The benchmark Sensex recorded its new all-time level on Wednesday June 21, surpassing its previous high level of 63,583 recorded in early December 2022. Nifty50 is also few points from its previous highs. In the past six months, since December 2022, both indices have taken a huge swing of over 10 percent.

Optically the markets may appear flat for the past six months, as the benchmark indices are almost unchanged; but a deeper dive would indicate that many material shifts have occurred in the market during this period of six months. For example:

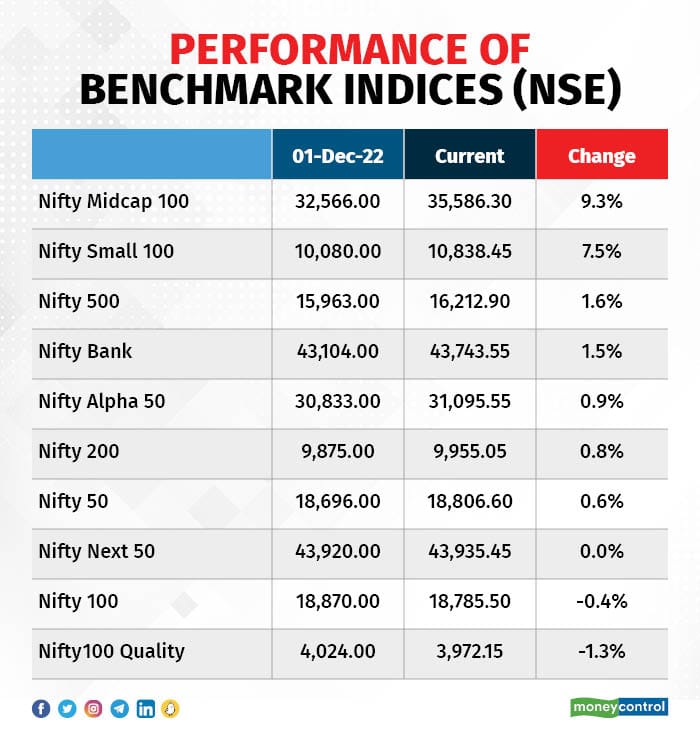

— Nifty50 was almost unchanged for the past six months but Nifty Midcap100 gained over 9 percent and Nifty Smallcap100 over 7 percent in this period.

— The sectors that led the markets to new highs in the post-COVID period such as IT services, pharma, energy and metals actually yielded negative returns in the past six months; while the FMCG sector has been the best performer in this period.

— Nifty PSU banks which were the best-performing sector for the past one year, have actually yielded a negative return for the past six months.

— Despite the turning of the rate cycle upwards, popular rate-sensitive sectors like auto and realty have been amongst the top three performing sectors.

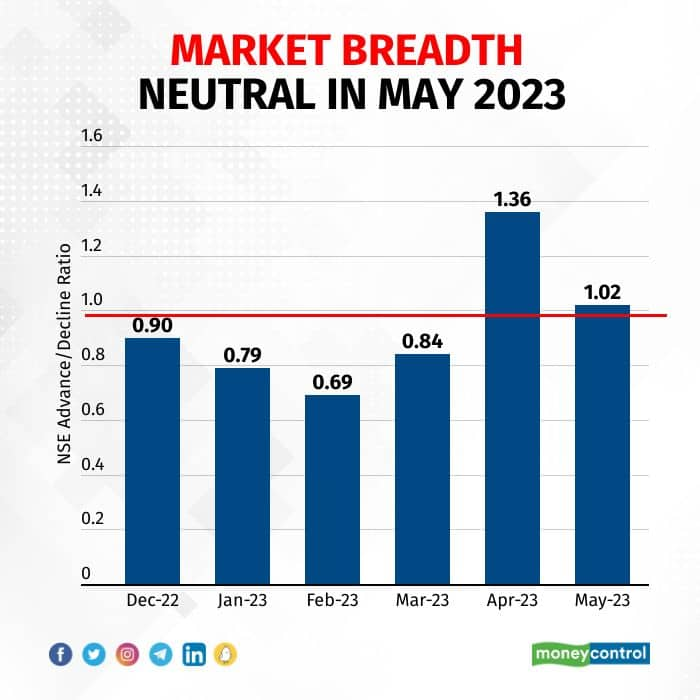

— Despite the sharp outperformance of broader markets, average market breadth for the past six months has been mostly negative. The months of January-March 2023 in fact witnessed the worst market breadth in over two years.

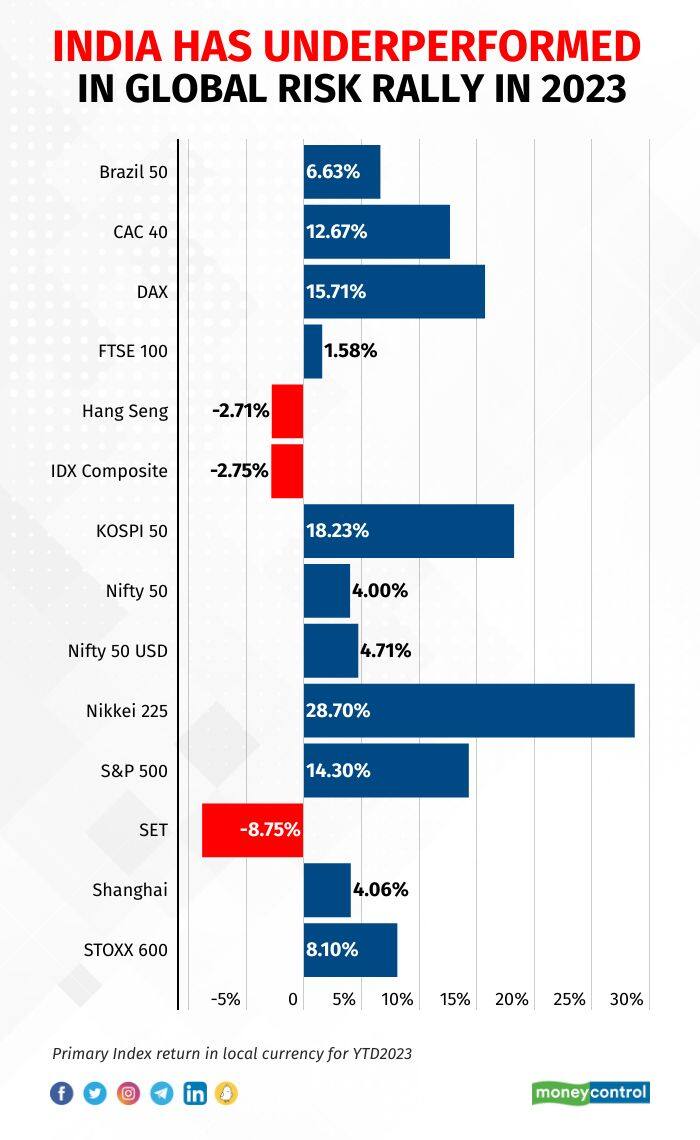

Another pertinent point to note in this context is that Indian markets have sharply underperformed the most emerging market peers and developed markets in the past six months. Note that in 2022 India was one of the top-performing global markets. This is in spite of net foreign flows being positive in the past six months to the tune of Rs 500 billion (vs Rs 1,256 billion outflows for 2022).

Taking a comprehensive look at the market performance during the past six months, I would draw the following conclusions:

1. From the sharp outperformance of broader markets, it is evident that the sentiment of greed is overwhelming the investors’ fears; and signs of irrational exuberance are now conspicuous.

2. Most of the good news (rate and inflation peaking, earnings upgrades, financial stability, etc.) is already well known and exploited; while the fragility in the global economy and markets has increased and hence the present risk-reward ratio for traders may be adverse.

3. From a historical relative valuation perspective, Nifty is currently trading at ~4 percent premium to its 10-year average one-year forward PE ratio. The same premium for Nifty Midcap100 is 14 percent while Nifty Smallcap100 is trading at ~2 percent discount to its 10-year average one-year forward PE ratio. The discount of smallcap PE ratio to Nifty PE ratio is presently close to 22 percent, larger than the 10-year average of 16.5 percent. The sharp outperformance of smallcap may be a consequence of value hunting and irrational exuberance, rather than greed and traders may soon return to Nifty as the valuation gap is filled.

In my opinion, therefore, it would make sense to take some money off the table, especially from broader markets and high-beta stocks.

Vijay Kumar Gaba is Director, Equal India Foundation. Views are personal, and do not represent the stand of this publication.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.