The market closed with third of a percent gains on May 10, though we have seen some volatility during the day, as there was caution ahead of US inflation data which was in line with estimates at 4.9 percent for April.

The BSE Sensex rose 179 points to 61,940, while the Nifty50 closed above 18,300 levels for the first time in the current calendar year, climbing 49 points to 18,315 and forming a Dragonfly Doji kind of pattern on the daily scale, indicating tug of war between bulls and bears.

"Normally, the formation of such Doji pattern at the highs post reasonable upside calls for caution for bulls at the hurdles. But, having formed this pattern within a range movement, the predictive value of this pattern could be less," Nagaraj Shetti, Technical Research Analyst at HDFC Securities said.

Though the Nifty placed at the strong overhead resistance of 18,250-18,300 levels, there is no indication of any reversal pattern unfolding at the highs, he feels.

Hence, "any weakness from here could find support around 18,200-18,000 band. A decisive move above 18,300-18,400 levels could open the next upside target of around 18,600-18,700 levels in the near term," he said.

The broader markets closed flat with a positive bias, while the India VIX, which measures the expected volatility in the next thirty days for Nifty50, rose by 3.19 percent to 13.08 levels.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks in this article are the aggregates of three-month data and not just the current month.

Key support and resistance levels on Nifty

The pivot charts indicate that the Nifty may get support at 18,241, followed by 18,214 and 18,170. If the index advances, 18.,328 is the initial key resistance level to watch out for followed by 18,356 and 18,400.

The Bank Nifty also gained 133 points to close at 43,331 and formed a Bullish Pin Bar kind of candle on the daily scale with a long lower shadow as buying is visible at lower zones.

"Index has got stuck in the wider range on a daily scale from past four sessions with buying visible near 42,800 levels while facing selling pressure near 43,600 levels. Now it has to hold above the 43,000 mark to make an up move towards 43,600, followed by 43,750 levels, whereas on the downside support is expected at 43,000 and 42,750 levels," Chandan Taparia, Senior Vice President, Analyst-Derivatives at Motilal Oswal Financial Services said.

As per the pivot point calculator, the Bank Nifty may take support at 42,964, followed by 42,832 and 42,617. Key resistance levels are expected to be 43,393 along with 43,526 and 43,740.

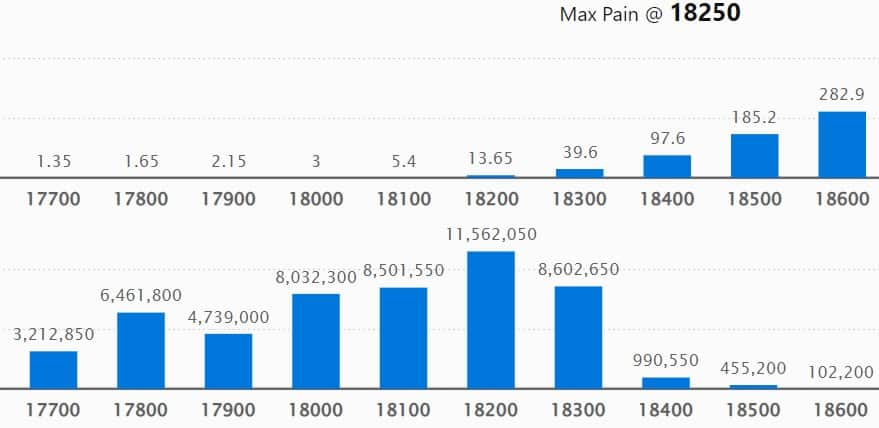

On the weekly options front, we have seen the maximum Call open interest (OI) at 18,500 strike, with 1.18 crore contracts, which is expected to be a crucial resistance level for the Nifty in the coming sessions.

This was followed by 18,400 strike, comprising 98.63 lakh contracts, and 18,300 strike, with more than 75.64 lakh contracts.

Call writing was seen at 18,500 strike, which added 16.08 lakh contracts, followed by 18,400 strike, which added 7.59 lakh contracts, and 19,000 strike which added 1.86 lakh contracts.

Call unwinding was at 18,300 strike, which shed 29.7 lakh contracts, followed by 19,100 strike, which shed 17.84 lakh contracts, and 18,200 strike, which shed 14.81 lakh contracts.

The maximum Put open interest was at 18,200 strike with 1.15 crore contracts, which is expected to act as an important support level in the coming sessions.

This was followed by the 18,300 strike, comprising 86.02 lakh contracts, and the 18,100 strike where we have 85.01 lakh contracts.

Put writing was seen at 18,300 strike, which added 37.91 lakh contracts, followed by 18,200 strike, which added 14.64 lakh contracts, and 17,900 strike, which added 2.84 lakh contracts.

We have seen Put unwinding at 17,500 strike, which shed 6.06 lakh contracts, followed by 17,700 strike, which shed 5.23 lakh contracts, and 18,000 strike, which shed 4.27 lakh contracts.

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in the stock. The highest delivery was seen in Sun Pharmaceutical Industries, Atul, SBI Life Insurance Company, Alkem Laboratories, and Infosys, among others.

An increase in open interest (OI) and price typically indicates a build-up of long positions. Based on the OI percentage, 58 stocks, including Indraprastha Gas, Siemens, Hindustan Petroleum Corporation, India Cements, and Divis Laboratories saw long build-ups.

A decline in OI and price generally indicates a long unwinding. Based on the OI percentage, 31 stocks including Canara Bank, Astral, Alkem Laboratories, Whirlpool, and Rain Industries saw a long unwinding.

37 stocks see a short build-up

An increase in OI along with a price decrease indicates a build-up of short positions. Based on the OI percentage, 37 stocks, including Aarti Industries, Punjab National Bank, UPL, PFC, and Polycab India saw a short build-up.

A decrease in OI along with a price increase is an indication of short-covering. Based on the OI percentage, 61 stocks were on the short-covering list. These included Oracle Financial, Lupin, Pidilite Industries, Samvardhana Motherson International, and Voltas.

(For more bulk deals, click here)

Asian Paints, Eicher Motors, Siemens, Aditya Birla Capital, Balrampur Chini Mills, BLS International Services, CARE Ratings, Deepak Nitrite, Gillette India, Gujarat State Petronet, Intellect Design Arena, Dr Lal PathLabs, PTC India Financial Services, Shankara Building Products, South Indian Bank, Ujjivan Small Finance Bank, and Zensar Technologies will be in focus ahead of quarterly earnings on May 11.

Stocks in the news

Larsen & Toubro: The engineering and infrastructure major has recorded a 10 percent year-on-year growth in consolidated profit at Rs 3,987 crore in the quarter ended March FY23 despite a drop in operating margin. Revenue from operations grew by 10 percent to Rs 58,335 crore compared to the year-ago period.

Dr Reddy's Laboratories: The pharma major has registered an 11-fold year-on-year increase in profit at Rs 959 crore for the March FY23 quarter as profit in Q4FY22 was impacted by impairment of non-current assets, but supported by healthy operating performance. Revenue for the quarter increased by 16 percent to Rs 6,297 crore compared to the year-ago period, with North America business growing 27 percent, Europe 12 percent, and India business showing a 32 percent growth YoY.

Hindalco Industries: Subsidiary Novelis said its net income attributable to the common shareholder in Q4FY23 was $156 million, down 27 percent compared to the year-ago period. Net income from continuing operations excluding special items was $175 million, down 7 percent YoY, while adjusted EBITDA of $403 million fell 6 percent YoY.

Godrej Consumer Products: The FMCG company has reported a 24.5 percent year-on-year growth in consolidated profit at Rs 452.1 crore for quarter ended March FY23, backed by better-than-expected operating numbers. Consolidated revenue grew by 10 percent YoY to Rs 3,200.2 crore in Q4FY23 with volume growth of 6 percent.

HDFC: The company has received final approval from the Securities and Exchange Board of India (SEBI) for a change in control of HDFC Asset Management Company, investment manager of HDFC AMC AIF II on account of the proposed composite scheme of amalgamation for the amalgamation of HDFC Investments and HDFC Holdings with HDFC, and HDFC with HDFC Bank.

Gujarat Gas: The leading city gas distribution company has reported a half a percent sequential decline in profit at Rs 369.22 crore for the quarter ended March FY23, impacted by weak operating performance. Revenue from operations (net of excise duty) in Q4FY23 grew by 6.6 percent to Rs 3,928.6 crore compared to the previous quarter.

CSB Bank: The private sector lender has appointed Satish Gundewar as Chief Financial Officer with effect from June 5, 2023. BK Divakara will step down as CFO on June 4.

Fund Flow

Foreign institutional investors (FII) bought shares worth Rs 1,833.13 crore, whereas domestic institutional investors (DII) sold shares worth Rs 789.67 crore on May 10, provisional data from the National Stock Exchange showed.

Stocks under F&O ban on NSE

The National Stock Exchange retained Canara Bank, BHEL, GNFC and Manappuram Finance on its F&O ban list for May 11. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.