Anubhav SahuMoneycontrol research

While skipping dividend last time, Just Dial had hinted at a share buyback ahead, by mentioning a more ‘tax efficient way’ of returning money to shareholders.

Besides being tax efficient, share buybacks are also the management’s way of signaling confidence in the business. Should the investors of Just Dial draw a similar conclusion? We think otherwise.

Buyback of shares

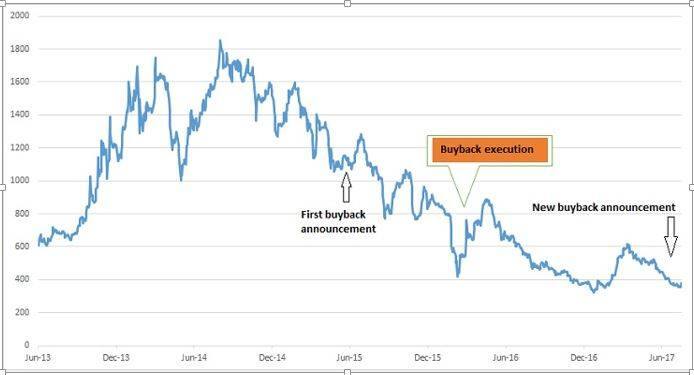

Share price trend since listing

In 2016, Just Dial bought back 25 percent of its paid-up capital (1.06 million shares) at a 37 percent premium to market price. The stock price rose 11 percent within a month, but slid soon after. The stock is currently trading 67 percent below the buyback price.

Institutional investors have shown reduced interest

While promoter shareholding rose marginally as a result of the buyback, foreign institutional investors have lost interest in the stock. FIIs now own 38.7 percent in the company, compared with 42.1 percent in August 2016.

Q4 FY17 result – sales growth remained moderate

Last quarterly result was a continuation of tepid show with 5.9 percent sales growth on YoY basis. The company’s focus on tier-2/3 cities helped in gaining a higher number of paid campaigns (18 percent YoY) but lower realisation impacted the overall revenue growth.

Moderating business growth is weighing on cash flow generation

In the last three years, company’s growth in total business listings (17.9 million) has grown at the CAGR of 10 percent (FY15-17). This is a sharp deceleration from the past when the company grew at a CAGR of 27 percent (FY12-15). In case of paid campaigns, volume growth was better at 14 percent CAGR (FY15-17) but as noted above, at the cost of lower realisations.

Resultant impact, amongst other things, was on cash flow generation. The company’s last reported cash flow from operations was at Rs 149.2 crore vs Rs 133 crore in FY15 - a subdued 6 percent CAGR growth.

Chart: Declining trend in RoE

Competitive intensity has risen

While 70 percent of its overall traffic comes through Google, the search engine has emerged as the biggest competitor for Just Dial. In recent past, Google has expanded into utilizing listings business through Google maps, which is well received. Further, introduction of an aggregator services app – Aero – in collaboration with already established players (Urbanclap, Fassos) in the services and food ordering business is a serious competitor for other players, given Google’s reach.

Spooked by this, Just Dial has recently increased its efforts on promotion and started with TV advertising in March 2017. Further, its employee cost has increased in recent years, adding to margin pressure. In Q4 2017, employee cost constituted 60 percent of operating revenue compared to 50 percent in FY14.

Not surprisingly, EBITDA margin which was around 28 percent in FY15 has declined significantly to 15.2 percent in FY17. Given company’s focus on low margin campaigns in tier 2/tier 3 cities and the competitive intensity, margins are bound to slip further.

Uphill task remains on technology & visibility

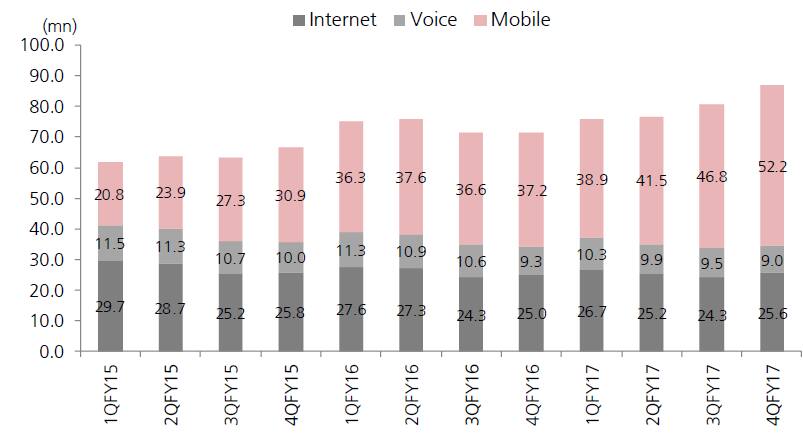

Chart: Unique visitors trend

The company’s effort on the technology side and introduction of new apps have borne results in terms of increase in unique visitors. In little over 2 years, unique visitors from the mobile platform has doubled but that from the voice platform has declined. However, within the mobile platform, only 10 percent comes from the app. So, the key challenge for the company is in improvising the user interface and visibility of service for the tech savvy users.

Given this context, we are not enthused by Just Dial’s current valuation. The stock is currently trading at a trailing PE of 22 times (FY17 earnings), which in still expensive in our view, given the structural challenges in the business. As the company is facing both growth and margin pressures, it looks like a difficult bet for long-term investors. Should the share price react positively on hopes of revival taking cue from the buyback, it would be prudent to exit positions in the stock.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.