“And I came here because [of] behavioural economics. How could economics not be behavioural? If it isn’t behavioural, what the hell is it?” -- Charlie Munger to an audience at Harvard University in 1995.

Initially, economics was conceived as a behavioural science, evident in Adam Smith's The Wealth of Nations (1776), devoid of equations. However, contemporary economic education often disconnects from real-world behaviour, focusing on an idealised realm where people act as economists posit, diverging from original behavioural roots.

In a more sensible world, economics would have been a subdiscipline of psychology. In today's article, I aim to exhibit why the enthusiasm surrounding small-cap stock rallies often leads to widespread cheer and also lays the groundwork for a potentially severe downturn.

To begin, let's establish some key facts. Currently, the market capitalisation of the top 500 listed companies (BSE500 Index) stands at $3.5 trillion, with the free-float market capitalisation accounting for approximately half of that. Foreign institutional investors own about 20 percent of listed entities, equivalent to $687 billion, while mutual funds hold 9 percent ($327 billion), and retail direct equity ownership comprises 13 percent ($444 billion).

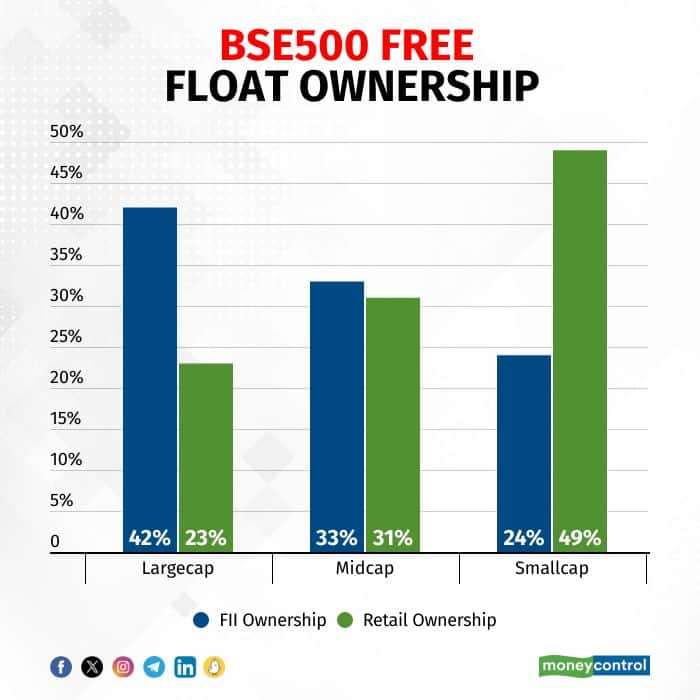

However, the breakdown of ownership is more pertinent. Please refer to the chart below.

Divergent ownership

Within the BSE500, FIIs own 42 percent of the free float of large-cap companies (SEBI definition), whereas retail owns 23 percent. However, within small caps, this ownership dynamic reverses: FIIs own 24 percent and retail directly owns 49 percent.

This discrepancy in ownership makes the small-cap segment particularly intriguing. Let's delve deeper.

The BSE SmallCap Index comprises 953 constituents, with their market cap ranging from Rs 450 crore to Rs 43,000 crore (the rationale behind including the latter in a small-cap index is a topic for another discussion).

Nevertheless, since March 28, 2023, that index has surged by over 48 percent, resulting in wealth accumulation of over Rs 4.4 lakh crore for retail shareholders—an impressive start to the new Samvat 2080! How these gains have been apportioned is even more impressive.

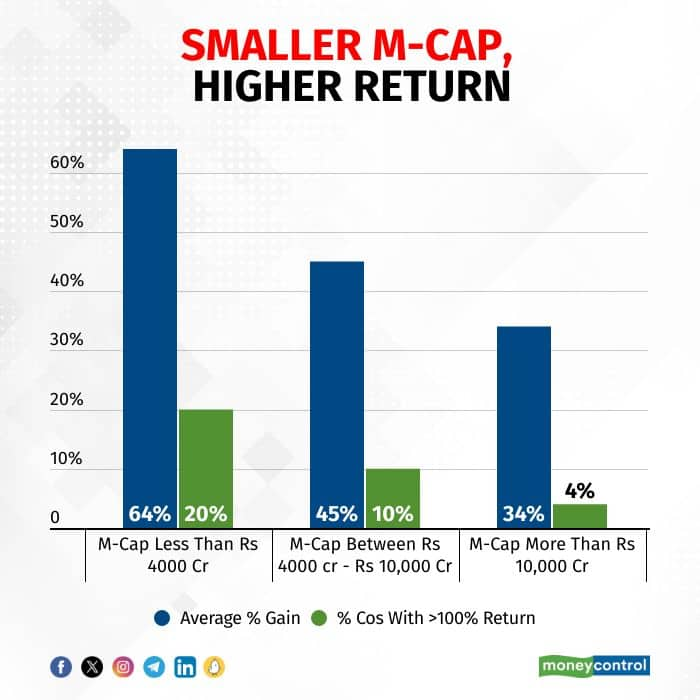

The chart below illustrates how the lower the free float, the higher the average returns, with a greater proportion of companies delivering returns exceeding 100 percent.

Furthermore, within the small-cap realm, relatively smaller market capitalisation companies have experienced higher average returns, along with a greater proportion of companies providing returns exceeding 100 percent.

In theory, an argument can be made along the following lines: First, with the likelihood of prolonged higher US interest rates, FIIs are poised to divest from risky assets, including emerging markets like India. Their withdrawal of over Rs 50,000 crore since September 2023 offers evidence in favour of this argument. Large caps are thereby rendered vulnerable.

Second, due to the expanding equity culture in India, bolstered by an influx of new investors post-Covid, and the increasing domestic flow into mutual funds (notable in the surge of small- and mid-cap inflows – their market-share has more than doubled recently: from 15 percent in 2021 to over 36 percent year to date in 2023), the small-cap sector emerges as an advantageous choice.

Furthermore, given the data shared above, the obvious preference should lean towards entities with lower free float and relatively smaller market capitalisation. Right?

Also Read: Privileging the hypothesis: Are we staring at an extended phase of subdued market returns?

Theory vs practice

Theoretically, as long as the profits of these companies continue to rise, their PE multiples will expand due to increased demand, leading to exceptional returns. Taken to an extreme, this logic implies that the PE multiples for many such outstanding companies could reach four digits.

But that is in theory. Yogi Berra once famously said: “In theory, there is no difference between theory and practice. In practice, there is.”

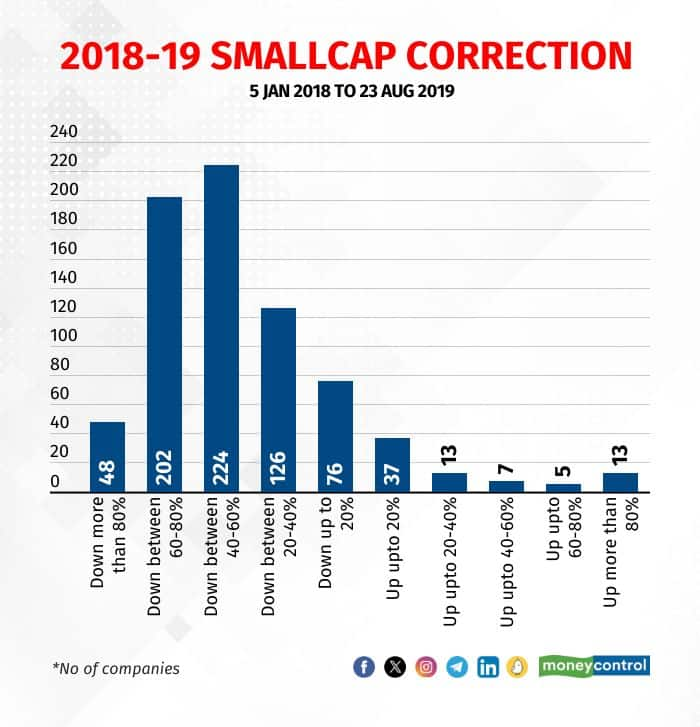

This is what happened the last time around we were this exuberant. Despite the PAT (profit after tax) for companies in the BSE SmallCap Index increasing from $67 billion in 2017 to nearly $94 billion by 2019—a 40 percent rise— notably, 63 percent of the companies within that index experienced a decline of over 40 percent between January 2018 and August 2019. Please note that I have on purpose excluded the Covid-19 impact. Please refer to the frequency distribution chart below for details.

What caused this downturn? The BSE SmallCap Index itself plummeted by 38 percent during that period. This was attributed to the introduction of long-term capital gains tax by the Central government in the 2018 budget, coupled with SEBI's re-categorisation of mutual funds to align with a "true to label" status later that year.

But how did the seemingly inconsequential changes lead to over 250 businesses plummeting over 60 percent in under 18 months? What holds today was equally valid back then.

Also Read: Network Effects: A double-edged sword in regulated markets

There's an element of behavioural economics at play. When things are going well, people tend to believe that the trend will persist. Initially, this sets off a positive feedback loop: increased inflows result in higher valuations, prompting even more inflows. This cycle continues until it becomes unsustainable and ultimately collapses, akin to a house of cards.

Examine the chart below. The downturns in the small-cap index are consistently more severe than those in larger-cap indices, but the period from December 2017 to March 2020 was particularly brutal for smaller-cap companies (on a relative scale).

Robust rally

If a 25 percent index pullback can be considered the threshold for a new cycle, the current small-cap rally proves to be the most robust since the 2004-2007 cycle. Notably, during that cycle, exceptional growth occurred at considerably lower entry valuations. The Small Cap Index EBITDA surged from Rs 10,400 crore to over Rs 56,000 crore, approximately 5.4 times, with a Nifty PE (more reliable measure compared to small-cap PE) of 15X.

Applying the same multiple to the current scenario, a comparable increase in index EBITDA from Covid lows would necessitate reaching Rs 12.5 lakh crore (F23 EBITDA at Rs 3.5 lakh crore), while the Nifty PE multiple currently hovers around mid-20X.

That said, if you were to ask me to pinpoint a reason for small-cap companies to repeat the experiences of 2018 or 2022, I would find it challenging. Things that have never happened before are happening all the time; predicting gets challenging. In physics, the opposite of a good idea is a bad idea; in economics, the opposite of a good idea can be a great idea. Perhaps this time it's truly different.

Nevertheless, the valuations of many small-cap businesses have started embedding significant potential upsides. Unless profits continue to surpass expectations, the odds of the small-cap rally not concluding favourably are rising.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.