One important thing: DeepSeek shocker: Nasdaq tumbles, with AI darling Nvidia hit hardest.

In today’s newsletter:

- Sridhar Vembu's new role at Zoho

- Juspay set to be India's first unicorn of 2025

- IPO incoming: Cure Foods, Pine Labs

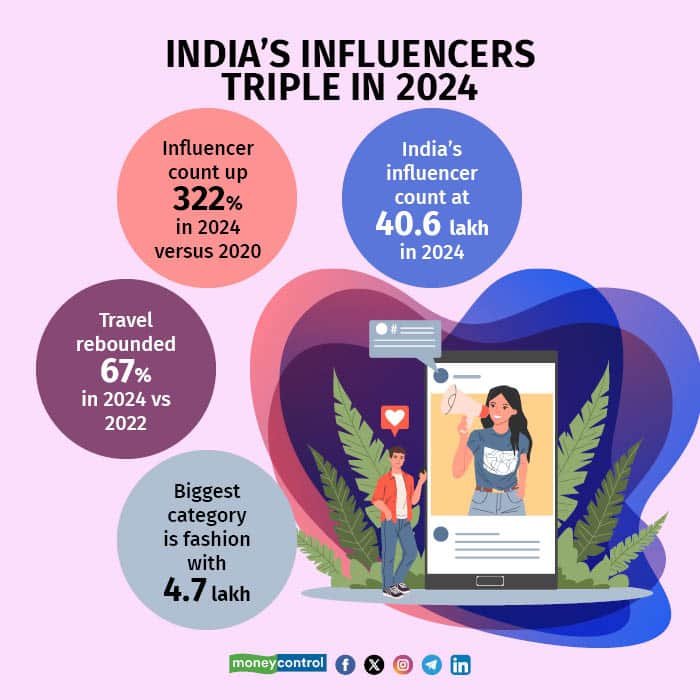

P.S. How many influencers does India have? Scroll below for more deets!

Was this newsletter forwarded to you? You can sign up for Tech3 here

Top 3 Stories

Top 3 Stories

Sridhar Vembu's new role at Zoho

In a surprising leadership change, Sridhar Vembu, the co-founder and driving force behind Zoho Corporation, has stepped down as CEO to assume the role of Chief Scientist.

Tell me more

This decision reflects Vembu’s deep-seated passion for advancing research in artificial intelligence, distributed systems, and other transformative technologies.

"The future of our company entirely depends on how well we navigate the R&D challenge, and I am looking forward to my new assignment with energy and vigor. I am also very happy to get back to hands-on technical work," Vembu wrote on X.

A vocal advocate for robust research and development, Vembu has consistently emphasised staying ahead of technological trends to deliver value to Zoho’s global customer base

New top-deck at Zoho

Zoho co-founder Shailesh Kumar Davey will take on the role of Group CEO, steering the company’s strategic direction. Another co-founder, Tony Thomas, will lead Zoho’s operations in the United States, its largest market.

- Rajesh Ganesan will head ManageEngine, Zoho’s IT management division, while Mani Vembu will oversee the Zoho.com division, the company’s flagship SaaS platform.

Changing trends in SaaS

Juspay set to be India's first unicorn of 2025

The Indian startup ecosystem is poised to get its first unicorn of 2025 and it's a startup that is currently in the thick of the news.

Driving the news

Juspay, a payment orchestration software provider, is raising $150 million in a round led by Kedaara Capital with participation from WestBridge and SoftBank, sources tell us.

- This funding comes on back of Juspay's strong financial performance, with operating revenue increasing by nearly 50% to Rs 319.32 crore in FY24.

Yes, but...

Juspay is facing intensifying competition in the payments space, with multiple payment gateways, including PhonePe, Razorpay, and Cashfree, severing ties with the payment orchestration platform (Read our explainer!)

- The company received RBI's nod to operate as a payment aggregator in February 2024. Industry insiders suggest this could be the reason many payment gateways have moved away from Juspay.

The startup, which also developed NPCI's BHIM UPI app, insists that it has other software solutions in place to help it stay competitive.

Read more

IPO incoming: Cure Foods, Pine Labs

Swiped that card to order a pizza? Soon, you may be owning a slice of that action…

Driving the news

Foodtech startup Curefoods and fintech major Pine Labs are making rapid strides on their IPO journeys

- Curefoods, the Accel-backed startup, is eyeing $300–400 million from its IPO, with bankers and law firms engaged to finalise advisors, sources tell us.

The IPO ambitions are surging in 2025, with the two firms joining the ranks of Zepto, Groww, Lenskart, PhysicsWallah, and Fractal, all aiming to capitalise on the growing appetite for new-age tech stocks in the country.

Serving on the platter

Curefoods, which houses brands like EatFit, Cakezone, Nomad Pizza, Sharief Bhai Biryani, and Frozen Bottle, is likely to hit the markets in the latter part of FY25.

- The final IPO size would depend on secondary share sales from current investors.

- What’s backing the plans is the company’s improved FY24 numbers wherein it slashed its losses by almost 50% on a Rs 585 crore revenue.

With 500 cloud kitchens and offline stores, its recent acquisition of Krispy Kreme’s operations in South and West India may add to its growth play.

Fintech play

Pine Labs is a step ahead in the IPO process, with top bankers like Axis Capital, Citi, Morgan Stanley, Jefferies, and JPMorgan already on board.

- The IPO could be worth $1.2–1.5 billion, with backers like Peak XV, Mastercard, and Temasek expected to offload 20% of the firm’s stake, sources tell us.

- The issue is expected to be one of the largest IPOs in the payments space after Paytm.

Also Read: Pine Labs' India business revenue rises 2.8% to Rs 1,317 crore in FY24, but losses surge threefold

MC Special - A Maha Kumbh for startups

As the Maha Kumbh enters its third week, devotees are thronging Prayagraj in Uttar Pradesh, both physically and virtually.

- Spiritual startups like Sri Mandir, Astroyogi, and Vama, that are enabling devotees to tune in to the event through live streams and digital consultations, are witnessing an unprecedented surge in demand as app downloads have increased 30-50%.

- These platforms have also introduced Maha Kumbh-specific product offerings like personalised pujas, VIP travel packages, and even delivering the holy Triveni Sangam Jal (water) to devotees’ homes.

Go deeper