Anubhav SahuMoneycontrol research

The third quarterly results from the food and beverages colour industry were broadly steady. Key listed companies in the sector - Dynemic Products and Vidhi Specialty are eyeing capacity expansion as they inch towards optimum utilisation.

Recent announcements of Vidhi Specialty acquiring Arjun Food Colorants and the increase of promoter’s shareholding in Dynemic Products point towards increasing promoter confidence in the sector and makes it an interesting investment space to look at.

Also read: For food color cos, the next trigger will be adding capacity, after a robust earning season

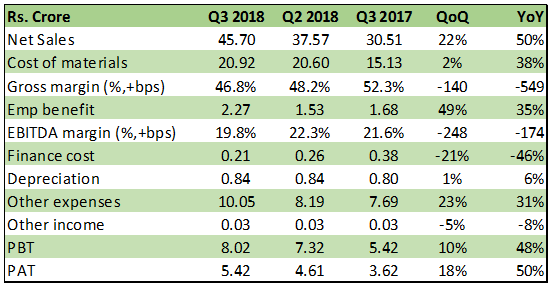

Dynemic Products: Good set of quarterly result

Dynemic Products witnessed improved topline growth of 50 percent on YoY basis. Cost of materials, also perked up by 38 percent. Additionally higher employee cost and other expenses led to shrinkage in EBITDA margin by ~174 bps YoY (Quarter on Quarter: +248 bps). Net profit, however, improved by 50 percent YoY aided by decline in finance cost.

Company’s current run rate suggest FY18 net sales can reach about Rs 165 crore (+11.5% YoY) and EBITDA margin can improve by ~270 bps on the back of improved realization and lower cost of materials.

Awaiting environmental clearance for capacity expansion

In our conversation with the representative of Dynemic Products management, we learnt that the company is in the process of setting up its third plant (1242 MT) in Dahej, for which it is awaiting environmental clearance. It’s currently having a capacity of about 7320 MT (Two plants in Ankleshwar) in Gujarat which are running at 82-85% capacity utilization.

Further, company is hopeful of getting environmental clearance in next two months, post which it might take one year or so for the new plant to get operational. Hence, if we assume new capacity would be available in FY20 and reach 30 percent capacity utilization in first year than we are looking at ~14 percent earnings CAGR (FY17-20E). Taking that into consideration, stock is trading relatively cheap at ~9.0x FY20e earnings.

Also Read: A tweak in our Diwali portfolio

Table: Dynemic Products

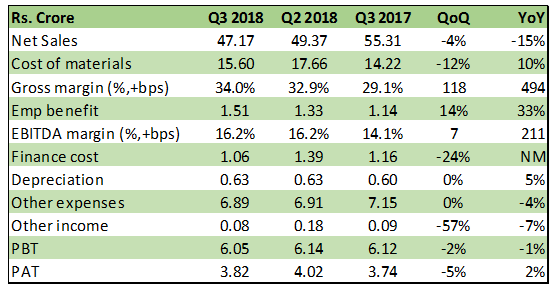

Vidhi: Q3FY18

Vidhi Specialty, however, witnessed de-growth in topline by 15 percent on Year on Year basis mainly due to company’s intention of lowering reliance on trading (~45 percent in FY17). Current check on inventory purchase of finished goods suggest contribution of trading goods have come down to ~30-35 percent. Change in mix has largely contributed to EBITDA margin improvement of ~210 bps

Company’s FY18 net sales is expected to exceed Rs 200 crore (+5% YoY) but EBITDA margin would possibly remain at similar level as the benefit of change in sales mix is expected to be offset by higher raw material cost.

Table: Vidhi Specialty

Inorganic growth and capacity expansion to aid earnings growth

As per our earlier communication with the management, company underlined its expectation for sales turnover of Rs 500 crore in CY 2020 on the back of its plan for doubling of food colour capacity to ~9000 MT and better product mix (higher margin products).

Additionally, company is also pursuing its inorganic growth strategy wherein it is waiting for shareholders’ approval to buy Arjun Food Colorants for a cash consideration of Rs.8 crore (~2% of Vidhi’s Enterprise Value).

We expect 27 percent CAGR in EBITDA for next four years based on topline growth and margin expansion of 210 bps (2017-21E). Stock is currently trading at a P/E multiple of 13x FY20e earnings.

We consider valuation premium for Vidhi Specialty with respect to its nearest peer as justified given the growth plans (both organic & inorganic), focus on R&D for new products and improving margin profile.

For more research articles, visit our Moneycontrol Research Page.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!