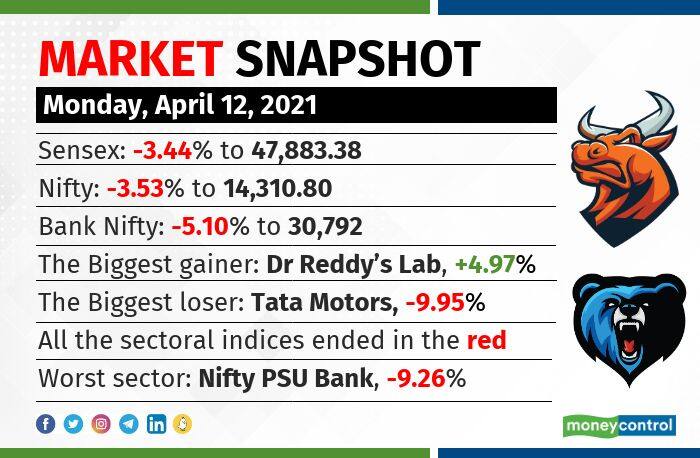

Indian markets plunged on April 12 as surging coronavirus cases spooked investors worried about lockdown-like restrictions hitting nascent economic recovery. At close, the Sensex was down 1,707.94 points, or 3.44 percent, at 47,883.38, and the Nifty was down 524.10 points, or 3.53 percent at 14,310.80.

The overall market capitalisation of BSE-listed firms fell to Rs 200.9 lakh crore from Rs 209.6 lakh crore in the previous session on April 9, making investors poorer by Rs 8.7 lakh crore in a day.

"After resisting at the 14950-15000 level, there has been no respite for the markets. We have witnessed a single slope fall. However, one needs to be cautious at these levels of the index. If we keep below the 14,250 level, we could fall to 13,800-13,900 sooner than later," said Manish Hathiramani, proprietary index trader and technical analyst, Deen Dayal Investments.

"In the short to medium-term time frames, this is the last support for the Nifty. If the index has to bottom out, we need to respect the 14,250 level and bounce from here."

All the sectoral indices ended in the red with the PSU bank index shedding over 9 percent, while auto, energy, infra and metal indices fell 4-5 percent. BSE midcap and smallcap indices also slipped 4-5 percent.

Tata Motors, Adani Ports, IndusInd Bank, Bajaj Finance and UPL were among major losers on the Nifty, while gainers were Dr Reddy’s Laboratories, Cipla, Divis Labs and Britannia Industries.

Stocks & sectorsOn the BSE, the realty index fell 7.7 percent, while power, metal, capital goods, bank and auto indices slipped 4-5 percent.

Among individual stocks, a volume spike of more than 100 percent was seen in Vodafone Idea, SAIL and Godrej Consumer Products.

| Index | Prices | Change | Change% |

|---|---|---|---|

| Sensex | 84,929.36 | 447.55 | +0.53% |

| Nifty 50 | 25,966.40 | 0.00 | +0.00% |

| Nifty Bank | 59,069.20 | 0.00 | +0.00% |

| Biggest Gainer | Prices | Change | Change% |

|---|---|---|---|

| Shriram Finance | 901.70 | 32.25 | +3.71% |

| Biggest Loser | Prices | Change | Change% |

|---|---|---|---|

| HCL Tech | 1,642.40 | -19.00 | -1.14% |

| Best Sector | Prices | Change | Change% |

|---|---|---|---|

| Nifty Infra | 9557.20 | 94.00 | +0.99% |

| Worst Sector | Prices | Change | Change% |

|---|---|---|---|

| Nifty Metal | 10521.10 | 4.95 | +0.05% |

Long buildup was seen in Dr Reddy's Laboratories, Cipla, while a short buildup was seen in Cholamandalam Financial Holdings, RBL Bank and Pfizer.

More than 150 stocks, including Cipla, Mphasis, Dr Lal PathLabs and Cadila Healthcare hit a fresh 52-week high on the BSE.

The Nifty closed in the negative with losses of more than 500 points and formed a bearish belt hold sort of candle on the daily scale.

"Till the Nifty remains below 14,500 zones, weakness could continue for the downside move towards 14,100 and psychological 14,000 zones, while on the upside, hurdles are seen at 14,650 and 14,800 zones," said Chandan Taparia of Motilal Oswal Financial Services.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.