Dear Reader,

The week ending August 2, 2024, was one of the most eventful in the equity markets in recent memory. In India, it marked a significant milestone as the Nifty crossed the 25,000 mark and the BSE Sensex surged past 82,000.

However, the real drama unfolded in the Japanese and the US markets. Since the Bank of Japan raised interest rates, Japanese equities have been on shaky ground. The Nikkei 225, which peaked at 42,426 on July 11, closed at 35,909 on August 2, marking three consecutive weeks of declines. The interest rate hike strengthened the Yen against the dollar, with the currency appreciating from a low of 161.951 to 146.472. This shift has hit Japan's export-dependent companies hard, leading to sharp declines in their stock prices.

In the US, the markets experienced their share of volatility. It was a hectic week, with nearly 40 percent of the S&P 500's market capitalization reporting earnings, including tech giants like Microsoft, Facebook, Apple, and Amazon.com. Amazon.com suffered a more than 10 percent loss on Friday, while Intel saw its value plummet by a quarter in a single day.

The highlight of the week was the Federal Reserve meeting, where the chair hinted at the possibility of a rate cut in September, sparking a sharp rally in the US markets. However, the release of the non-farm payroll data on Friday dampened the optimism, confirming fears of a significant slowdown.

Private sector job growth slowed to its lowest level since October 2021, and the unemployment rate rose to 4.3 percent, also the highest since October 2021. This data caused the yield on the US 10-year Treasury note to dip below 4 percent. Compounding the negative sentiment was the Institute for Supply Management's (ISM) report on July manufacturing activity, which dropped to 46.6, its lowest level since November 2023.

While U.S. markets are still hopeful for a rate cut, the Bank of England took action, cutting its key interest rate by a quarter point to 5.00 percent—the first rate cut in four years.

As a result of these developments, the MSCI World Index declined by 2.14 percent. The Dow Jones and S&P 500 dropped nearly 2.10 percent, the Nasdaq fell by 3.35 percent, and the Small Cap 2000 took the hardest hit, down 6.67 percent.

The Euro Stoxx 600 also saw a significant drop of 3.08 percent, with all major European markets closing in the red. The only outlier was Shanghai, which surprisingly closed 0.50 percent higher.

The overall market performance at the week's close in major global indices suggests that further selling may be on the horizon for the first half of the coming week.

Fear Factor

The Nifty closed lower this week, while the Bank Nifty ended higher. Is this a sign of divergence or simply sector rotation? Most indices finished the week in the red. Does this suggest that a short-term correction is beginning, or has it already run its course? Let’s see if the data offers any clues.

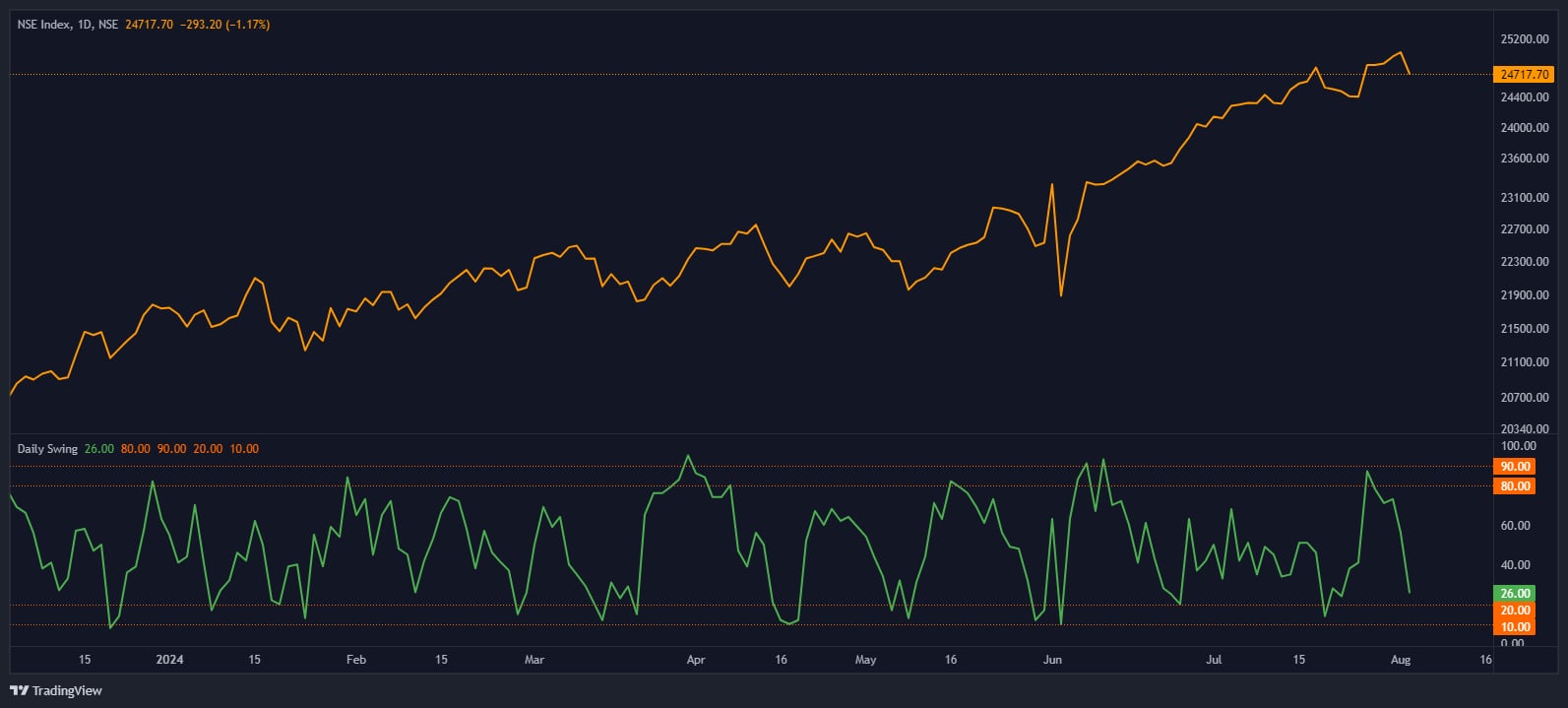

The Momentum Swing has rebounded to 26 from a low of 14 just before the budget announcement (see Daily Swing chart). Since then, the market has reached a new record high. If the Nifty declines for another day, the reading should drop below 20, entering oversold territory and potentially setting the stage for a rebound.

Daily Swing

Source: web.strike.money

The 20-day A/D ratio hasn't significantly improved since its recent low, as global sentiment has dampened the post-budget rally. We came close to the lower red line and have remained near it, but the ratio has not returned to overbought levels (see Advance-Decline Ratio chart).

Advance Decline Ratio

Source: web.strike.money

For long-term investors, the greatest threat is fear itself. The constant barrage of news about inflation, interest rates, and a looming US recession is reflected in the high volume of Puts relative to Calls traded. The Volume PCR (Put Call Ratio) has remained elevated over the past two years (see Put Call Ratio chart).

Historically, this indicator tends to decline in a bullish market, often dropping below 0.40 as the market nears the top. However, it currently sits at 0.69, close to the upper red lines since 2023. This indicates a high level of fear in the markets. It's important to note that fear does not typically build long-term market tops. As of now, this indicator does not reflect these emotions.

Put Call Ratio

Source: web.strike.money

Sector Rotation

The markets' performance last week was mixed. Few sectors posted gains, while most closed in the red.

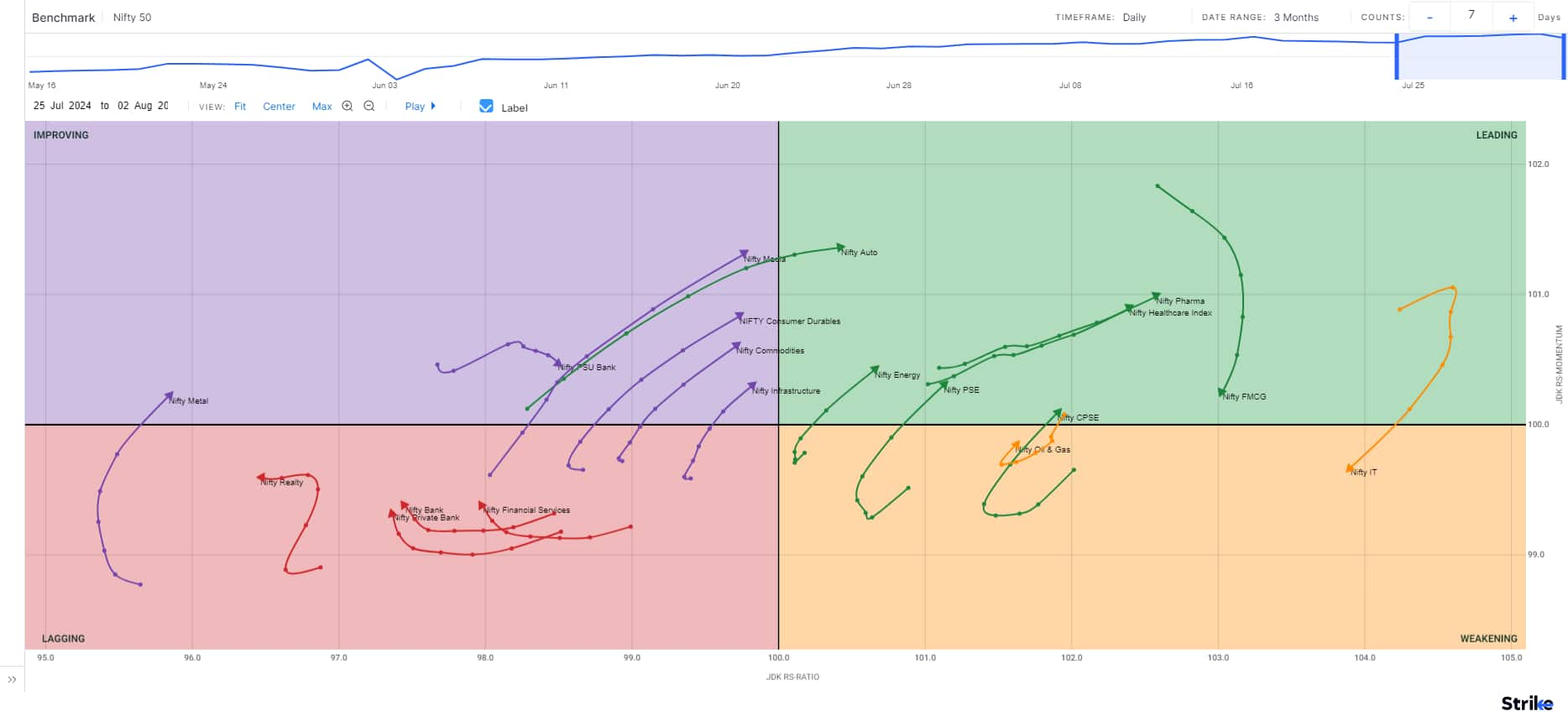

According to the daily Relative Rotation Graph (RRG) from India Charts, Nifty Auto, Media, Consumer Durables, Commodities, and Infrastructure rose in Relative Strength and Relative Momentum.

Nifty IT and FMCG counters lost momentum during the week, and the IT index entered the weakening quadrant.

Nifty Pharma and Healthcare displayed bullish momentum and maintained their position in the leading quadrant. Nifty Energy, PSE, and CPSE are back in the leading quadrant with a pickup in Relative momentum.

The rest of the sectors, namely, Realty, Private Banks, and Financial Services, are all still in lagging territory.

RRG

Source: web.strike.money

Data collated by Quant Lab shows that the Nifty CPSE and Nifty Commodity indices continue to outperform the headline index in the short term (7-14 days).

Traditionally, financial sectors react negatively to global market turbulence. However, this time around, the Nifty Financial and Nifty Private Bank indices have shown remarkable strength. Over the past five days, these financial indices have not only withstood market pressures but have also gained significant momentum compared to the broader market.

Over the longer term (90 days), data shows that the Nifty CPSE, Nifty Pharma, and Nifty Consumption indices maintain their strength, while the Nifty Auto and Nifty PSU Bank indices weaken.

Sector Strength

Source: Quant Lab

Indices and Market Breadth

After touching a new high during the week, benchmark indices closed 0.47 percent lower. During the week, the BSE Sensex fell 350.77 points, or 0.43 percent, to end at 80,981.95, while the Nifty50 index lost 117.15 points, or 0.47 percent, to close at 24,717.70.

FIIs continued to sell during the week, offloading Rs 12,756.26 crore. What is interesting is that despite the fall in the market, FIIs have marginally reduced their position. The chart below shows FIIs reducing their position from 166279 contracts to 145109 (see chart FII Index Futures).

FII Index Futures

Source: web.strike.money

Among the top performers of the week were Granules, which gained 14.74 percent, IEX, which was up 10.56 percent, and Bandhan Bank, which closed 10.41 percent higher.

The stocks that fell the most were BSoft, which lost 16.83 percent, Mphasis, which was down 8.40 percent, and Exide Industries, which fell 8.11 percent.

Stocks to watch

The stocks expected to perform better during the week are Sun Pharma, Power Grid, Zydus Life, TVS Motor, MCX, Lal Path Lab, Sun TV, Colgate Palmolive, ICICI Pru, United Spirits, Adani Ports, HDFC Life, and Shriram Finance.

Among the stocks that can witness further weakness are IDFC First Bank, IDFC and IndusInd Bank.

Cheers,

Shishir Asthana

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.