After losing the momentum from day's high in late trade in the previous session, the market continued its downtrend amid volatility on August 31 too, the monthly F&O expiry day. Going ahead, the Nifty50 is likely to take a support at 19,250-19,200 area and the failure to hold the same can extend selling up to 19,100-18,900 levels, while the 19,400-19,500 level is expected to remain as a key hurdle area on the higher side, experts said.

The BSE Sensex dropped 256 points to 64,831, while the Nifty50 declined 94 points to 19,254 and formed bearish candlestick pattern on the daily scale. The index has broken 50-day EMA (exponential moving average placed at 19,289).

"Technically, the candlestick pattern indicates that the market is now placed at the edge of downside breakout of the support around 19,250-19,200 levels," Nagaraj Shetti, technical research analyst at HDFC Securities said.

The negative chart pattern like lower tops and bottoms is intact on the daily chart. Hence, he feels the underlying trend of Nifty remains choppy with weak bias.

"There is a possibility of weakness below 19,200 levels in the coming sessions. The strong support is placed around 19,000-18,900 levels, where one may expect a sizable upside bounce from the lows," Nagaraj said.

The broader markets continued to see buying interest as the Nifty Midcap 100 index gained 0.11 percent and Smallcap 100 index rose 0.8 percent. The market breadth was not very weak as it slightly tilted in favour of bears.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks are the aggregates of three-month data and not just the current month.

Key support and resistance levels on Nifty

The pivot point calculator indicates that the Nifty may get support at 19,226, followed by 19,226 and 19,124. In case of an upside, 19,351 can be the key resistance, followed by 19,390 and 19,453.

On August 31, the Bank Nifty remained under pressure for second consecutive session, falling 243 points to 43,989 and formed bearish candlestick pattern on the daily timeframe with lower high, lower low formation, but took a support at downward sloping support trendline.

"The upcoming sessions are crucial for the bulls as they aim to defend the critical support zone of 44,000-43,800. Failure to hold this support level could trigger additional declines, potentially pushing the index towards the 43,000 mark," Kunal Shah, senior technical & derivative analyst at LKP Securities said.

On the upside, he feels the immediate obstacle for the index lies at 44,200. If the index manages to breach this level, it could set the stage for further upward movement towards the 44,500 level, he said.

The pivot point calculator indicates that the Bank Nifty is likely to take support at 43,902, followed by 43,783 and 43,590. On the upside, the initial resistance is at 44,287, followed by 44,406 and 44,599.

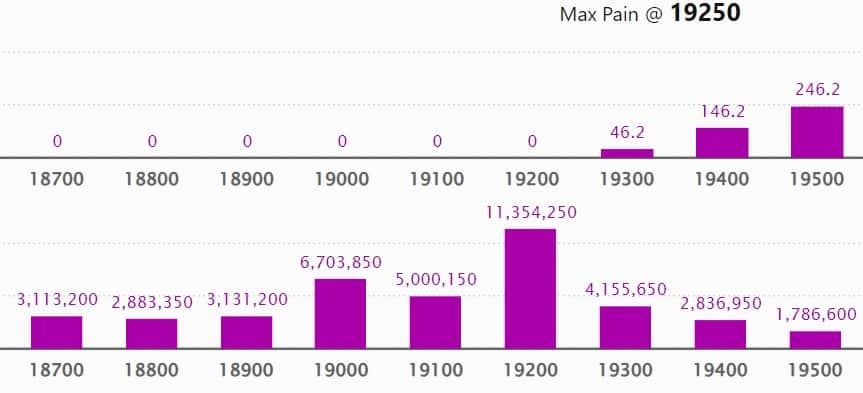

As per the options data, we have seen the maximum monthly Call open interest (OI) at 19,300 strike with 1.27 crore contracts, which can act as a key resistance for the Nifty. It was followed by 19,400 strike, which had 92.53 lakh contracts, while 19,500 strike had 81.63 lakh contracts.

The maximum Call writing was seen at 19,300 strike, which added 62.9 lakh contracts, followed by 20,300 and 19,200 strikes, which added 14.61 lakh and 11.76 lakh contracts, respectively.

We have seen the maximum Call unwinding at 19,500 strike, which shed 76.58 lakh contracts, followed by 19,400 strike and 19,600 strike, which shed 56.2 lakh contracts, and 56.02 lakh contracts, respectively.

On the Put front, the maximum Put open interest was seen at 19,200 strike, with 1.13 crore contracts. This can be an important support for Nifty in the coming sessions.

It was followed by 19,000 strike, comprising 67.03 lakh contracts, and 19,100 strike with 50 lakh contracts.

The maximum Put writing was seen at 19,200 strike, which added 6.91 lakh contracts, followed by 18,900 strike and 18,400 strike, which added 4.01 lakh and 2.79 lakh contracts, respectively.

Meaningful Put unwinding was at 19,300 strike, which shed 80.47 lakh contracts, followed by 19,000 and 19,400 strikes, which shed 25.82 lakh and 18.98 lakh contracts, respectively.

Stocks with high delivery percentage

A high delivery percentage suggests that investors are showing interest in the stock. Tata Communications, Bharti Airtel, Shree Cement, Aditya Birla Capital, and UPL were among the stocks that saw the highest delivery.

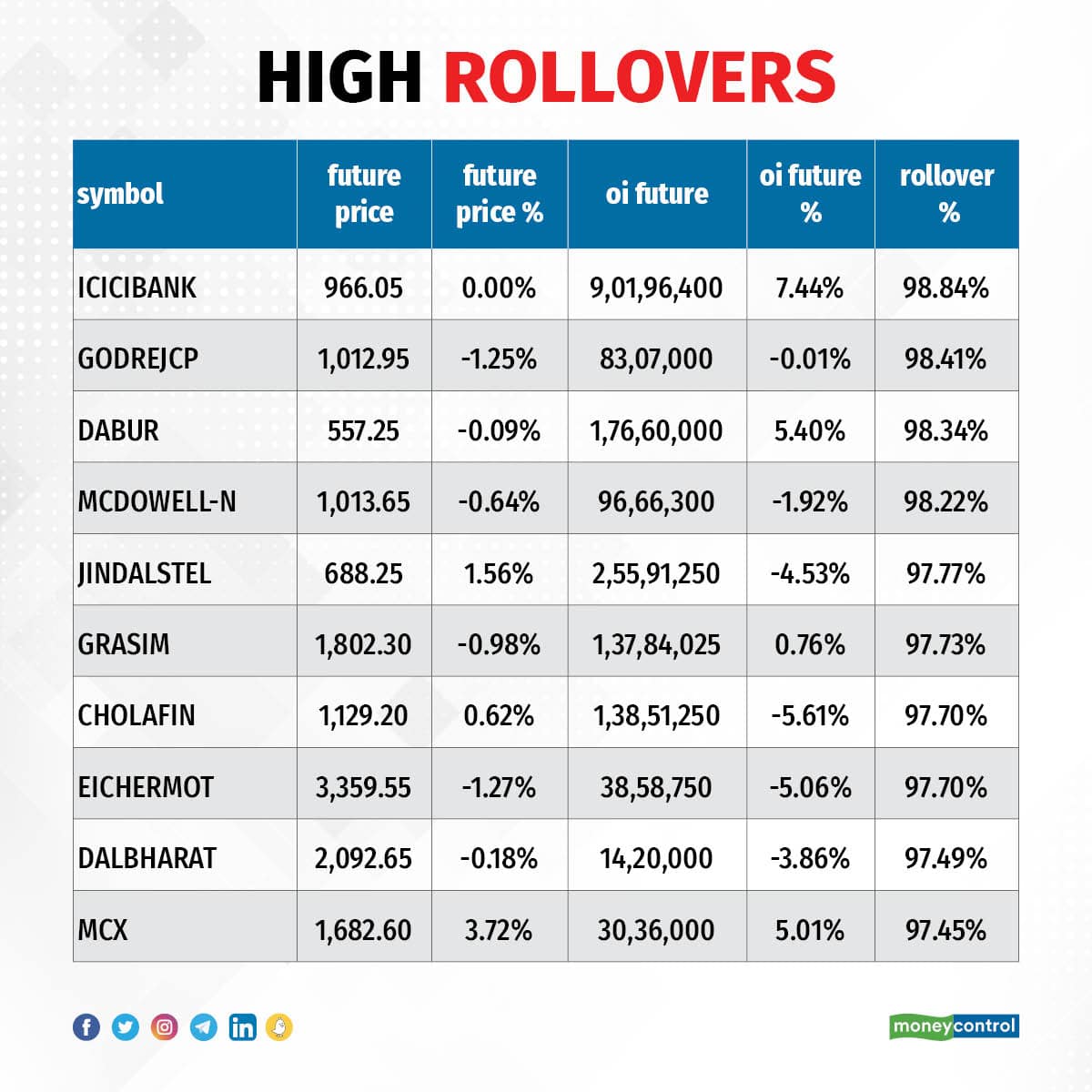

Here are the top 10 stocks which saw the highest rollovers on expiry day including ICICI Bank, Godrej Consumer Products, Dabur India, United Spirits, and Jindal Steel & Power with 97-99 percent rollovers.

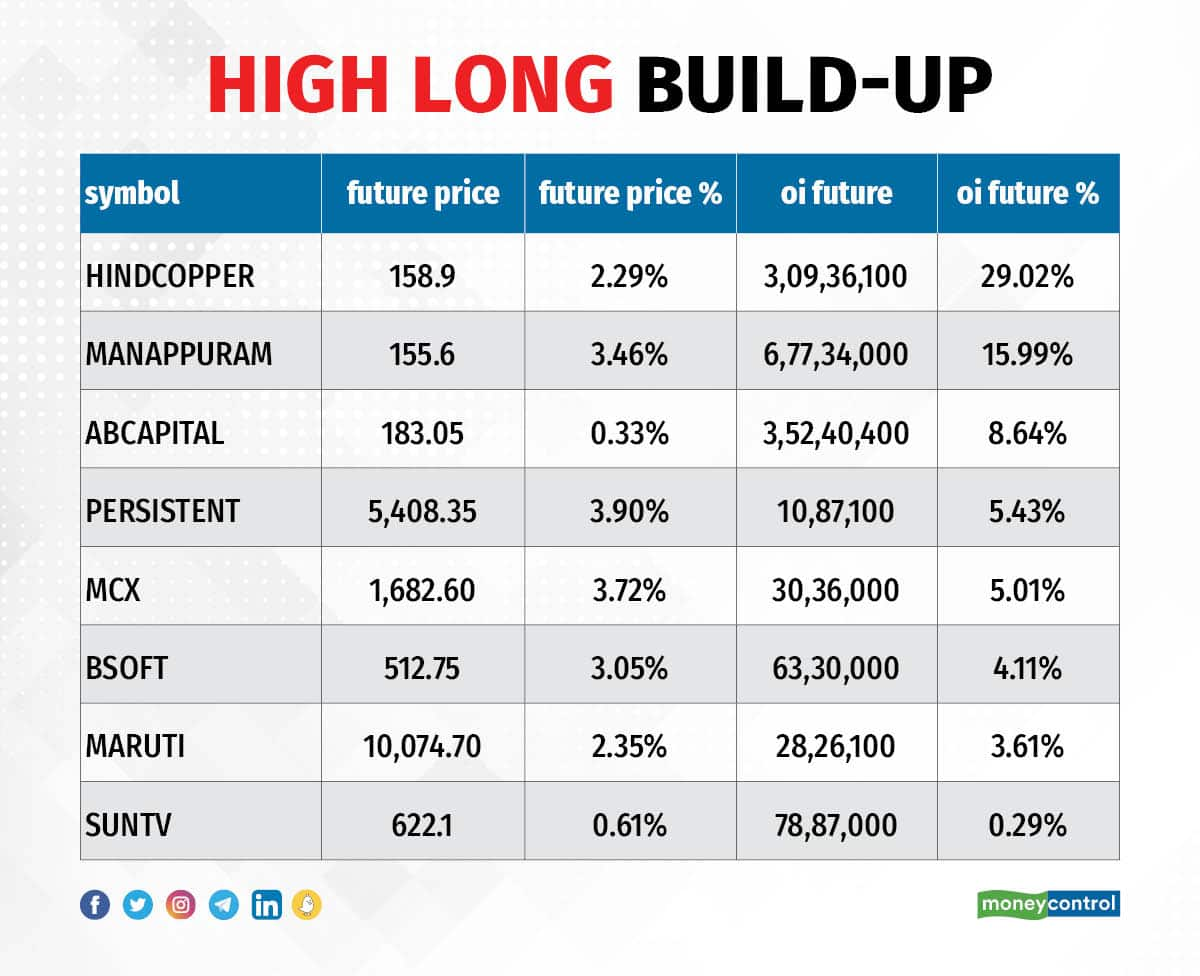

Hindustan Copper, Manappuram Finance, Aditya Birla Capital, Persistent Systems, and MCX India were among the 8 stocks to see a long build-up. An increase in open interest (OI) and price indicates a build-up of long positions.

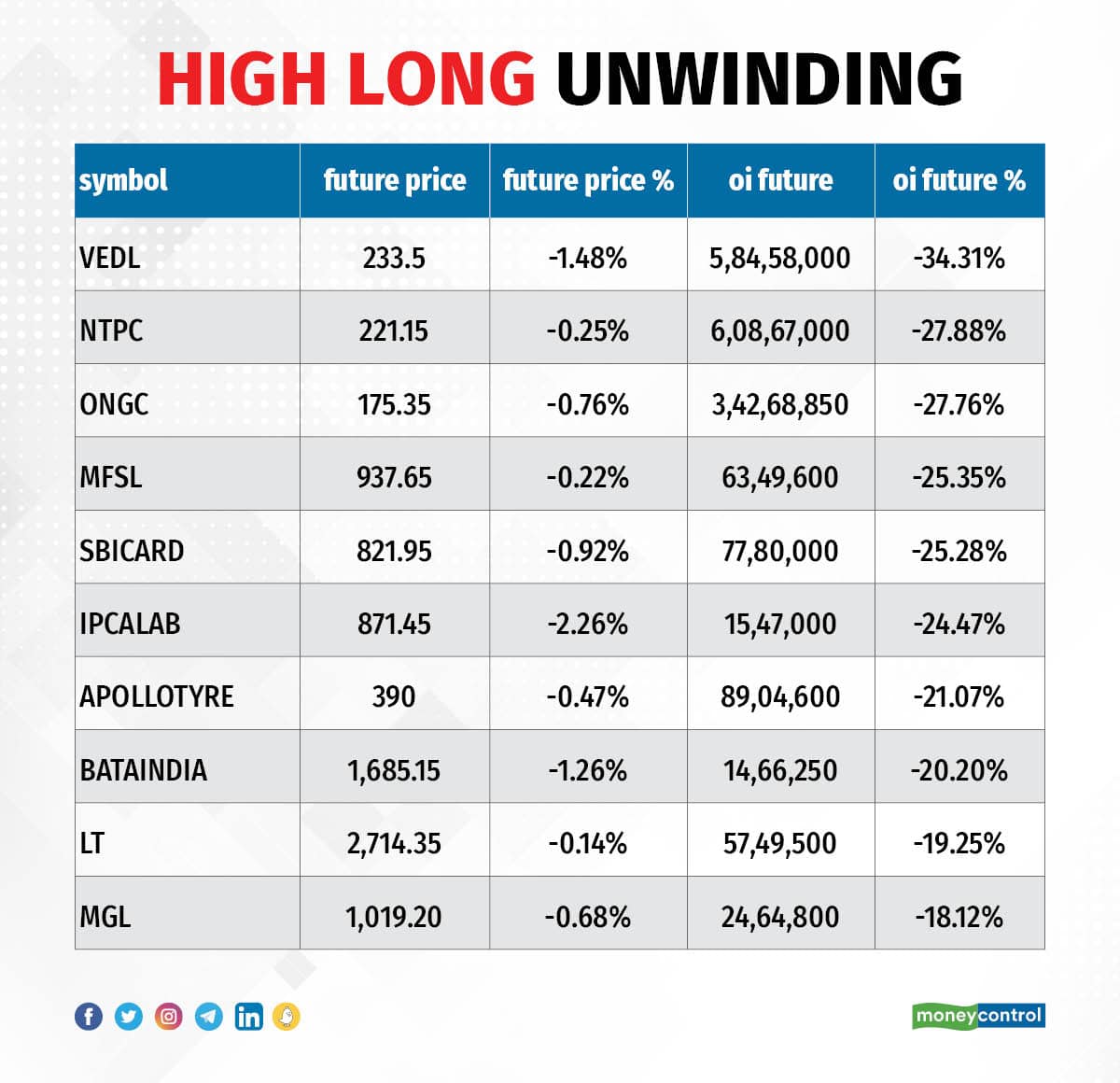

Based on the OI percentage, 98 stocks, including Vedanta, NTPC, ONGC, Max Financial Services, and SBI Card saw long unwinding. A decline in OI and price indicates long unwinding.

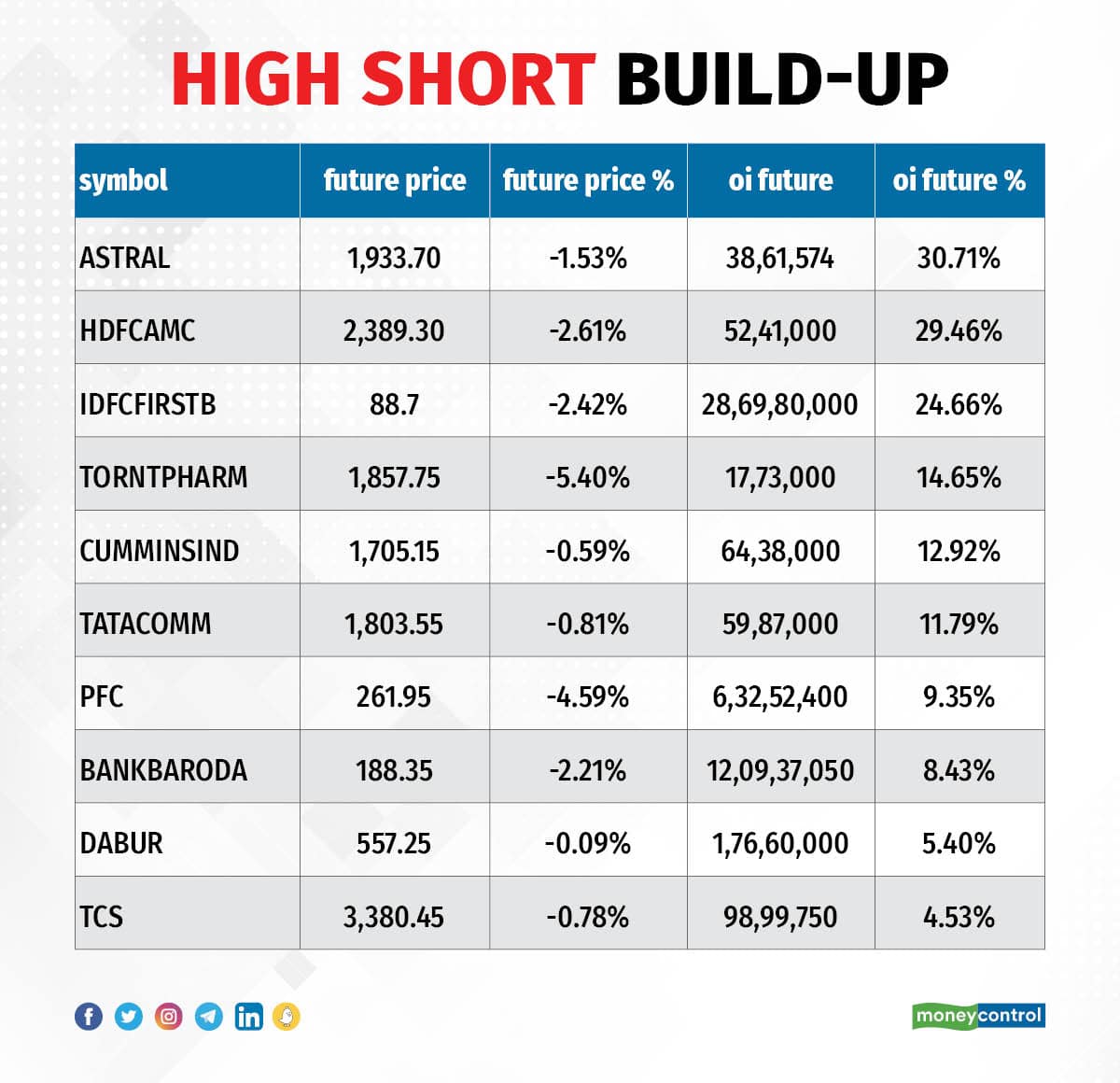

24 stocks see a short build-up

A short build-up was seen in 24 stocks, including Astral, HDFC AMC, IDFC First Bank, Torrent Pharma, and Cummins India. An increase in OI along with a fall in price points to a build-up of short positions.

Based on the OI percentage, 54 stocks were on the short-covering list. These included BHEL, Indiabulls Housing Finance, Jubilant Foodworks, L&T Technology Services, and Infosys. A decrease in OI along with a price increase is an indication of short-covering.

(For more bulk deals, click here)

Investors meeting on September 1

Stocks in the news

Stocks in the news

Torrent Pharma, Cipla: Ahmedabad-based Torrent Pharmaceuticals has likely submitted a non-binding bid to acquire the stake of promoters of pharma major Cipla, reported CNBC-TV18 quoting sources. Torrent Pharma may decide on a binding offer in the coming weeks. According to the news report, the company is also holding talks with three to four private equity companies and foreign institutions as it considers several funding options for the offer.

Container Corporation of India: The Central Government has appointed Sanjay Swarup as the Chairman & Managing Director of the company. Sanjay Swarup is currently Director (International Marketing & Operations) at Container Corporation.

Genus Power Infrastructures: The subsidiary has received a letter of award (LOA) of Rs 2,247.37 crore for appointment of advanced metering

infrastructure service providers (AMISPs). The total order book now stands at around Rs 11,000 crore.

Punjab National Bank: The public sector lender has raised lending rates by 5 bps across tenures. The hike in lending rates is effective from September 1.

India Pesticides: The UP-based agrochemical company is going to buy 11,461 square meters land adjacent to its existing Sandila plant for setting up a manufacturing unit of pesticides. It has received the allotment letter for the said land from the concerned competent authority and the acquisition of this new land will help the company in capex plans for further expansion of Sandila plant.

Navneet Education: The educational syllabus-based supplementary content provider has received board approval for the composite scheme of arrangement, comprising amalgamation of Genext Students and demerging of Edtech business of Navneet Futuretech into Navneet Education.

Fund Flow (Rs Crore)

Foreign institutional investors (FII) sold shares worth Rs 2,973.10 crore, while domestic institutional investors (DII) purchased Rs 4,382.76 crore worth of stocks on August 31, provisional data from the National Stock Exchange (NSE) showed.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!