The market had a healthy rally on July 13 morning but came off record highs in later part of the session due to profit taking at higher levels, and closed with moderate gains, with support from global peers after fall in US inflation. The rally was majorly led by technology and private banking & financial services.

The BSE Sensex surpassed the 66,000-mark for the first time before closing with 165 points gains at 65,559, while the Nifty50 hit a fresh all-time high of 19,567, before ending the session at 19,414, up 30 points and formed bearish candlestick pattern on the daily charts, but made higher high, higher low formation.

Overall, the index remained in the range of 19,300-19,500 levels for sixth straight session. "The indicators still showcase overbought sentiments, but the bulls are resilient in letting loose their grip," said Osho Krishan, Sr. Analyst, Technical & Derivative Research at Angel One.

As far as levels are concerned, he feels an authoritative closure above 19,500 could only trigger the next leg of rally towards 19,600-19,650. On the flip side, a series of support zone could be seen from 19,350-19,300 on an immediate basis, while the sacrosanct support lies at the bullish gap of 19,200-19,235, he said.

The market breadth was in favour of bears with 1:2 ratio. The Nifty Midcap 100 and Smallcap 100 indices were down 0.8 percent and 1 percent, respectively.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks in this article are the aggregates of three-month data and not just the current month.

Key support, resistance levels on Nifty

The pivot point calculator suggests that the Nifty may get support at 19,386, followed by 19,344 and 19,274, whereas in the case of an upside, 19,525 can be a key resistance area followed by 19,568 and 19,637.

On July 13, the Bank Nifty also closed off day's high at 44,665, up 26 points after hitting 45,000 mark intraday. The index has formed bearish candlestick pattern on the daily timeframe, but formed higher high, higher low formation for first time in last seven consecutive sessions.

"The Bank Nifty closed near its 20 DEMA (44,526). Now till it holds below 45,000 levels, some weakness could be seen towards 44,444, then 44,250 levels, whereas on the upside hurdle is expected at 45,000, then 45,250 levels," Chandan Taparia, Senior Vice President | Analyst-Derivatives at Motilal Oswal Financial Services said.

The pivot point calculator indicates that Bank Nifty is likely to take support at 44,607, followed by 44,495 and 44,315, whereas 44,968 can be the initial resistance zone for the index followed by 45,080 and 45,260.

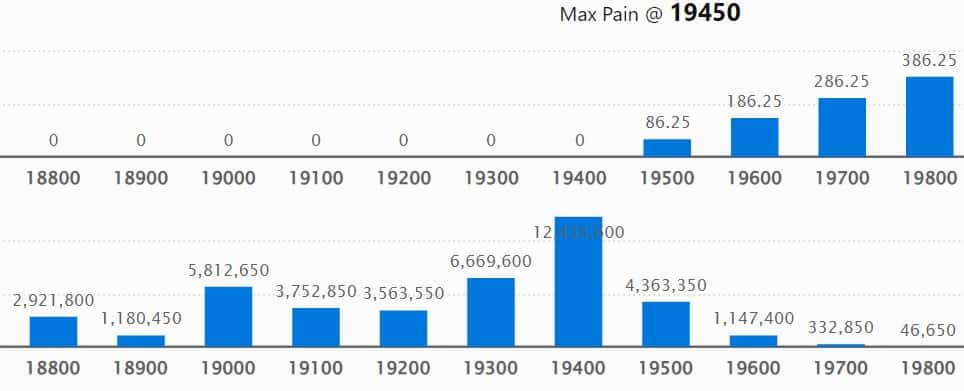

We have seen the maximum weekly Call open interest (OI) at 19,600 strike, with 1.61 crore contracts, which can act as a resistance for the Nifty in the coming sessions.

This is followed by 1.03 crore contracts at 19,500 strike, while 20,000 strike has 77.91 lakh contracts.

Meaningful Call writing was seen at 19,600 strike, which added 19.98 lakh contracts, followed by 19,900 strike, which added 76,050 contracts.

Maximum Call unwinding was at 19,500 strike, which shed 78.8 lakh contracts, followed by 19,400 and 20,400 strikes, which shed 46.17 lakh and 32.09 lakh contracts, respectively.

On the Put side, the maximum open interest was at 19,400 strike, with 1.24 crore contracts, which could be an important support level for the Nifty.

This was followed by the 19,300 strike, comprising 66.69 lakh contracts, and the 19,000 strike, which had 58.12 lakh contracts.

Put writing was seen at 19,400 strike, which added 33.42 lakh contracts, followed by 18,500 and 19,600 strikes, which added 14.79 lakh and 1.7 lakh contracts, respectively.

Put unwinding was at 19,200 strike, which shed 34.71 lakh contracts, followed by 19,300 and 19,100 strikes, which shed 33.8 lakh and 30.66 lakh contracts, respectively.

Stocks with high delivery percentage

A high delivery percentage suggests that investors are showing interest in the stock. The highest delivery was seen in Coal India, Dalmia Bharat, Bharti Airtel, Hindustan Unilever, and Aditya Birla Fashion & Retail among others.

Twenty-six stocks, including Colgate Palmolive, Coforge, Bajaj Finance, Piramal Enterprises, and Intellect Design Arena, saw a long build-up based on the open interest (OI) percentage. An increase in open interest and price indicates a build-up of long positions.

Based on the OI percentage, 66 stocks, including Hindustan Copper, Can Fin Homes, Punjab National Bank, Reliance Industries, and Havells India, saw a long unwinding. A decline in OI and price generally indicates a long unwinding.

70 stocks see a short build-up

A short build-up was seen in 70 stocks, including Delta Corp, Federal Bank, Power Grid Corporation of India, Chambal Fertilizers and Bata India. An increase in OI along with a price fall indicates a build-up of short positions.

Based on the OI percentage, 26 stocks were on the short-covering list. These included Mphasis, Ipca Laboratories, HDFC AMC, Astral, and RBL Bank. A decrease in OI along with a price increase is an indication of short-covering.

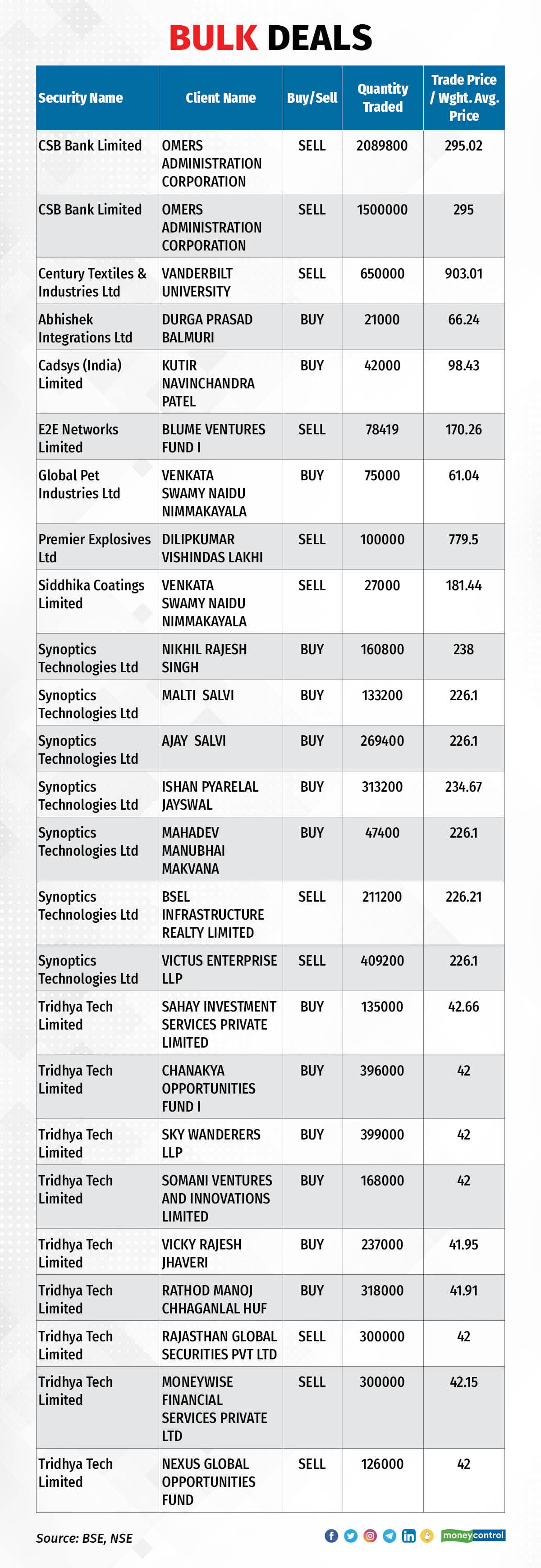

(For more bulk deals, click here)

Results on July 14 and July 15

Stocks in the news

Wipro: The software services provider has recorded a 6.6 percent sequential decline in consolidated profit at Rs 2,870 crore for quarter ended June FY24. IT services revenue fell by 1.8 percent QoQ to Rs 22,755 crore, while revenue in dollar terms at $2,778.5 million marginally beat analysts' estimates, down 1.6 percent QoQ and in constant currency the IT services topline was down 2.8 percent QoQ. Large deal bookings stood at $1.2 billion during the quarter against $1.1 billion in previous quarter. Wipro expects Q2 IT services revenue in dollar terms in the range of $2,722-2,805 million.

Senco Gold: The Kolkata-based jewellery retailer is set to debut on the bourses on July 14. The issue price has been fixed at Rs 317 per share.

Rail Vikas Nigam: The state-owned railway company has received Letter of Award from National Highways Authority of India for rehabilitation and upgradation from 4 to 8 laning of Chandikhole- Paradip section of NH-53 in Odisha on HAM mode. The project is worth Rs 808.48 crore.

Ahluwalia Contracts: The construction company has received a project worth Rs 199.58 crore for civil structural, facade and related external development works for enterprise computing and cybersecurity training institute at Bhubaneshwar. The project is expected to be executed within 20 months.

Angel One: The retail stock broking house has recorded a 21.6 percent year-on-year growth in consolidated profit at Rs 220.8 crore for the quarter ended June FY24, backed by healthy operating and topline performance. Revenue for the quarter at Rs 807.5 crore grew by 18.4 percent over same period last year, while EBITDA jumped 20.2 percent to Rs 320.3 crore and margin expanded by 60 bps to 39.66 percent in Q1FY24. The company has declared first interim dividend of Rs 9.25 per share for FY24.

Deep Industries: The oil & gas field equipment provider has entered into joint venture arrangement with Euro Gas Systems S R L (EGS), for supplying oil filed equipments to the oil & gas industry. EGS has acquired 26 percent equity stake in joint venture company Deep Onshore Drilling Services and the balance 74 percent stake is held by Deep Industries. Deep Onshore Drilling Services is also a subsidiary of Deep Industries.

Samvardhana Motherson International: The auto ancillary company has completed acquisition of 51 percent equity stake in Saddles International Automotive and Aviation Interiors Private Limited. Saddles International is engaged in manufacturing of premium upholstery for passenger vehicles.

Fund Flow

Foreign institutional investors (FII) have net bought shares worth Rs 2,237.93 crore, whereas domestic institutional investors (DII) net sold shares worth Rs 1,196.68 crore on July 13, provisional data from the National Stock Exchange (NSE) shows.

Stocks under F&O ban on NSE

The NSE has added Delta Corp to its F&O ban list for July 14, while retaining Hindustan Copper, Indiabulls Housing Finance, India Cements, Manappuram Finance, Punjab National Bank, and Zee Entertainment Enterprises. Securities thus banned under the F&O segment include companies where derivative contracts have crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

Disclaimer: MoneyControl is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!