a film at the box office will offer a producer more income and profits, said Varun Bagla, who was also part of Forensic.

"But it swings both ways as release costs for theatrical films are much more as a lot of money goes into P&A compared to OTT releases," he said.

Mansi Bagla said that for a successful theatrical release the profits can range up to 5x times the cost of production.

Acharya said the return on investment can go up to 7-10x.

"Also, there is revenue which is also generated through licensing (with TV, OTT) which comes on a recurring basis if the deal is structured well," said Mansi Bagla.

"Once a film fulfills audience’s expectations, it can go to any limit in terms of theatrical revenue and the return on investment could be very high like we saw for The Kashmir Files (over 10 x return on investment), Bhool Bhulaiyaa 2 (around 4x ROI) and Kannada film Kantara (20x)," said Kumar.

Acharya said a producer can retain the intellectual property and monetise derivative rights like prequels and sequels of a film in case of a theatrical release.

In the case of direct-to-digital releases, the OTT platform takes everything.

Some of the direct-to-digital releases he thinks could have fared well in theatres include Akshay Kumar's Cuttputlli, Dasvi starring Abhishek Bachchan and Monica O My Darling featuring Huma Qureshi and Rajkummar Rao, among others.

He added that 2022 theatrical releases like Amitabh Bachchan's Goodbye and Janhit Mein Jaari would have performed well as direct-to-OTT releases. The two films turned out to be weak performers at the box office.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.