The market remained on a strong footing on July 3, as the benchmark indices have consistently been hitting new record highs day-after-day. The rally was backed by banking & financial Services, FMCG, metal and oil & gas stocks.

The BSE Sensex climbed 486 points to 65,205, while the Nifty50 jumped 134 points to 19,322.5 and formed bullish candlestick pattern on the daily charts.

"A long bull candle was formed with gap up opening. We observe unfilled gaps in the last three sessions, which is signaling a bullish run away gaps. Normally, such bullish runaway gaps area formed in the middle of the trend," said Nagaraj Shetti, technical research analyst at HDFC Securities.

Though Nifty being placed at all-time highs, still there is no indication of any reversal building up at the higher levels, he feels.

Hence, the crucial overhead resistance comes around 19,500 and next at 19,800 levels, which are 1.236 percent and 1.382 percent Fibonacci projections, taken from the bottom-top-bottom swings as per weekly timeframe chart, he said, adding that immediate support is at 19,200 levels.

The broader markets also traded higher for the fifth consecutive session, with the Nifty Midcap 100 index rising 0.25 percent and Smallcap 100 index climbing 1.23 percent on positive breadth.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks in this article are the aggregates of three-month data and not just the current month.

Key support, resistance levels on Nifty

The pivot point calculator suggests that the Nifty may get support at 19,258, followed by 19,232 and 19,190, whereas in the case of an upside, 19,343 can be a key resistance area for the index, followed by 19,369 and 19,411.

The Bank Nifty also hit a new milestone of 45,000 on July 3, climbing more than 400 points to 45,158 and formed bullish candlestick pattern on the daily scale, after gap up opening.

"Bank Nifty faced a stiff resistance around the 45,200 levels on the back of strong Call writer additions. It needs to be seen if the Call writers up the ante at the 45,200 strike on Tuesday and monitoring the same will be crucial for Bank Nifty’s future direction," said Ashwin Ramani, derivatives & technical analyst at SAMCO Securities.

He feels the support is placed at 45,000 while the 45,500 levels on the upside will act as an immediate resistance.

The pivot point calculator indicated that the Bank Nifty is likely to take support at 44,951, followed by 44,840 and 44,660, whereas 45,311 can be the initial resistance zone for the index, followed by 45,422 and 45,602.

As per weekly options data, we have seen the maximum Call open interest (OI) at 19,500 strike, with 1.01 crore contracts, which can act as a crucial resistance area for the Nifty50 in coming sessions.

This was followed by 91.44 lakh contracts at 19,300 strike, while 19,400 strike has 73.78 lakh contracts.

The meaningful Call writing was seen at 19,300 strike, which added 32.67 lakh contracts, followed by 19,500 strike and 20,000 strike, which added 28.1 lakh and 26.08 lakh contracts, respectively.

Maximum Call unwinding was at 19,200 strike, which shed 40.14 lakh contracts, followed by 19,100 and 19,000 strikes, which shed 21.99 lakh and 8.26 lakh contracts, respectively.

On the Put side, the maximum open interest was at 19,300 strike, with 94.11 lakh contracts, which can be a crucial support level for the Nifty50 in the coming sessions.

This was followed by the 19,000 strike, comprising 93.57 lakh contracts, and the 19,200 strike, which has 76.23 lakh contracts.

Put writing was seen at 19,300 strike, which added 83.12 lakh contracts, followed by 19,200 strike and 19,400 strike, which added 29.27 lakh contracts and 17.36 lakh contracts, respectively.

We have seen Put unwinding at 19,000 strike, which shed 24.84 lakh contracts, followed by 19,100 and 18,200 strikes, which shed 12.07 lakh contracts and 8.84 lakh contracts, respectively.

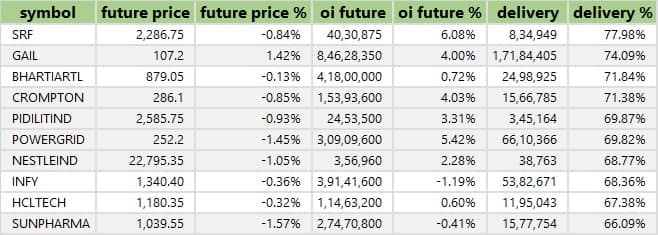

Stocks with high delivery percentage

A high delivery percentage suggests that investors are showing interest in the stock. We have seen the highest delivery in SRF, GAIL India, Bharti Airtel, Crompton Greaves Consumer Electricals, and Pidilite Industries among others.

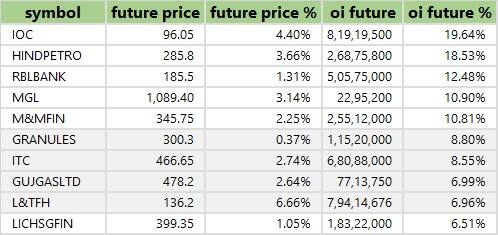

We have seen a long build-up in 56 stocks including Indian Oil Corporation, Hindustan Petroleum Corporation, RBL Bank, Mahanagar Gas, and M&M Financial Services, based on the open interest (OI) percentage. An increase in open interest and price indicates a build-up of long positions.

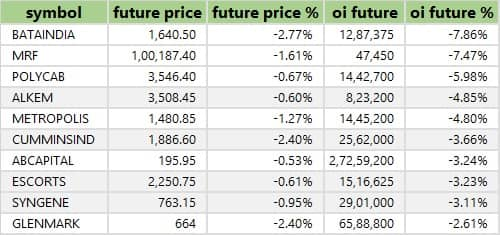

Based on the OI percentage, 34 stocks including Bata India, MRF, Polycab India, Alkem Laboratories, and Metropolis Healthcare saw a long unwinding. A decline in OI and price generally indicates a long unwinding.

61 stocks see a short build-up

We have seen a short build-up in 61 stocks including Persistent Systems, Bandhan Bank, JK Cement, Atul, and Divis Laboratories, based on the OI percentage. An increase in OI along with a price decrease indicates a build-up of short positions.

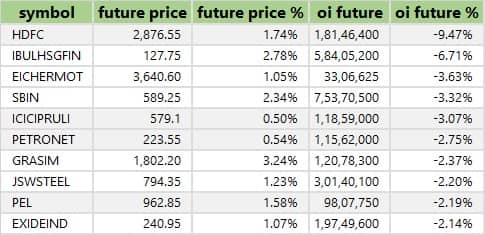

Based on the OI percentage, 36 stocks were on the short-covering list. These included HDFC, Indiabulls Housing Finance, Eicher Motors, State Bank of India, and ICICI Prudential Life Insurance Company. A decrease in OI along with a price increase is an indication of short-covering.

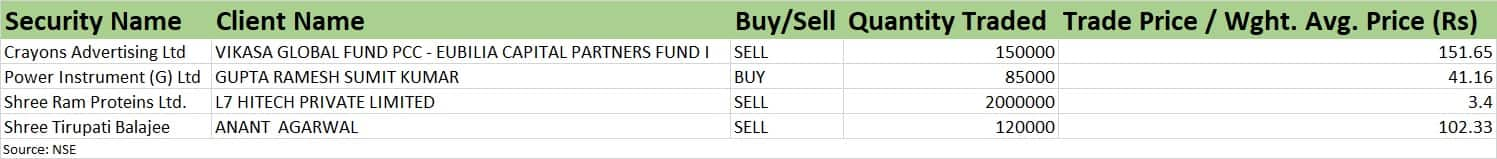

(For more bulk deals, click here)

Investors Meetings on July 4

Adani Transmission: Company officials will interact with investors in equity non-deal roadshow.

Suyog Telematics: Management of the company will meet various investors.

SIS: Company's officials will interact with BOB Capital Markets.

Hero MotoCorp: Officials of the company will interact with analysts and investors.

Stocks in the news

HMA Agro Industries: The company will make its debut on the BSE and NSE on July 4 after closing the public issue on June 23 with 1.62 times subscription. The final issue price has been fixed at Rs 585 per share.

Bajaj Finance: The new loans booked during Q1 FY24 grew by 34 percent to 9.94 million compared to 7.42 million in Q1FY23. Deposits book stood at approximately Rs 49,900 crore as of June 2023, increasing 46 percent over Rs 34,102 crore as of June 2022. Assets under management increased by 32 percent to Rs 2.7 lakh crore in Q1FY24 against same period last year. Consolidated net liquidity surplus stood at Rs 12,700 crore as of June 2023.

Avenue Supermarts: The operator of hypermarkets chain D-Mart has clocked a 18.1 percent year-on-year growth in standalone revenue at Rs 11,584.44 crore for the quarter ended June FY24, up from Rs 9,806.9 crore in same period last year. The total number of stores as of June 2023 stood at 327.

Vedanta: The miner's cast metal aluminium production increased by 2 percent YoY and 1 percent QoQ to 579kt (kilo tonnes) due to efficiency in the operations. Highest-ever mined metal production in Q1FY24 at 257kt rose by 2 percent YoY due to higher ore production, primarily at Rampura Agucha and Kayad mines, supported by improved mined metal grades and better mill recovery.

IDFC First Bank: The bank said the board members have approved the amalgamation of IDFC with the bank. The share exchange ratio for the amalgamation will be 155 equity shares of IDFC First Bank for every 100 equity shares of IDFC. As a result of the proposed merger, the standalone book value per share of the bank would increase by 4.9 percent as per financials FY23.

Lupin: The pharma company has received approval from the United States Food and Drug Administration (US FDA) for its abbreviated new drug application for Cyanocobalamin nasal spray. Cyanocobalamin is a generic equivalent of Nascobal nasal spray, which is available in the strength of 500 mcg per spray, of Par Pharmaceutical Inc. This product will be manufactured at Lupin’s Somerset facility in the US.

Tube Investments of India: The auto ancillary company has forayed into electric small commercial vehicle business as its subsidiary Tl Clean Mobility (TICMPL) has entered into an agreement with Anand Jayachandran for pursuing electric small commercial vehicle business (e-SCV) through a subsidiary to be incorporated by TICMPL. TICMPL will be investing Rs 160 crore and Anand Jayachandran will be investing Rs 40 crore in the form of equity.

Fund Flow

Foreign institutional investors (FII) bought shares worth Rs 1,995.92 crore, whereas domestic institutional investors (DII) sold shares worth Rs 337.80 crore on July 3, provisional data from the National Stock Exchange shows.

Stock under F&O ban on NSE

The National Stock Exchange has retained Indiabulls Housing Finance to its F&O ban list for July 4. Securities thus banned under the F&O segment include companies where derivative contracts have crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!