The Bulls charge on D-Street pushed the Sensex above 41,000 while the Nifty reclaimed 12,050-12,080 levels for the week ended December 13. Investors however dumped small-cap stocks in the same period.

The Nifty rallied 1.38 percent while the Sensex recorded a rally of 1.39 percent for the week ended December 13, compared to 1.1 percent gain seen in the S&P BSE Mid-cap index and 0.05 percent fall witnessed in the S&P BSE Small-cap index in the same period.

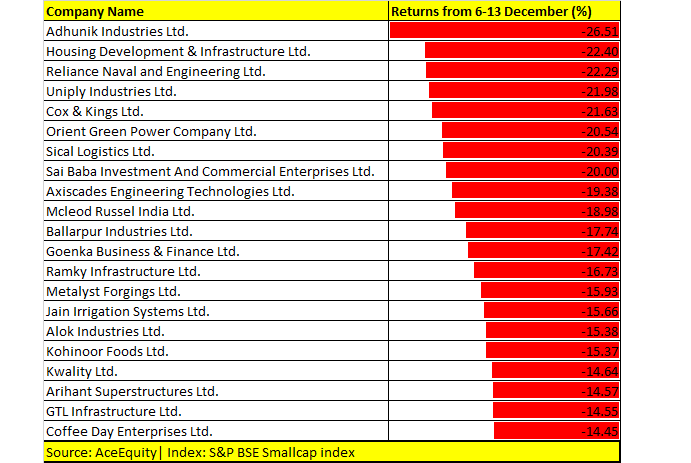

There are as many as 48 stocks in the S&P BSE Smallcap index which fell 10-20 percent in a week when benchmark indices reclaimed important resistance levels.

Stocks that witnessed double-digit losses include names like Alok Industries, Kwality, Coffee Day Enterprises, Cox & Kings, Reliance Naval, HDIL, and Adhunik Industries among others.

There are select small & midcap stocks which are doing well, excluding that the broader market is likely to remain under pressure for some more time before investors’ confidence revives, suggest experts.

"The recent cut in corporate tax rates was a bold decision which also points towards the intent of the government. But, in real macro terms, it still may take at least three to four quarters for the economy to actually start showing positive numbers," Mohit Ralhan, Managing Partner & CIO of TIW Private Equity told Moneycontrol.

"Small and mid-cap stocks are not expected to revive until the investors' confidence is back. Right now, it is only for those investors who are a bit savvier and can do their own research to zero down on better companies among the mid and small caps so that they don't sell in a hurry if prices decline further," he said.

In the BSE 500 index there are as many as 11 stocks which fell 10-20 percent for the week ended December 13, such as KEI Industries, PNB Housing Finance, Reliance Capital, Jain Irrigation and Yes Bank.

Where is market headed?Positive global cues fuelled a rally on D-Street which helped the benchmark indices reclaim crucial resistance levels. The Sensex is just 0.38 percent and the Nifty about 0.6 percent away from hitting fresh record highs.

Prospects of a trade deal between the United States and China and hopes of a swift Brexit after thumping election win by Britain’s Conservative Party spurred risk appetite, said a Reuters report.

"Bulls seem to be rejoicing as there is good news from all corners. The US President agrees on a phase one deal with China to postpone the new tariffs and Boris Johnson wins the UK election by a majority which raises hope for a sooner Brexit deal," Umesh Mehta, Head of Research, Samco Securities told Moneycontrol.

"Macros on the international front are acting as a stimulus for the Street to rise further," he said.

Weak macro data with respect to inflation could keep the market range-bound, but the strategy should be to buy on dips. The next possible target for the index is around 12,300 levels, suggest experts.

“Weak macro data could keep the market range bound but may not spoil it. This is because the reforms process is on a continual basis. The strategy should be to buy on dips," as per Shrikant S. Chouhan, Senior Vice-President (Equity Technical Research) at Kotak Securities.

"I think it has already begun and Nifty could hit the levels of 12,300 eventually," he added.

In terms of technical charts, Nifty formed a bullish candle on the daily and weekly charts on December 13. Investors should stay long in the index as the momentum could take the index to fresh record highs.

"Nifty formed a strong Bullish candle on a weekly scale with a highest-ever weekly close near to 12,100 marks. The index is just 72 points away from its lifetime high of 12,158 and a small follow up could lead the fresh leg of a rally to cherish the bullish momentum," Chandan Taparia, Vice President, Analyst-Derivatives at Motilal Oswal Financial Services told Moneycontrol.

"Now, the index has to continue to hold above 12,035 zones to extend its momentum towards 12,250-12,300 zones while on the downside support exists at 12,000 then 11,950 levels," he added.

Disclaimer: The views and investment tips expressed by investment experts on moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.