Apple Inc.’s earnings were an even bigger disaster than expected thanks to a combination of a stronger US dollar, global economic malaise, and more strife at its China factories. That analysts were unable to model for each of these known factors could signal that problems will persist even after supply returns to normal.

A 5.5 percent drop in December-quarter revenue to $117.2 billion was the widest miss for the holiday period in seven years. Sales of iPhones, Macs and wearables all dipped from a year prior. As much as $7 billion may have been left on the table after a Covid-19 outbreak and harsh lockdowns at a key production site operated by Foxconn Technology Group in November led to workers storming out of the Zhengzhou factory. At the time, Bloomberg Opinion estimated the impact to be $6 billion to $7.2 billion, so the scale of the hit was largely known.

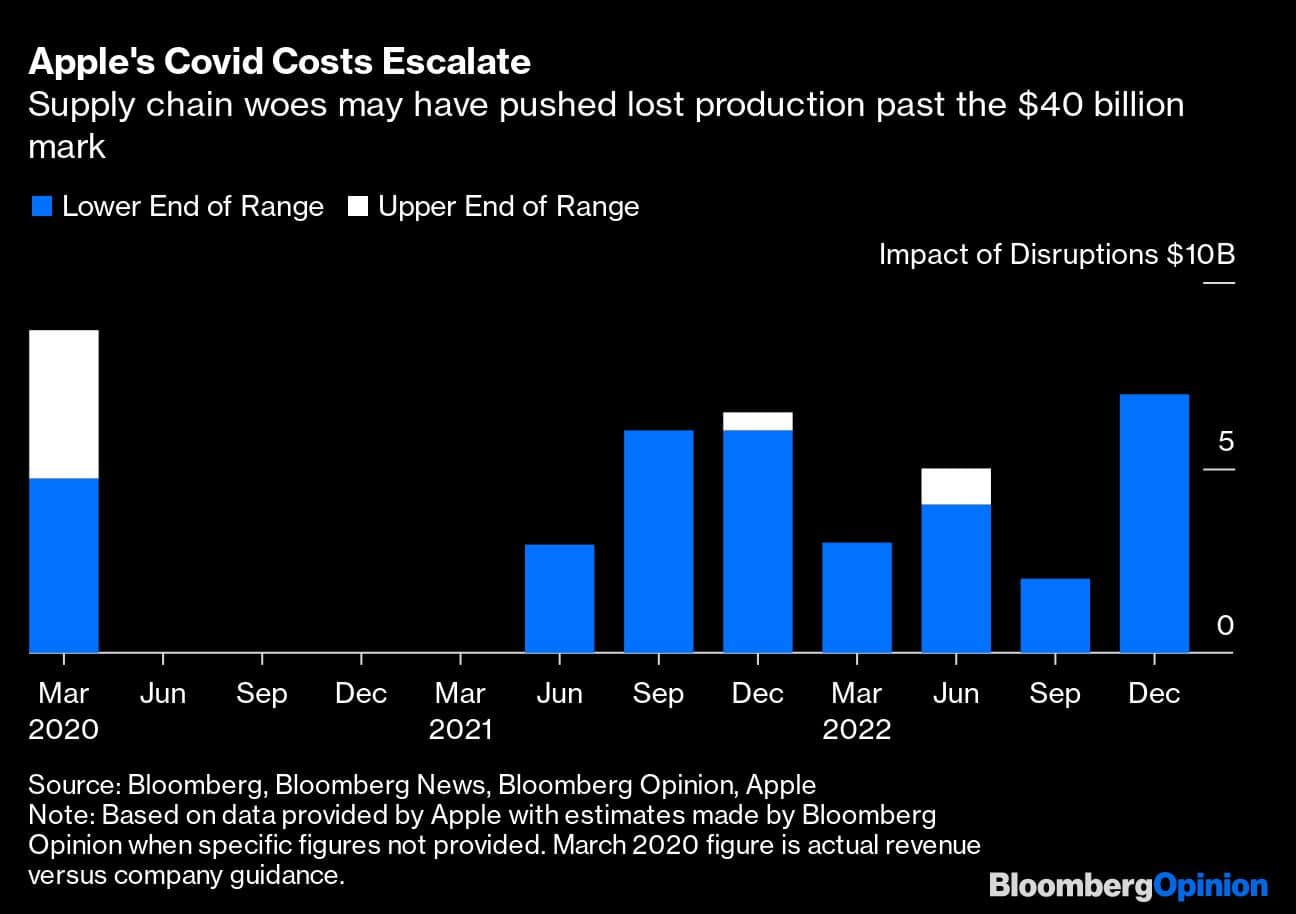

It’s worth noting that this is the seventh straight quarter of lost revenue due to supply-chain woes, with around $6 billion missed in the same quarter the previous year, according to Bloomberg Opinion estimates based on statements from the company and news reports. All told, the tally may have passed $40 billion. Such problems have now subsided, Chief Executive Officer Tim Cook told investors late Thursday in the US, without putting a value on the latest quarter of disruptions. Data was calculated based on ranges or specific data given by Apple, while 50 percent was assumed when the company stated the figure would be “significantly lower.”

Foreign exchange headwinds were also a significant contributor to the recent weakness, having a nearly 800-basis point impact, the company said. While missed sales from a lack of devices may be hard to estimate, the effect of currency swings can be modeled down to the dime. So while forex might account for the drop in revenue, it doesn’t much explain the divergence from analyst estimates.

And production woes don’t fully tell the story either. November’s worker uprising hit iPhones hard, yet sales of both Macs and wearables such as AirPods and Apple Watch also fell significantly short of estimates. IPads surpassed expectations. As if to prove the point about modeling, services revenue was in line even though it faced a 700-point forex impact.

So if supply chain problems and currency fluctuations don’t explain Apple’s big miss, then there must be other factors at play. The global economy, including Russia’s war in Ukraine, are issues to consider. Although crude oil prices are back near levels seen before the Feb. 24 invasion, interest rates are higher than a year ago. While both are tracked daily, modelling their impact on consumer spending is as much art as science.

More recently, though, the big news has been massive layoffs across the tech sector as revenue and profits weaken. Google owner Alphabet Inc. posted sales that missed estimates and Amazon.com Inc. profit fell short, even though revenue surpassed expectations. Both companies, which also reported earnings Thursday, have joined Microsoft Corp. and Facebook parent Meta Platforms Inc. in slashing jobs, and that means fewer high-salaried professionals eager to shell out $1,000 on a new smartphone.

Asked about its high-priced products running head-on into the challenges of a slower economy, Cook once again reiterated the importance of the iPhone in people’s lives. “I think people are willing to really stretch to get the best they can afford in that category,” he said.

But as the economic uncertainty continues and consumer confidence weakens, that unfailing belief may itself be a stretch.

Tim Culpan is a Bloomberg Opinion columnist covering technology in Asia. Views are personal and do not represent the stand of this publication.Credit: Bloomberg

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.