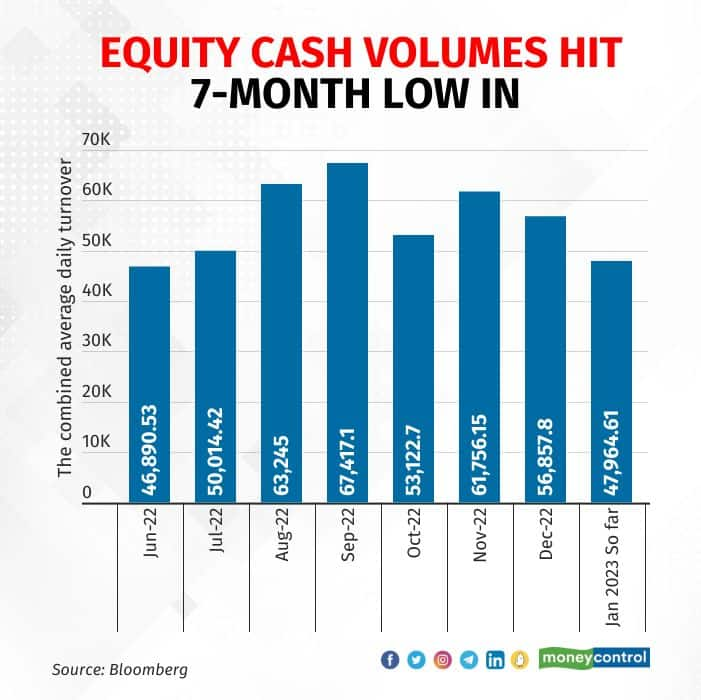

Cash volumes in the local equity markets hit a seven-month low in January, falling nearly 16 percent from the previous month, as volatility continued to weigh on investor participation.

The combined average daily turnover (ADTV) in the equity cash segment of BSE and NSE was at its lowest point since June 2022. The ADTV stood at Rs 47,964.61 crore between January 1 and January 25, which is a significant drop from the Rs 56,857.80 crore recorded in December. This marks the second consecutive month of decline in ADTV. The ADTV has also fallen 18.5 percent in 2022 from a year ago, which is the first annual drop since 2013 and the steepest one since 2011.

Why the fall?

Experts attributed the recent fall in volume to a combination of factors, including underperformance in the small and midcap space and a lack of initial public offerings (IPOs).

Analysts also suggested that the volatility in the equity markets ahead of the Budget 2023, the start of the December quarter earnings, which indicate a slow recovery, and the recent fall in equity markets led by Adani Group stocks have deterred investors from making aggressive bets.

"The recent fall in volumes on the markets may be due to a few reasons. One, the small and midcap space has been underperforming and has seen significant erosion in values; two, a lack of IPOs where retail investors can make money. The end of the bullish era in the small and midcap space where investors saw prices rising almost every day also contributed to this," said Deepak Jasani, Head of Retail Research, HDFC Securities.

He said retail and high networth investors have seen lower participation in the local equity markets, and their interest has partly shifted to the debt market, where yields have become more attractive.

Derivatives at a record high

While the cash volume dropped, the derivative segment volume remained close to all-time highs in every month since last year. The ADTV for the derivative segment was Rs 206.92 lakh crore in January 2023 so far, up 9 percent from the Rs 189.86 lakh crore in December 2022.

Also, the Securities and Exchange Board of India recently mandated that a 100 percent margin must be collected upfront for trading, which, analysts suggest, may have contributed to a decrease in trading volumes in the cash segment along with a decline in the opening of demat accounts.

According to a recent Motilal Oswal Securities report, the number of demat accounts increased by 2.1 million in December 2022, bringing the total number of accounts to 108 million. This increase was higher than the previous month's increase of 1.8 million but below the average of 2.9 million per month seen during fiscal 2022.

Why markets are volatile?

The local equity markets have been volatile over the past year due to geopolitical tensions, higher inflation, and interest rate hikes by global central banks, and are expected to remain volatile in the first half of the year, as inflation is unlikely to moderate and global central banks are not in favour of pausing interest rate hikes.

Recently, the local equiy markets started falling led by banking and Adani group stocks after US-based Hindenburg Research said it held short positions in Adani Group and flagged concerns about debt levels and the use of tax havens.

During January, the Sensex and Nifty declined 2 percent each, whereas the BSE midCap index dropped 3.4 percent and the BSE smallCap lost 3.8 percent.

Dr VK Vijayakumar, Chief Investment Strategist at Geojit Financial Services, said retail investor participation historically increases during a boom phase and declines during a bear phase. He also noted that when the trend is uncertain and volatility is high, cash market volumes decline but this should not be taken as an indicator of investor apathy.

Instead, he suggested that a better indicator of investor interest is the investment through mutual funds, particularly through SIPs, which are growing and healthy. He also pointed out that a lot of volumes are generated through day trading but it is a known fact that around 95 percent of traders lose money in trading. Therefore, a decline in volume is not necessarily a negative. He concluded that the market will continue to be volatile in the near term.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.