These days we hear that the markets don’t believe that the BJP is winning the 2024 election.

Every time the market falls, people start panicking that there is something wrong with the trend of the election.

This type of analysis / panic / fear / belief automatically assumes that markets know everything. That the markets are right always. And that markets expect the BJP to win or else they will go down.

If this were the case today, wouldn’t this be the case five years ago too? After all, stock markets have been around for decades!

So, it should be possible to judge the real predictive worth of the markets looking at the past data, isn’t it?

The 2019 Election ScheduleLet’s look at 2019 – which today, many people say was an easy election to predict.

This was the schedule in 2019 – the seven phases along with the eventual results are given below:

* 11 April Thursday (Seats going to poll: 91) - BJP 31, Congress 9, Others 51

* 18 April Thursday (97) - BJP 38, Congress 12, Others 47

* 23 April Tuesday (115) - BJP 67, Congress 19, Others 29

* 29 April Monday (71) - BJP 49, Congress 2, Others 20

* 6 May Monday (51) - BJP 42, Congress 1, Others 8

* 12 May Sunday (59) - BJP 45, Congress 1, Others 13

* 19 May Sunday (59) - BJP 31, Congress 8, Others 20

Key Observations for 2019 Elections- BJP started slow winning fewer seats than the total of all other opponents in Phase 1 as well as Phase 2

- BJP went past the tally of combined opposition in Phase 5

- BJP went past the half way 272-mark in Phase 6

- Most exit polls showed clear win for the BJP and the NDA on 19 May

If the markets were in sync with this sentiment, a few logical conclusions could be:

*Market should have crashed or kept going down till Phase 5

*Market should have gone up massively after Phase 5

*Market should have really celebrated after Phase 6 as the BJP then got the biggest single-party non-Congress mandate ever

*Market should have given a loud cheer after the 7 phases as the exit polls were in consensus on a BJP win

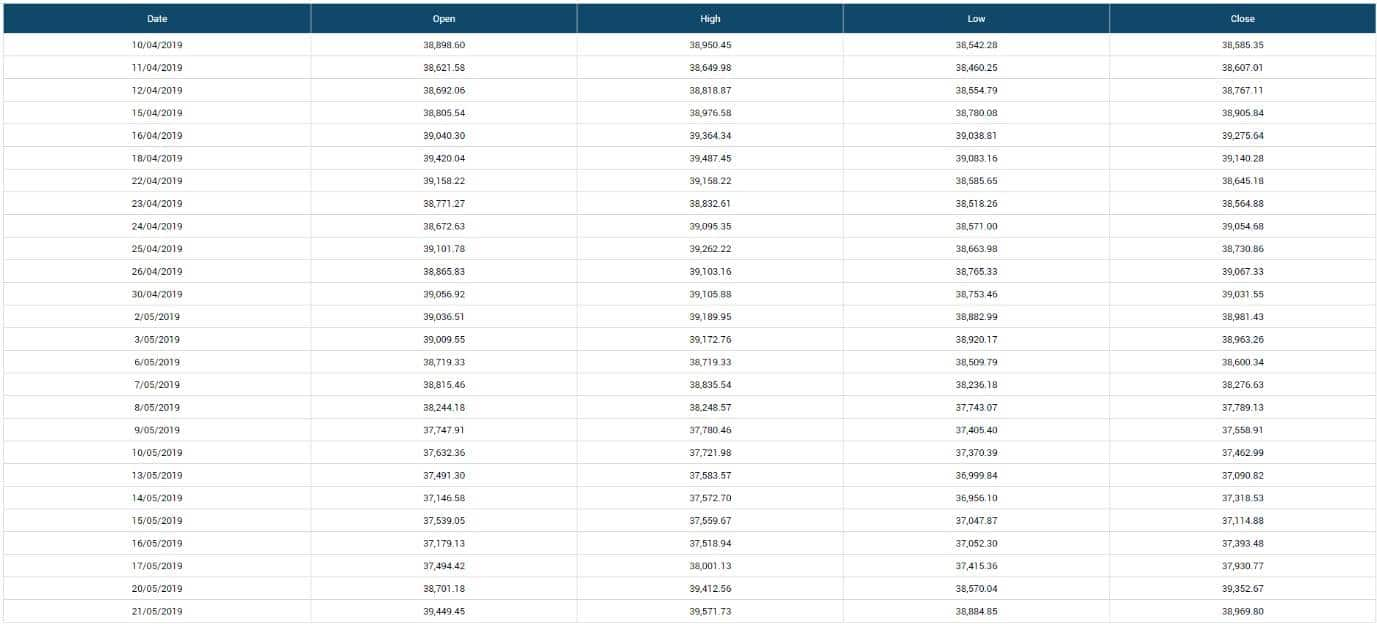

How Did the Markets Look?The below table shows the behaviour of BSE Sensex from 10th April 2019 to 21st May 2019.

This data can be easily pulled from the BSE website.

So, what actually happened?

1. Between 11th and 22nd April (first trading day after 18th April), when the BJP was languishing behind the opposition, the market actually went up except a marginal fall on 22nd April.

2. After 23rd April, the day when the BJP won the highest number of seats in any one phase, the market hardly reacted for the next few trading sessions.

3. On 29th April, 6th May and 12th May, the days when the BJP won most handsomely against the Congress, the market remained flat or went down on next few trading days.

4. In fact, the lowest Sensex level of the election period was on 13th May, which was the day after three rounds of strong BJP performance.

5. On 17th May, the last trading day before the close of the election, the market ended almost 2000 points (~5.1%) below the levels of 10th April, the last trading day before the start of the election.

6. In today’s market level terms, this would be ~3800 points fall between the start and the end of the election.

7. The market cheered on 20th May after the exit polls. But again, ended flat on 21st May. Note that the market close on 21st May was less than 100 points over the 10th April level.

Even in 2019 election, supposedly an easy election in today’s hindsight, the market was as restless as it is today. Most importantly, the market movements on specific days had nothing to do with what had already transpired in the elections before that day.

In SummaryWhat happens when markets go up and down? Someone gains either way.

Volatility always benefits someone, so can volatility be engineered?

Your anxiety is someone’s profit boosting.

Also note, that the number of NSE investors themselves have gone up ~4.7 times from 88 lakh to 4 crore plus between the 2019 and 2024 elections

Many of these new investors are active on social media, in fact their stock market participation is very social media driven

Hence, every rise and fall in the market gets overinterpreted

Markets do what they do and the Indian voters do what they do.

Trying to second guess Indian voters through the proxy of market movements may be injurious for intellectual health.

Sit back, relax, enjoy the election campaign and wait for 4th June.

Key TakeawaysWhen you were nervous in 2019, the Sensex was at 37-39K levels.

When you are nervous in 2024, the Sensex is at 72-73K levels.

So then, should we all prepare for nervousness at 125K levels in 2029 after Modi 3.0? Ye nervousness achhi hai.

Data Sources(2019 Election schedule and Exit poll information: https://en.wikipedia.org/wiki/2019_Indian_general_electionSeat breakup by phase: https://www.amarujala.com/election/phase-wise-lok-sabha-results-in-2019-and-party-wise-performance-2024-03-19BSE Sensex data: https://www.bseindia.com/Indices/IndexArchiveData.html - choose index and date rangeInvestor data: https://www.investorgain.com/active-customers/zerodha/18/)Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.