Shishir Asthana Moneycontrol Research

The sharp rally on Indian bourses since the start of the year has prompted experts to call for a correction which they say is long overdue. Many still continue to be skeptical about the rally and feel Indian markets are overvalued.

Indeed, ‘overvalued’ is a term that disbelievers have been using for a long time now, however, markets continue to stride forward. As the December 2017 quarter earnings pour in, some of the optimism seems grounded in fact.

Apart from strong financial numbers, there are other tailwinds that are taking Indian markets higher. The biggest factor is strong inflows into most markets, especially emerging markets, which have seen the highest inflow since 2013. According to the latest data from fund tracker EPFR Global, emerging markets have witnessed USD 40 billion of inflows.

Along with equities, oil and commodities have also witnessed strong inflows resulting in a strong rally in these assets.

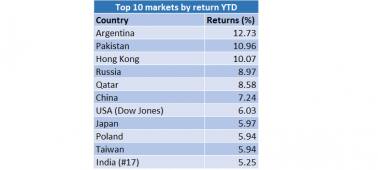

But on a comparative basis, India is nowhere near the returns of the top markets globally. As per the data available on Reuters, Indian equity markets have given a 5.25 percent return since the start of the calendar year 2018, which is only good enough to place the country as the 17th market in terms of returns. In fact, there are three countries that have already given a double-digit return, nearly twice that of India.

Argentina has given the highest return at 12.73%; this follows a 77% return in 2017. The election of President Mauricio Macri in late 2015 has been the game changer for the country. The second country on the list with a double-digit return was Pakistan which is witnessing unusual calm on the political front. It also helped that the country was upgraded to MSCI’s Emerging market list in the previous year. Hong Kong with a 10.07% run has been helped by inflows from China and European market as Asian markets.

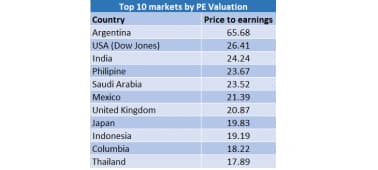

However, in terms of valuation judged by historical price to earnings (PE) basis, Indian markets are close to the top. Without getting into the discussion of the utility of PE as a valuation tool, especially based on historical data, we have scanned through the data of all countries using the same filter.

Argentina with a PE of 65.68 is by far the costliest market in the world. This is followed by the USA at 26.41 and India at 24.24.

In fact, an analysis by Bloomberg based on a range of metrics including growth, yields, current-account position and asset valuations shows that India is the least attractive developing economy of the 20 that has been studied. China stands one rung higher at 19th.

The report says that India and China’s valuations are relatively expensive in historical terms and their economic growth is unlikely to be as fast as it has been in the past decade.

Many in India would differ from this analysis given the strong performance visible in corporate earnings and government data points.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.