January 1, 2023 would have brought in a bizarre regulation (if I may call it so) that would have restricted popular UPI apps from growing.

The National Payments Corporation of India (NPCI) on March 2021 had came up with a novel idea to save the unified payments interface (UPI) from concentration risk.

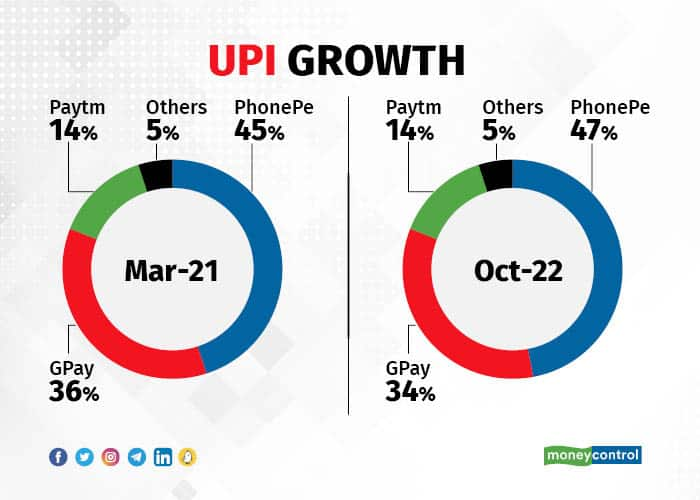

The guidelines mandated each UPI third-party app to adhere to a 30 percent transaction volume cap by December 31, 2022, to avoid the concentration of UPI volumes in the hands of a few players. Currently, three players — PhonePe, Google Pay, and Paytm — account for approximately 96 percent of monthly UPI volumes.

But on December 2, in a widely expected move, the NPCI extended the deadline for UPI players to adhere to a market cap of 30 percent by two years, to December 31, 2024.

Well, the NPCI’s original intent was not entirely unfounded, as the UPI was suffering from large tech outages starting from a big bang issue that happened in 2020 when PhonePe went down due to a moratorium on Yes Bank. That’s when we all realised our dependency on an app to make daily payments.

When the NPCI came up this restrictive policy in 2021 (to be implemented phase wise from January 2023), the UPI was seeing close to 2.5 billion monthly transactions. PhonePe with 45 percent share, and Google Pay at 36 percent share were walking away with the bulk of it. In October, the UPI grew by 193 percent to 7.3 billion transactions. In terms of app share, nothing changed. In fact, PhonePe cemented its leadership further by increasing its market share.

The CEO of PhonePe, Sameer Nigam had made it very clear in 2021, and reiterated it few months ago, that the company was not going to abide by this erratic regulation of imposing 30 percent cap. Many, including this author, then wrote why the rule was never going to work.

In 2021, the NPCI believed that WhatsApp Pay will take off, and will naturally balance out the app share. Sadly that never happened, and even after a year and a half it is struggling to make a dent whatsoever.

Here are some reasons why the deadline was extended:

While this has been deferred by two years, nothing much would change from the current scenario unless we see another dominating app, like WhatsApp, taking off in payments; the likelihood of that at the current stage looks very difficult.

Also, it’s a very long period in the fast-changing fintech industry so we are not sure what future dynamics would be at play. The New Umbrella Entity (NUE), which was positioned as a UPI competitor, has been delayed by the RBI, but it may take birth during these three years. The NUE is an attempt by the RBI to create a new retail payment system for India comprising of but not limited to the ATMs, White Label PoS; Aadhaar-based payments, and remittance services.

I hope all players find ways to overcome the technology overhang risks and work on improving the infrastructure instead of finding consumer unfriendly ways like usage capping.

Deepak Abbot is co-founder, Indiagold. Views are personal, and do not represent the stand of this publication.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.