India's creditworthiness is unlikely to face any "material near-term pressure" from the external channel, S&P Global Ratings said on August 25.

"Emerging markets are facing broad-based external pressures from higher commodity prices, US dollar dominance, and tightening financial conditions. India is no exception, with hallmarks of these factors including a higher current account deficit and higher domestic inflation rates," S&P said in a note.

"However, India is facing these trends from a position of relative strength. In particular, India is a net creditor to the world (narrow net external debt basis), meaning that it has some buffer built up against cyclical difficulties such as these. We do not therefore see material near-term pressure to India's creditworthiness on this basis," the ratings agency added.

S&P has a BBB- rating on India with a stable outlook.

The comments from S&P today come after it said earlier in August that the Indian economy can handle some erosion of its foreign exchange reserves as its external position is "very strong".

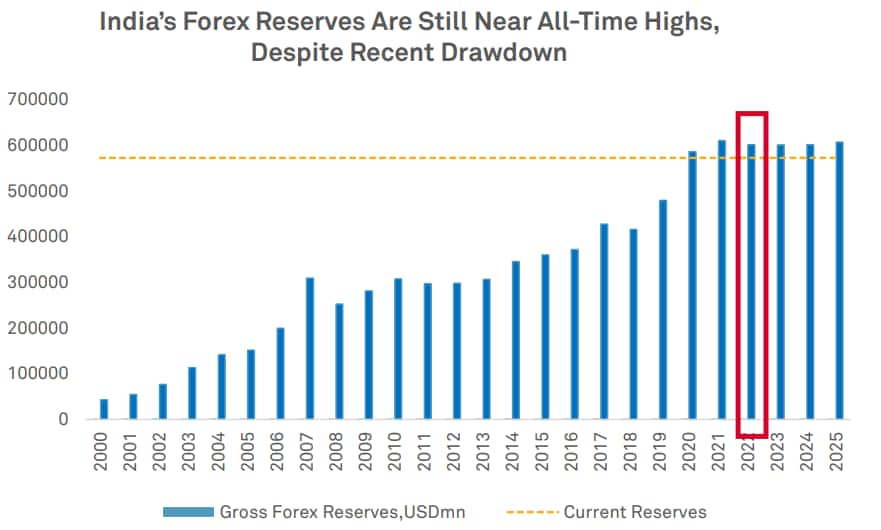

As on August 12, India's foreign exchange reserves stood at $570.74 billion, down more than $70 billion from their peak of $642.45 billion, achieved on September 3, 2021.

India's reserves have fallen over the last year on account of a widening trade deficit following a surge in global commodity prices, with the Reserve Bank of India's (RBI) defence of a weakening rupee also depleting the stock of foreign exchange.

However, according to Andrew Wood, director of Asia Pacific Sovereign Ratings at S&P Global Ratings, India's foreign exchange reserves could recover to around $600 billion given S&P's expectations of the current account deficit for the year and the likely foreign inflows.

"This is pretty ample buffer considering somewhat limited external indebtedness of the Indian economy on the whole," Wood said on August 25 in a webinar.

Source: S&P Global Ratings

Source: S&P Global Ratings

Commenting on the fiscal situation, Wood said India's general government debt is likely to stay elevated in the 8-10 percent range until FY26.

"We are not expecting very powerful fiscal consolidation in India over the next few years. So we are seeing that general government debt remaining quite elevated, certainly above 9 percent of GDP in the current fiscal year and possibly hovering around 8-10 percent of GDP until FY26," Wood said.

The general government fiscal deficit includes that of states in addition to the central government.

Wood pointed out that India's debt stock - at around 90 percent of GDP - and interest burden are high. And while fast economic growth will help avoid further deterioration of the government's finances, a "material sharp downturn" in the economy or the GDP growing at a "much lower rate of growth" for a sustained period would make it difficult to ensure sustainability of the debt, Wood said.

S&P expects India's GDP to grow by 7.3 percent in FY23 and moderate to 6.5 percent or so in the subsequent couple of years.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.