India’s business and consumption activity showed conflicting signs of recovery in July as elevated inflation, rising borrowing costs and fears of a global slowdown weighed on Asia’s third-largest economy.

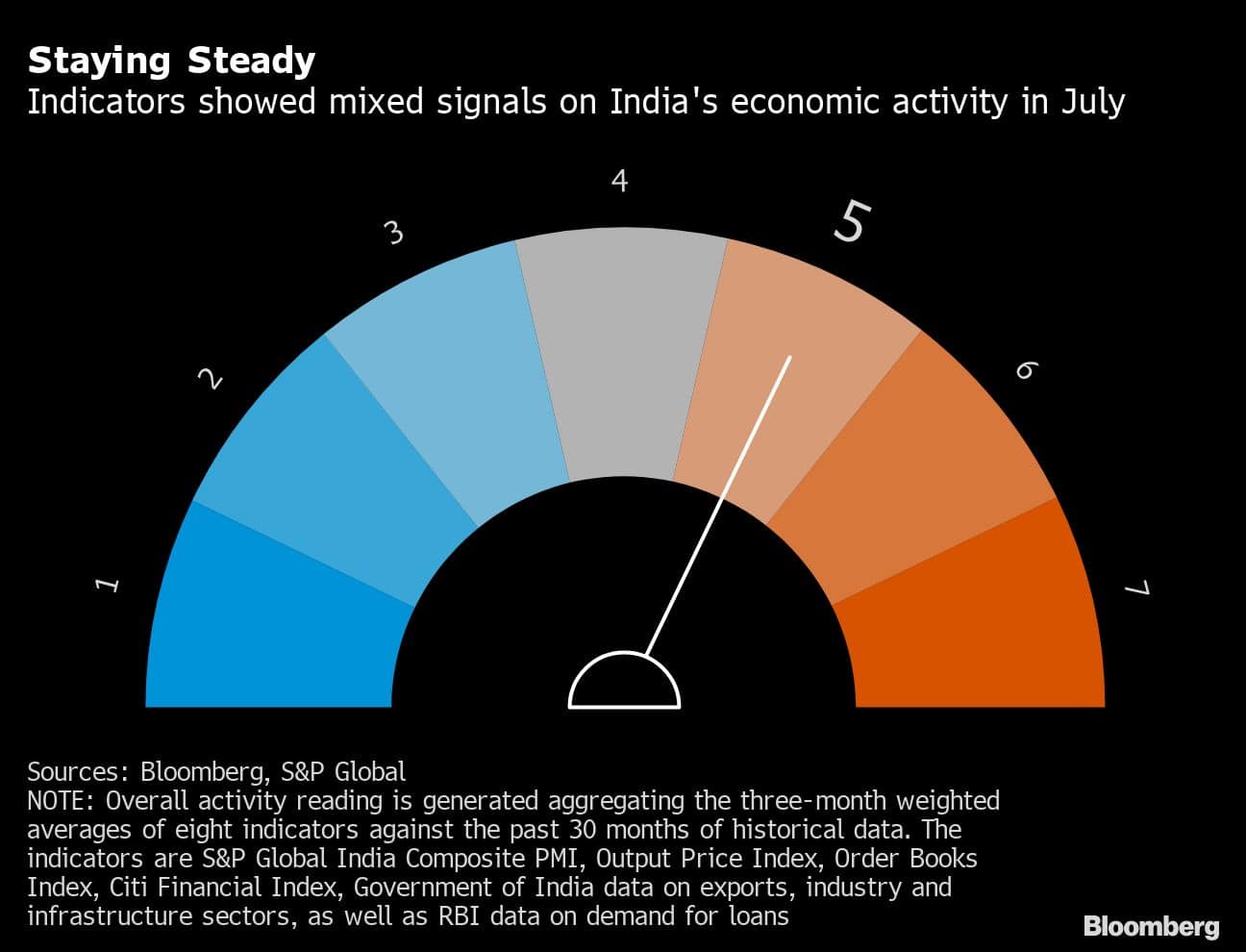

Demand for Indian goods and services softened, a cross-section of high-frequency indicators compiled by Bloomberg News showed. The needle on a dial measuring so-called animal spirits, however, remained steady at 5 last month as the gauge uses a three-month weighted average to smooth out volatility in the single month readings.

The Reserve Bank of India, which has raised interest rates by a total of 140 basis points in three moves this year, has signaled future tightening would be calibrated to ensure there isn’t a massive slowdown in the economy, and sees price pressures moderating from its recent peak. A pulse-check of the economy is due next week, with gross domestic product data for the April-June quarter likely to show a double-digit growth, reflecting demand thanks to a wider reopening from the pandemic.

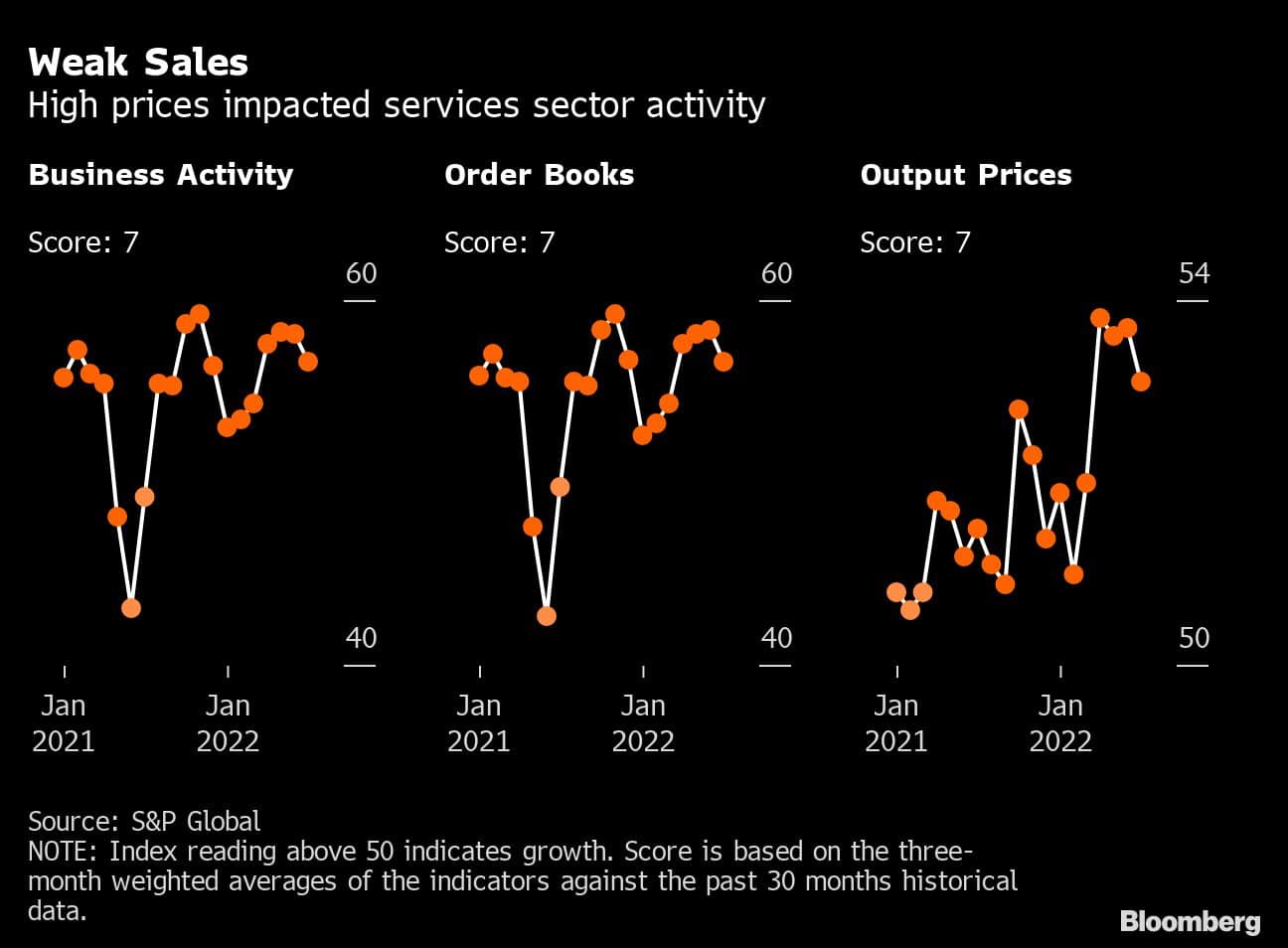

Business Activity

Purchasing managers’ surveys showed India’s services activity in July falling to the lowest level in four months on weaker sales growth and elevated inflation. While domestic demand for Indian services remained steady, international demand worsened, offsetting gains in the manufacturing sector that expanded to the highest level in eight months.

Moderation in business outlook in services pulled down the S&P Global India Composite PMI Index to 56.6 in July, from 58.2 a month earlier.

Exports

Trade deficit widened to a fresh record of almost $30 billion as exports growth slowed to a 17-month low led by weak global demand and a levy on outbound shipments of fuel, which makes up more than 15% of India’s exports.

Imports stayed near the record-high levels due to a weaker rupee, which was one of the worst performing Asian currencies in the last three months. Crude, which comprises about one-third of India’s imports, and coal with an 8% share, primarily contributed to the rise in inbound shipments.

Consumer Activity

Passenger vehicle sales rose for a second-straight month helped by a broad-based recovery in all segments, including two-wheelers. While supply issues due to semiconductor shortage are easing, automakers cautioned that costlier loans could crimp demand for new vehicles.

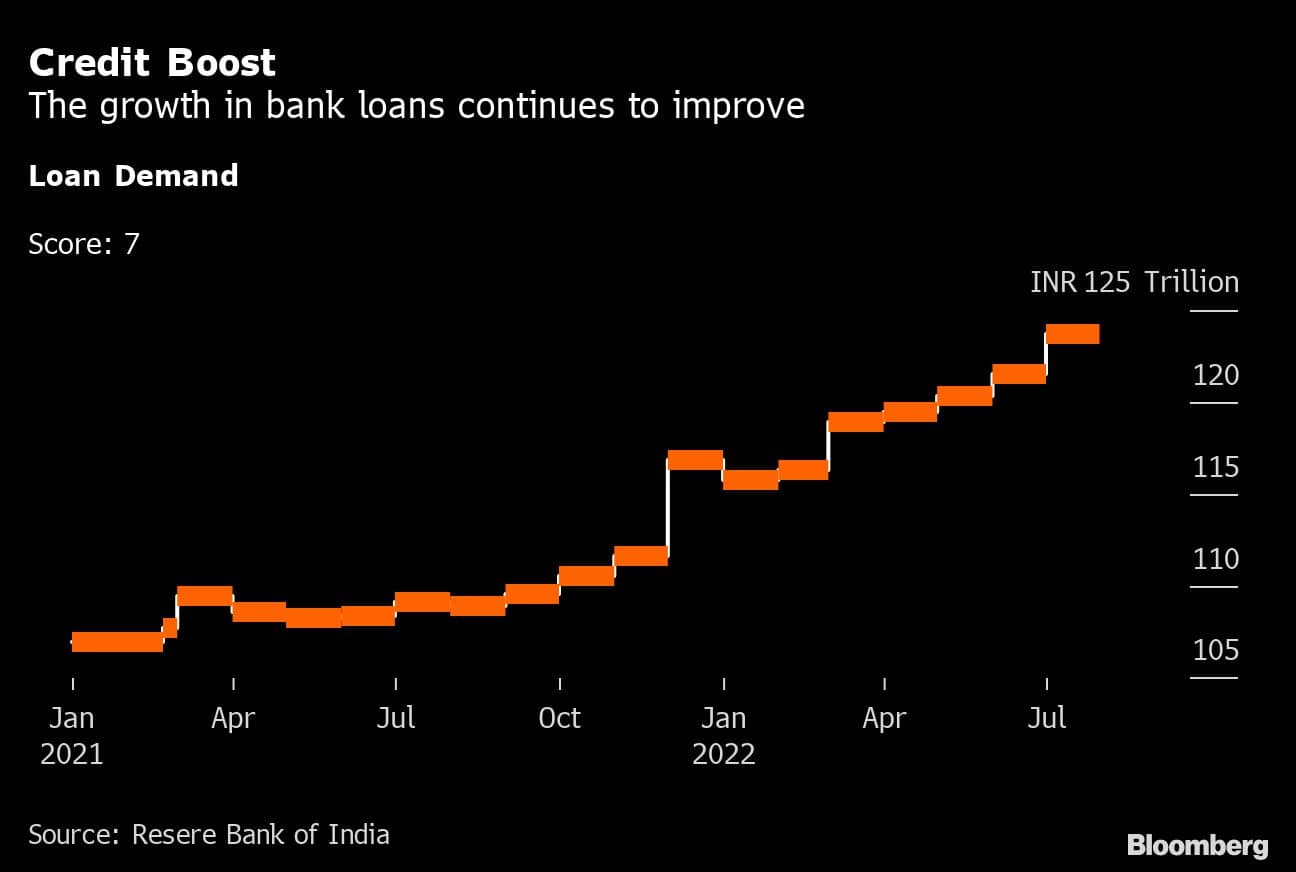

Bank credit continued to grow despite higher interest rates, rising the most in more than three years to 14.5% at the end of July. Liquidity in the banking system continued to remain in surplus.

Industrial Activity

Among signs of industrial activity, factory output as well as core sector signaled moderation in June as electricity consumption and coal production slowed down with the onset of monsoons. The year-on-year growth in Index of Industrial Production eased to 12.3% from a one-year high in May. The growth of eight key infrastructure industries also dropped to 12.8 from 19.3% in the previous month. Both the data are published with a one-month lag.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.