Anubhav SahuMoneycontrol Research

The initial public offering of ICICI Securities is part of ICICI Bank’s plan to unlock shareholder value by listing its various subsidiaries (ICICI Prudential, ICICI Lombard). The primary market offering of the broker comes at a time when the base of retail investors has increased considerably in the last few years. And yet, an underpenetrated market, growing awareness about the need for financial planning, better digital infrastructure as well poor returns from physical assets, all point to a bullish future for financial market intermediaries.

Company briefing

ICICI Securities Limited (incorporated in 1995), better identified with its electronic brokerage platform – “ICICI Direct”, is a leading brokerage house in India (5.6% market share) that offers financial Services like broking (63% of FY17 revenue), financial product distribution (25%) and investment banking and others (13%).

OFS: 4,017 crore

IPO size is Rs 4,017 crore offer for sale from ICICI Bank, at a price band of Rs 519-520, constituting ~24% of the post offer paid up capital. It puts the implied valuation at Rs 16,750 crore.

Strong macro drivers and enabling infra support higher share of financial savings

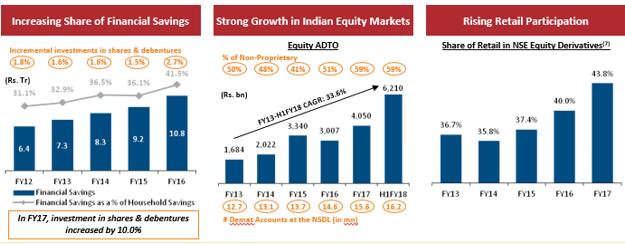

The trend towards increasing share of financial savings (41% of household savings) has been helpful for both brokerage and financial products distribution businesses. In recent times, this has been supported by demonetization, improved financial markets awareness, financial inclusion and ramp up in digital infrastructure. This is evident by sharp increase in demat accounts (30% CAGR FY13- H1FY18) and rise in retail participation (43.8%) in the equity market trading.

Source: ICICI Securities roadshow presentation

Pan-India presence

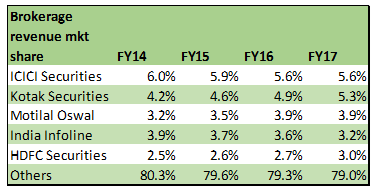

ICICI Securities have a well-entrenched distribution network (200+ branches in 75 cities), which along with 4,600 sub-brokers/IFAs help it reaching tier-2,3 cities. This along with the allied financial service offerings help ICICI Securities to meet the competition, particularly from the discount brokers. It’s noteworthy that ICICI Securities remains a market leader in terms of both brokerage revenue (14.8% CAGR FY13-17) and trading volumes, even though brokerage revenue share has trimmed over the years.

Diversified business model

Company’s business model is increasingly diversified towards non-brokerage/financial products distribution business (36.4% in 9MFY18 vs. 29.7% in FY13). AUM distributed has grown by 36.6% CAGR (FY13-9MFY18).

While this business has a regulatory risk of capping trailing fees for distribution and the increasing direct reach, compared to brokerage business income flow here is steadier and hence commands higher valuation. In other words, distribution business provides cushion against volatility in the brokerage revenue.

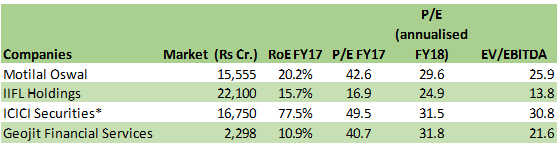

Elevated multiples vs peer group

While there are many listed financial investment firms, segment exposures are not akin to ICICI Securities, in most cases. Both JM Financials and Edelweiss have a major business exposure to fund based activities (+70 percent). While Motilal Oswal and IIFL Holdings have a more balanced exposure with about 50-60% business exposure to wealth management and broking. Geojit Financial Services is the closest peer with about 68 percent of the revenue exposure from the broking business.

*Based on Upper price band in the IPO

While implied multiples are certainly towards the higher end prevailing among the peer group, SOTP valuation also reflects that part of the near term growth is priced in the offer.

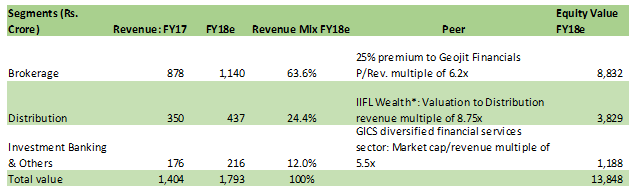

Table : SOTP valuation

SOTP valuation suggest premium valuation in the offer price and therefore signify that there is a limited scope for listing gains

However, one should also note that there is an upside risk to estimation particularly to the distribution revenue/segment which can command higher valuation due to improved macroeconomic drivers and higher retail participation in the equity market.

Overall, due to underlying long term drivers and valuations, we recommend subscribing to IPO only for a long term investment horizon.

For more research articles, visit our Moneycontrol Research Page.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!