Quick Heal Technologies share price jumped more than 5 percent in the morning trade on March 5 after the firm said a board meeting on March 10 would consider and approve the proposal for buying back the fully paid-up equity shares of the company.

The stock was trading at Rs 182.45, up Rs 10.20, or 5.92 percent, at 1044 hours. It touched a 52-week high of Rs 187. It touched an intraday high of Rs 187 and an intraday low of Rs 180.

"Pursuant to regulations 29(1) and 29(2) of the listing regulations, it is hereby notified that a board meeting of the company is scheduled on March 10, 2021 to consider and approve a proposal for buy back of the fully paid-up equity shares of the company," Quick Heal told exchanges.

The company also informed about Employee Stock Option Scheme -2021 for the aforesaid purpose. It further notified that the trading window for dealing in securities would remain closed from March 5, 2021 to and shall be opened 48 hours after the conclusion of the board meeting for all designated persons in terms of the company’s insider trading code of conduct.

On a consolidated basis, the company reported a 24.3 percent fall in net profit to Rs 13.46 crore on a 6.35 percent rise in net sales to Rs 69.88 crore in Q3 FY21 over Q3 FY20.

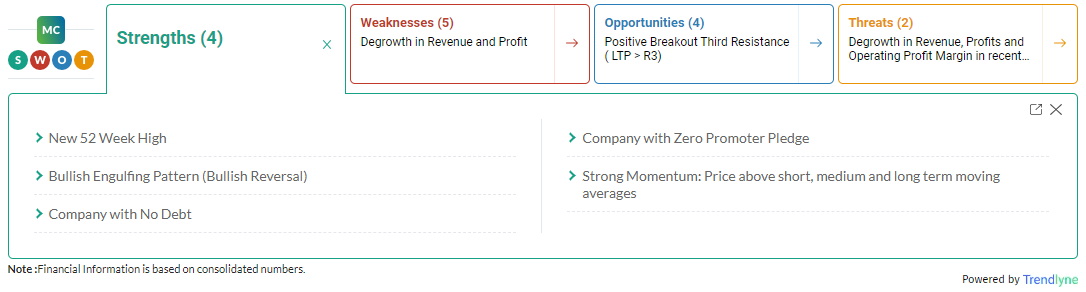

According to Moneycontrol SWOT Analysis powered by Trendlyne, the company has no debt with zero promoter pledge. The stock is showing strong momentum—price above short, medium and long term moving averages.

However, Moneycontrol technical rating is neutral, with moving averages being bullish and technical indicators being neutral.

Disclaimer: The views and investment tips expressed by experts on moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.