It’s no secret that one of the most important decisions that any entrepreneur or businessperson will make in 2022 is choosing the right payment gateway for their business. That’s because customers can love your entire brand journey but if you falter in any way at the product checkout stage, it tends to leave a bad impression that is hard to recover from.

From loss of sales to negative word of mouth and brand image and lower customer loyalty among others, having the wrong payment gateway could be a disaster in more ways than one. Indeed, you could even say that when it comes to online payments, the last impression is often the best impression.

Which is why we’ve done all the hard work to help you figure out the best payment gateway that will ensure your brand story translates into sales with a robust and smooth checkout experience. Before we get into that, let us look at eight ways in which you need to evaluate a payment gateway as an online business.

1 – Choice of Payment Solutions – A payment gateway today needs to be smart about offering the widest possible number of payment instruments as well. Gone are the days of simply offering options between debit/ credit cards and Netbanking. Today’s customer needs options like mobile wallets, UPI and more apart from traditional sources. As the decision maker, you need to opt for a gateway that offers all of these options. In fact, the more the merrier as the customer doesn’t need to choose from a limited number of options.

2 – Reliability and Success Rates - Success rates are by far the most important factor for payment gateways since it dictates the frequency of payment failures. The best way to measure them is not during daily or weekly roundups but on sale-heavy and festive days such as like Navratri, Diwali, Christmas and New Year when transactions spike up significantly. A good measure of high success rates even during peak traffic is 'Transactions per second', the higher this is, the more robust and scalable the payment gateway. Another key aspect to look for is the payment gateway's repository of saved cards, bank accounts and UPI IDs. A transaction is more likely to be successful if these details are auto-filled and the customer does not have to re-enter these manually time and time again.

3 – Checkout Experience – By far, the worst experience a customer can have is multiple redirects during checkout. Customers today are looking for superfast checkouts and one-click payments. Having mobile wallet and Buy Now Pay Later support is a must for payment gateways if you like one-click checkout options.

4 – Pricing – Since pricing directly impacts profit margins, one needs to make sure to choose a payment gateway that gives 0% transaction rates on UPI and Rupay debit payments. That’s because today, UPI payments and Rupay debit transactions account for over 50% of all transactions. Depending on your monthly transaction volume, an online business could save close to INR 1 lakh every month.

5 – Platform Compatibility – As your business grows, you are likely to make bigger investments and move to bigger platforms to handle scale and security for your online business. In this instance, businesses shift between various platforms and would need to work with multiple CRM and ERP software as their business scales, hence it is critical that all major CMS, e-commerce platforms, CRM and ERP tools are compatible with your payment gateway.

6 – Settlements – An important point when choosing a payment gateway is to choose one that offers T+1 settlements with no exceptions on holidays. Here ‘T’ refers to the day the transaction is made, T+1 means next day settlements. Since most settlements do not happen on bank holidays, business owners have to wait for holidays to pass over before their accounts gets credited. Choosing one with no such exceptions immensely helps in maintaining cash-flow for businesses of any size.

7 – Security – This goes without saying but its important to stress the security of the payment gateway to ensure it is compatible with the latest standards in all aspects. Thankfully, most gateways are aware of the need to keep up with security standards.

8 – Ease of Onboarding and Integration – Finally, you need to choose a payment gateway that offers an easy way of signing up and integrating with your website and app to make sure there are no delays in implementation of the payment gateway or any long-term compatibility issues.

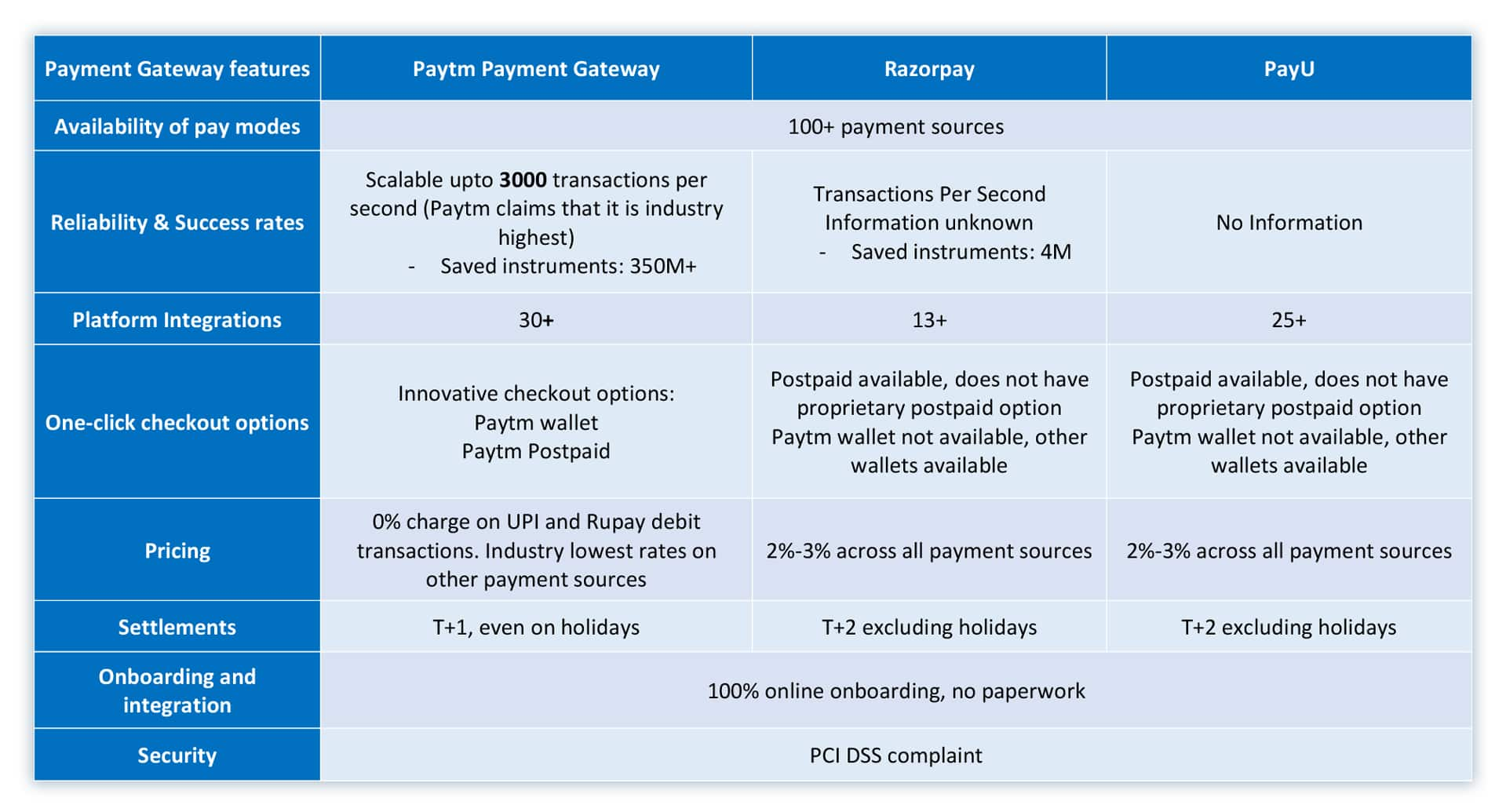

Based on these eight factors, we’ve looked through the top payment gateways in the country and ranked them alongside each of these points to decide which one trumps over the others. Here’s how they stack up:

As you can see, the clear winner when it comes to choosing an online payment gateway is Paytm, thanks to its robust, industry-leading 3000 transactions per second, over 30 platform integrations, T+1 settlements that also includes holidays as well as the option of providing 0% charge on transactions done via UPI and Rupay debit cards.

While the T+1 settlement means that as a business owner you do not have to endlessly wait for payments to hit your bank account, the 0% charge is a game-changer for customers looking to save money on online transactions and preferring Paytm Payment Gateway for the same.

If you’re looking to add a payment gateway for your online business, it makes sense to go with a trusted as well as feature-rich and future-proof platform in the form of Paytm Payment Gateway. Learn more and sign up for your gateway here.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!