Growth is back in the Indian IT sector, as though it never left. After a sharp dip in the first quarter of the last fiscal year (April-May 2020), there has been a steady rebound over subsequent quarters — and the guidance augurs well for this fiscal year. The way the Indian IT services industry, with more than 4 million employees, made a smooth transition to work from home (WFH) delivery model and met client expectations in the digital transformation space has been commendable.

Year-over-year (YOY) growth (in USD) for large Indian IT services companies (with revenue greater than $5 billion — Infosys, Wipro, HCL, etc.) moved from -4 percent to 0 percent to 1.5 percent to 7.5 percent in the first, second, third, and fourth quarters of the year ending March 2021 (FY2021), respectively. Indian mid-tier companies (revenue between $1 billion and $2 billion — LTI, Mindtree, Mphasis) showed a similar trend of increasing growth in each quarter of FY21. The was reflected in the stock market as well — Nifty IT grew 104 percent, outperforming Nifty 50, which went up 71 percent between April 1, 2020 and March 31.

Uptick In Profitability

In addition to growth, the icing on the cake is the improved profitability of the sector. Among large- and mid-tier Indian IT companies, earnings before interest and taxes (EBIT) increased on an average by 200–250 basis points (with the exception of Cognizant). There was variance across players — for instance the average EBIT for Mphasis, Mindtree and LTI increased by 300–350 bps. Margin expansion in the industry was driven by reduced attrition, WFH efficiencies including lesser travel and aggressive short-term cost measures. Some of these gains will likely be shaved off (100–150 bps), driven by planned wage hikes and expected higher attrition in the new fiscal year.

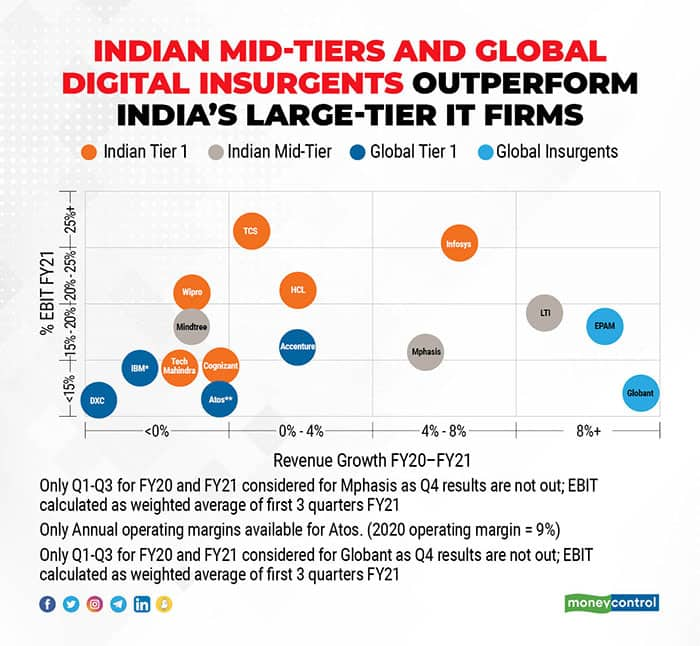

Performance versus global peers

Interestingly, the average growth of large Indian IT companies was higher than the average growth of global peers (e.g. Accenture, IBM, DXC, Atos), which de-grew at the start of the fiscal and bounced back in later quarters (Accenture continued to grow at par/outperform some large Indian players).

However, global digital insurgents (for instance, EPAM and Globant) stood out clocking double-digit growth across the quarters. Their valuations (revenue multiple) at 8–10X are also double that of Indian mid-tier companies.

Indian ITeS industry will continue to show strong growth, indicated by healthy revenue guidance and promising order books

The uncertainties over the last 12 to 15 months have accelerated digital transformation. Even industries like manufacturing, energy, and utilities, which historically have been digital laggards, are beginning to spend a lot more on digital. The trend is here to stay and will likely sustain strong growth in both large and mid-tier IT services companies.

In their recent quarterly earnings, Wipro, Infosys, HCL, and Cognizant, raised their revenue forecast to double-digit growth for fiscal year 2021–2022, reflecting excellent demand conditions. Wipro revised its revenue guidance for the first quarter of fiscal year 2021–2022 to 8–10 percent quarter-over-quarter growth, up from the previous expectation of 2–4 percent. Infosys gave a guidance of strong double-digit business growth for fiscal year 2022. TCS reported its highest quarterly deal closure of $9.2 billion in the fourth quarter. In fiscal year 2021, HCL signed 58 large deals, and its total contract volume was $7.3 billion, up 18 percent from last year.

Indian mid-tiers have outperformed the larger Indian companies in the last three years and we expect the trend to continue. This has been driven by an increasing digital presence through partnerships and acquisitions. All Indian mid-tiers have key partnerships with cloud hyperscalers (e.g. AWS, Google cloud, Azure). Mphasis and LTI acquired Datalytyx (in November) and Powerup technologies (in October 2019) respectively to gain a stronghold in the data and cloud space.

These companies are already starting to get a ‘foot in the door’ of the European market — Mindtree setup its European headquarters in London in September 2019, this month Mphasis announced its plan to setup a nearshore centre in London, and in December LTI announced a partnership with financial services software company Temenos to target the banking and financial services sector in the Nordics.

The Indian mid-tiers are also catching up with global digital insurgents in terms of valuations. They have seen a 2.5–2.7X increase in valuations in the last 12 months since April 1, 2020 (vs a ~2X increase for global digital insurgents). They remain companies to watch-out for in the IT services industry.

(This article is part of a three-part series on the Indian IT services space. In the next two articles, we will conduct an analysis on growth drivers for Indian ITeS and digital insurgents, and the implications for Indian mid-tier companies.)

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.