If you’re a CEO today, don’t just ask how you’re managing capital, risk, talent, or transformation. Ask: “What is all of this doing to our reputation?” Because that’s the scorecard the world is watching.

In its annual CEO survey, Deloitte (along with PwC, KPMG, and other global consultancies) routinely ranks the top concerns of business leaders across the world. Commonly featured areas include talent, cybersecurity, digital disruption, sustainability, inflation, capital access, and regulatory change.

These are all valid, critical challenges. CEOs are under immense pressure to lead through complexity, mitigate risks, and drive resilient growth.

But if we pause and look beyond these surface-level priorities, we see something striking:

Each of these concerns—no matter how operational or technical—is ultimately filtered through one unifying factor: Reputation.

And yet, reputation is rarely ranked #1. In some lists, it doesn’t even appear. That’s not just a blind spot. It’s a strategic risk.

Makes one wonder why the real top concern isn’t at the top spot as the loudest one

Why Reputation deserves the top spotReputation isn’t just a brand or PR issue. It is the accumulated public perception of how well a company manages every single one of its business concerns. It is shaped not only by success or failure, but by how those outcomes are achieved and communicated.

Reputation multiplies the impact of good performance. It amplifies the fallout of missteps. And it shapes how every stakeholder—investors, regulators, employees, customers, and partners—reacts to your decisions.

Reputation is what remains when everything else is stripped away. And in today’s connected, volatile, and hyper-transparent world, a damaged reputation doesn’t just hurt. It threatens survival.

What the rankings miss

Let’s look again at the typical ‘top CEO concerns’ lists from Deloitte and others. They usually feature items like:

1. Talent retention and upskilling

2. Cybersecurity threats

3. Regulatory pressure

4. Geopolitical instability

5. Technological disruption

6. Access to capital

7. Climate risk and ESG expectations

8. Innovation velocity

9. Operational resilience

10. Growth

But here’s the truth: A cybersecurity breach becomes a reputational crisis in seconds. A toxic culture drives attrition—and leaks that damage brand credibility. Greenwashing or ESG failures trigger public backlash. Missteps in innovation (especially around AI) invite scrutiny and distrust. Crises test not just your systems, but your character in the public eye.

Every one of these is either a reputational input or a reputational outcome.

So while CEOs may name ‘cyber’ or ‘talent’ as their top pain points, what they’re really afraid of is:

“What happens if the world sees us as incompetent, unsafe, unethical, or irrelevant?”

Let’s use two simple but powerful filters to re-evaluate CEO priorities:

First, what contributes to Reputation as a concern area? Are there multiple, interdependent, and high-stakes sub-factors?

Second, what happens when Reputation fails—or excels? Does it trigger significant impact on stakeholders, financial performance, or license or even the very ability to operate?

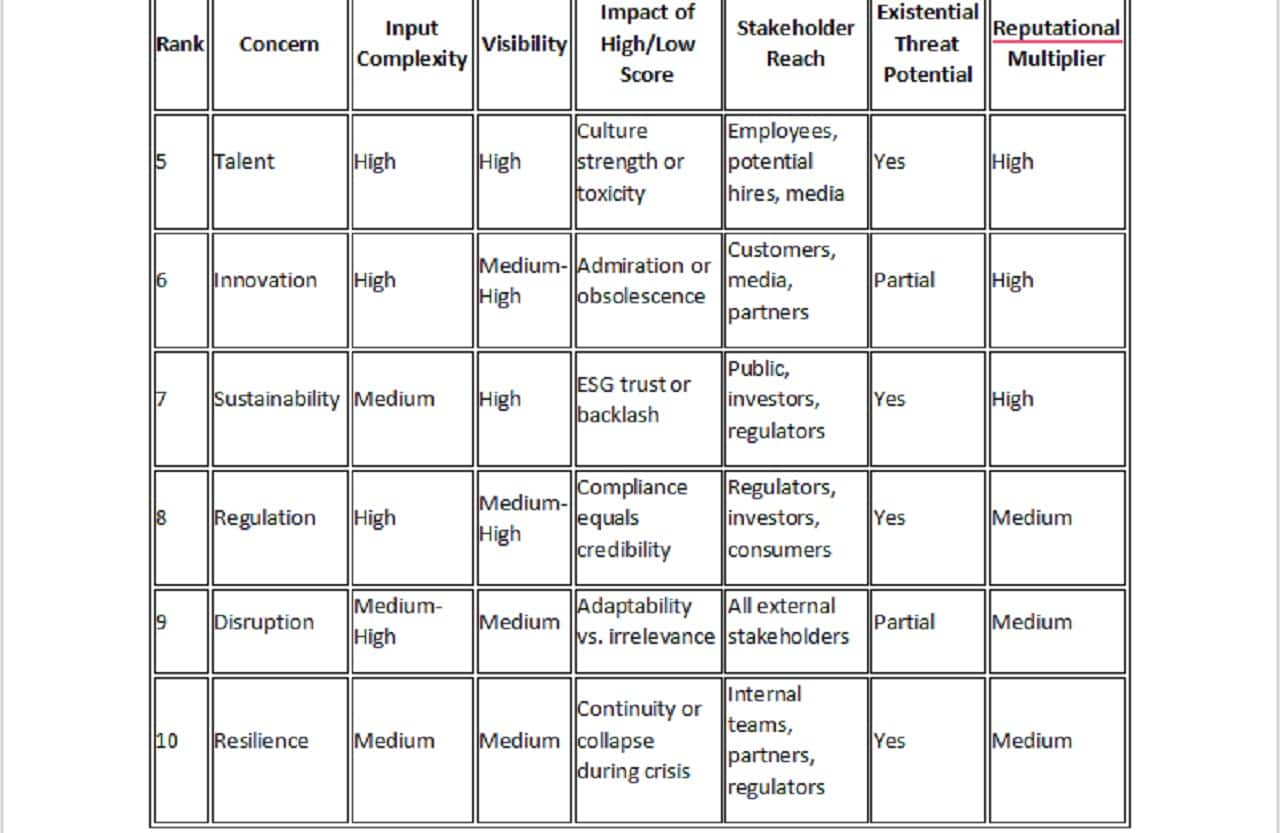

Using these criteria, here’s how Reputation compares to other CEO concerns:

Most traditional CEO priority lists reflect long-standing operational risks—talent shortages, regulatory pressures, and digital transformation. But in today's hyper-visible, high-stakes world, where trust is currency and reputation is fragile, those lists need a deeper, more reputationally anchored reordering.

So the reordered CEO Concern Matrix above places Reputation at the center—not as a soft concern, but as the master risk vector. It is the scorecard – the sum of every leadership decision – that stakeholders use to judge all other CEO decisions.

And here’s how the rest logically follow Reputation on the list:

Cybersecurity is at the second spot because no breach stays private. It’s not just a tech issue—it’s a direct assault on trust. One breach can collapse years of brand credibility overnight.

Capital is at third, especially in today’s tightened financial climate. Cash flow, solvency, and financial agility are now boardroom obsessions. Nothing exposes leadership faster than a liquidity crisis.

Growth is at fourth place, because strong, sustainable growth doesn’t just signal success—it reassures stakeholders that the company is resilient, capable, and led with vision.

Talent sits just below growth, because Culture leaks fast in a digital age. Employees are brand ambassadors—or whistleblowers. Toxicity within is reputational poison outside. And how you treat your talent is how customers will expect the company to treat them.

Innovation is next—not for its novelty, but because failing to innovate signals strategic stagnation. Stakeholders expect agility and foresight.

Sustainability follows innovation. It is essential, still reputation-critical, but often weighed more heavily once capital, growth, and talent are stable. Without operational strength, even the best ESG strategy rings hollow.

Regulation is climbing higher, especially as governments get more aggressive on data privacy, AI, ESG, and consumer protection. Non-compliance is reputational suicide.

Disruption and Resilience round out the list because they’re often measured through the success or failure of all the other items. You’re only seen as resilient if you manage capital, talent, and growth under pressure.

So this list doesn’t just describe what CEOs fear; it reflects what stakeholders see, judge, and remember. It mirrors how the world perceives, reacts to, and ultimately rewards or punishes corporate behaviour. Because Reputation is no longer a communications outcome. It is the operating system of leadership.

When Reputation breaks, so does the business

There are countless examples that prove how a broken reputation can shatter even the most well-capitalized or high-growth company.

Satyam Computer Services’ is a well-known case of reputational collapse. The once-respected IT giant fell apart almost overnight when its founder admitted to falsifying accounts. What began as fraud quickly became a reputational crisis. Investors, clients, and employees lost confidence. We know how Satyam's market value crashed, and the regulators stepped in. It didn’t just lose business—it lost trust, and with it, its future.

Café Coffee Day (CCD) also suffered heavy reputational damage. The sudden death of founder V.G. Siddhartha—and his letter citing financial stress—shocked the public. Though the company had a strong presence, the lack of transparency after the incident shook confidence. CCD’s brand as a stable business was badly hit, affecting investors, employees, and customers alike.

Globally, Theranos is a textbook example—not of failed technology, but of broken trust. Once a high-profile startup, it collapsed after reports exposed that its tech didn’t work. With credibility gone, the company’s value, deals, and leadership all fell apart. Reputation, not competition, was its downfall.

Wells Fargo too saw massive damage after its fake accounts scandal. It wasn’t just the fraud—it was the breach of public trust. The fallout cost billions, forced top resignations, and deeply harmed the brand’s standing with regulators and the public.

These are proof, should any still be needed, that in the long run, it is not what a company sells, but how it behaves—and is perceived to behave—that defines its fortunes and growth, or even survival.

Why CEOs must lead Reputation from the top

In many companies, reputation is still treated as the domain of the communications or PR function. But that model is dangerously outdated. Today, reputation is a CEO-level responsibility, for one simple reason: The CEO’s decisions, tone, and visibility are the most powerful reputational levers the company has. Which is why crisis communication is not just a very important protective function, but a strategic leadership competency for every company.

What CEOs say in a crisis, how they treat employees, which causes they champion, and how they respond to public pressure—all of these are now under constant observation and contribute directly to how the company is judged.

The shift in expectation is not optional. In the age of radical transparency and stakeholder capitalism – and because it is a no-compromise requirement for every company that must operate with the utmost integrity – Reputation Leadership has become Reputation Risk Management. And it must come, and be driven, from the top.

What CEOs should do right now

The first step is to re-center Reputation as a board-level strategic asset—on par with intellectual property, capital, and market share. The leadership team must then actively link every item on the corporate risk register to reputational impact. It is no longer enough to ask what could go wrong; they must ask what it would look like if it did.

Every function in the organization – from HR to operations to legal and product – should understand that their decisions shape the company’s external narrative. While reputation may be everyone’s responsibility, it must remain the CEO’s mandate.

CEOs must also invest in reputational readiness. This means leadership crisis training, cross-functional alignment for rapid response, and scenario planning that includes legal, ethical, and emotional intelligence—not just media statements.

Finally, reputation must be measured actively. Sentiment analysis and templated PR reports being sold for years unchanged, are not enough; the tracking of possible reputation risks or opportunities must be tracked real time, from a powerful, tech-, AI- and data-enabled intersection. Leadership must also track stakeholder confidence, employee trust levels, investor and analyst perception, regulatory tone, and the subtle but powerful shifts in how media frames the organization’s story.

So Reputation is not a department or the isolated function entrusted to a particular department, but the sum total of every action, decision, and behaviour that a company puts into the world. Reputation is built quietly in moments of consistency—and revealed publicly in moments of crisis. And when it breaks beyond repair, no spreadsheet, no press release, and no business plan can save you.

So yes, Deloitte’s lists are important. But if you’re a CEO today, don’t just ask how you’re managing capital, risk, talent, or transformation. Ask: “What is all of this doing to our reputation?”

Because that’s the scorecard the world is watching.

(The author Pavan R Chawla is Founder-Editor – Mediabrief.com)Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.