The general buzz in the street and the frenzy in the market surrounding the Life Insurance Cooperation (LIC) of India’s initial public offering (IPO) is akin to the Friday release of a much-awaited multi-starrer big budget film. The mega IPO, expected to be the biggest in India’s history, has got everyone involved in tenterhooks. For the government this disinvestment is a huge step. To understand the background, it’s important to look back at India’s three-decade tryst with disinvestment.

Ever since Margaret Thatcher privatised many a public sector organisations in England, the governments worldwide are also judged by their willingness to privatise their own public sector firms. This is the case in India too, but in India we prefer to call privatisation as disinvestment. Privatisation is seen as selling public assets to a private sector, which is not acceptable to political classes.

All you need to know before applying for LIC's Mega IPO (Illustration: MoneyControl)

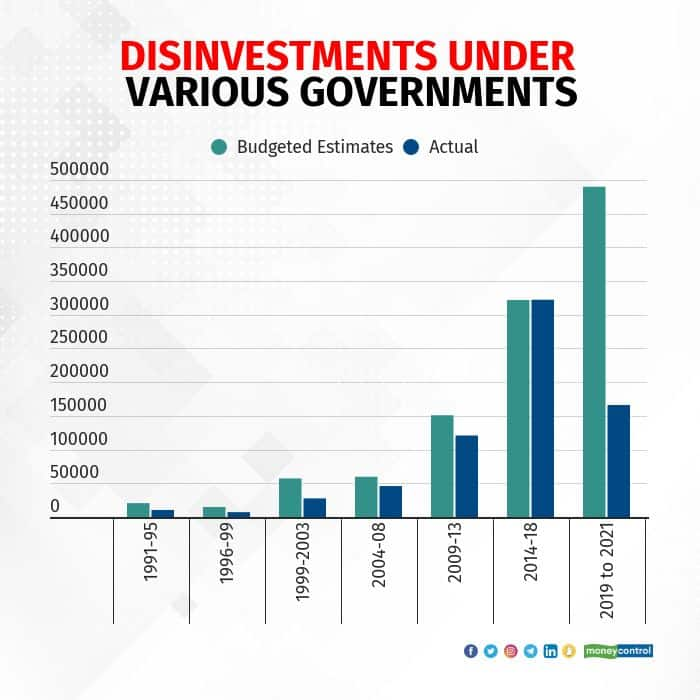

All you need to know before applying for LIC's Mega IPO (Illustration: MoneyControl)In the 1991 Budget Speech, then finance minister Manmohan Singh kick-started the disinvestment process. He remarked: “the government has decided to disinvest up to 20 percent of its equity in selected public sector undertakings in favour of mutual funds and investment institutions in the public sector.” The government projected disinvestment at Rs 2,500 crore, but received Rs 3,038 crore on account of selling shares in 32 Central Public Sector Enterprises (CPSEs). In fact, 1991-92 was one of the rare years where actual amounts were larger than the budgeted figures. In the 30 years of disinvestments, the actual has been lower than the budgeted in the 22 years.

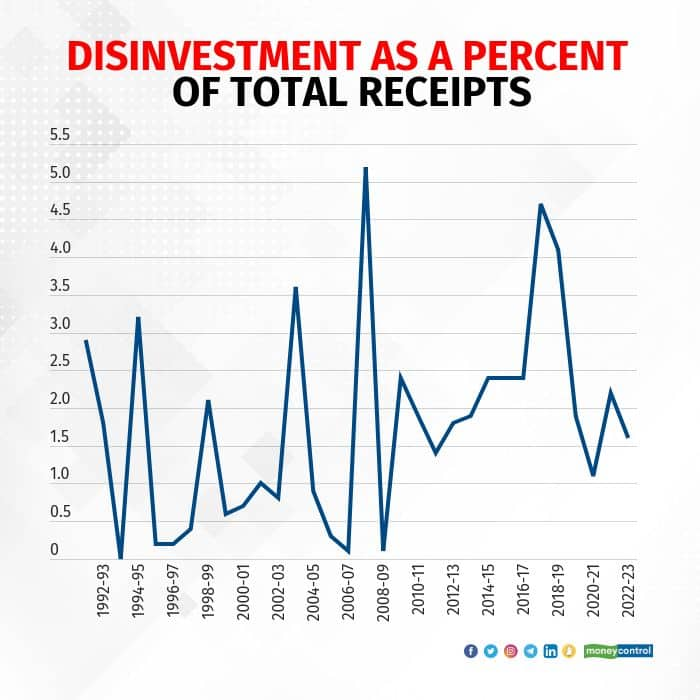

In the Budget speeches of 1992-93, Singh called disinvestment receipts as ‘raising non-inflationary resources for development'. From 1993-94 Budget speech onwards, disinvestments were mentioned as part of receipts. This practice was criticised by economists as it implied the disinvestment receipts were used for financing the deficit. However, even on this front the share of disinvestment receipts in total receipts in the last 30 years has also averaged just 1.7 percent. We also see high volatility in the disinvestment growth in the last three decades.

The volatile figures are an outcome of the inconsistent disinvestment strategy followed by the government over the years. The governments have been consistent on one matter viz. the government shall retain ownership of strategic sectors, and disinvest in non-strategic sectors. We get a view of this changing disinvestment policy by analysing speeches of Finance Ministers in this 30-year period.

In 1996-97, then Finance Minister P Chidambaram announced the establishment of the disinvestment commission. The commission submitted 12 reports covering 58 CPSEs, recommending strategic sale in 25 cases, and disinvestment through modes other than strategic sale in 33 cases. Revenues generated from such disinvestment were to be utilised for allocations for education and health, and for creating a fund to strengthen public sector undertakings.

In the Budget speech of 1998-99, then Finance Minister Yashwant Sinha announced that the government stake in non-strategic firms shall be lowered to 26 percent. Accordingly, the government specified three sectors as strategic: defence, atomic energy and railway transport. The government also established the department of disinvestment to co-ordinate disinvestments across the ministries, and also implement the decisions including appointment of advisers and pricing of shares. The department also subsumed the disinvestment commission.

In 2000, the government re-constituted disinvestment commission. The commission submitted 13 reports examined examining 41 CPSEs, recommending strategic sale in 34 cases, and disinvestment through other modes in seven cases.

In 2001, the department of disinvestment was converted into a ministry of disinvestment. The preferred mode of disinvestment during this period of 2001-04 was selling equity stakes to a strategic partner. The government sold stakes in VSNL, CMC, Hindustan Zinc, etc.

In the period 2004-09, the disinvestment strategy was derailed due to political opposition. In the Budget speeches from 2005-06 to 2007-08, the word disinvestment is not even mentioned!

The government also did away with the ministry of disinvestment and restored the department of disinvestment under the Ministry of Finance. In the year 2007-08, disinvestments touched 5.2 percent of receipts, due to the RBI transferring ownership of the SBI to the government. In 2007, the government also constituted a ‘National Investment Fund’ (NIF) into which the proceeds from disinvestment of government equity in select CPSEs would be kept to be used for social welfare purposes.

In 2009-10, then finance minister Pranab Mukherjee announced that the government will retain at least 51 percent equity in the CPSEs. He also encouraged people to participate in the disinvestment programme renaming it as ‘People’s Ownership of PSUs’.

The next change came in the Budget speech of 2015-16. Then finance minister Arun Jaitley remarked that the “Budget reflects considerable scaling up of disinvestment figures”. The budgeted estimate increased significantly to Rs 69,500 crore of which Rs 42,132 crore was achieved. The government also renamed the department of disinvestment as the Department of Investment and Public Asset Management (DIPAM). Apart from disinvestments, plans were also laid to monetise the CPSE assets such as land. In 2017-18, the government announced that minor stakes in the CPSE will be done via Exchange Traded Funds (ETFs).

In 2019-20, the government projected the disinvestment proceeds at Rs 1.05 lakh-crore, the first time the figure crossed Rs 1 lakh-mark. However, the government only received Rs 50,304 crore. In 2020-21, the government scaled the disinvestment target even higher to Rs 2.1 lakh-crore, but again it could only mobilise Rs 37,897 crore due to the outbreak of the pandemic. The government also announced that it will sell part of its holding in the LIC.

In 2021-22, the government made a new disinvestment policy. The government listed four strategic sectors: i) atomic energy, space and defence ii) transport and telecommunications, iii) power, petroleum, coal and other mineral; and iv) banking, insurance and financial services. There will be bare minimum presence of the CPSE in the strategic sector. The CPSE in the non-strategic sector will be privatised. The targets for the year were kept at Rs 1.75 lakh-crore. For the first time, the government mentioned that it will sell stakes in two public sector banks and one general insurance company. However, the government could only mobilise Rs 78,000 crore, and the strategic sales in banking and insurance were not achieved.

In the 2022-23 Budget, the projections are kept at a more modest Rs 65,000 crore, which is similar to levels in 2016-17. Perhaps, the government has rescaled the disinvestment targets seeing the large differences between budgeted and actual figures in the last few years (see graph).

(in Rs crore)

The above discussion provides a long history of India’s disinvestment programme. Despite the focus on disinvestments, the number of CPSEs have actually risen in the 30 year period. In 1990, the number of CPSEs were 244 with investments worth Rs 99,326 crore which implied investment per PSE was Rs 40 crore. In 2019-20, number of PSEs had risen to 366 aggregating investments of Rs 21.5 lakh-crore implying investment per PSE to be around Rs 5,900 crore. While it is perfectly fine to divert budgetary resources towards strategic sectors and profitable CPSEs, this should have led to lower number of CPSEs. India’s first Prime Minister Jawaharlal Nehru called the CPSEs the 'commanding heights' of the economy, and the heights have become more commanding.

All eyes are on the LIC’s public offer as apart from liberalising the insurance sector, it is expected to add fuel to the disinvestment programme. However, the history of India’s disinvestments programme questions any such optimism. Disinvestments in India are driven mainly by the political cycle which has taken multiple turns in the last 30 years.

Amol Agrawal is faculty at Ahmedabad University.Views are personal and do not represent the stand of this publication.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.