India's automotive landscape seems to be going through a significant transformation. It is evident in the sustained slowdown in demand for entry-level cars, particularly hatchbacks, and continued surge in sale of sports utility vehicles (SUVs).

Despite a generally positive growth trajectory in the passenger vehicles (PV) market, cheaper models, those priced below Rs 10 lakh (ex-showroom), are struggling to attract buyers. The trend was underscored by Maruti Suzuki Chairman RC Bhargava in the recent Q2 earnings call.

Bhargava noted that the market for cars under Rs 10 lakh is not only stagnating but also declining. He warned that this decline poses a risk to the entire automotive ecosystem: “Unless the lower end of the market grows, there are going to be no feeders into the upper market.” As entry-level options diminish, manufacturers are concerned about the long-term implications for consumer access to affordable vehicles.

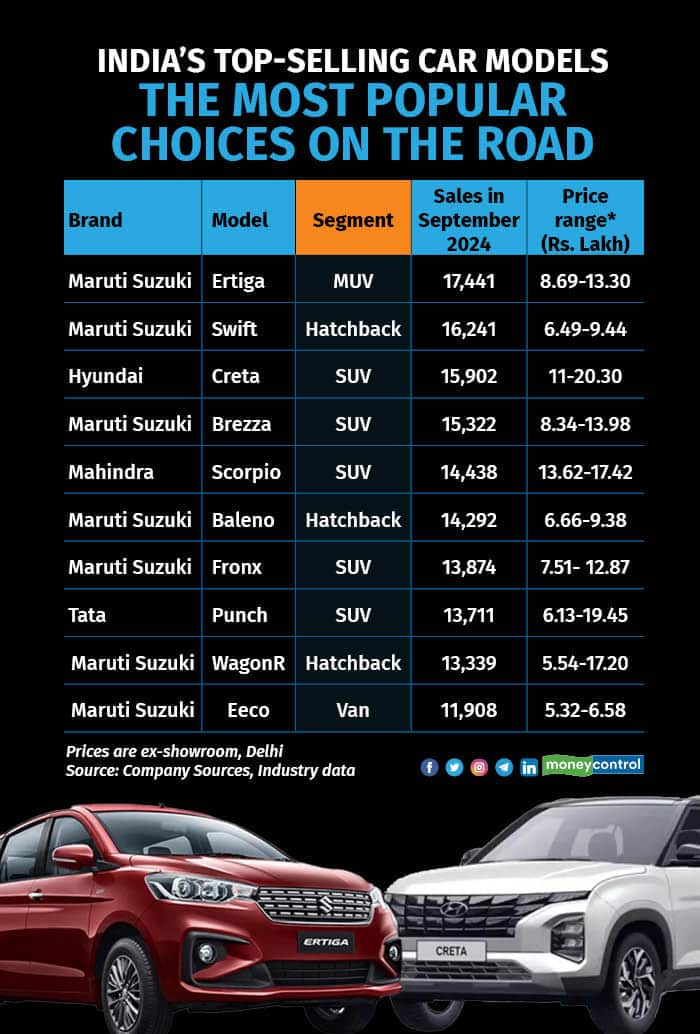

The emergence of subcompact SUVs has shifted consumer preferences away from traditional hatchbacks. Models like the Tata Nexon, Maruti Suzuki Brezza, and Hyundai Venue have gained traction due to their appealing price range of Rs 7.5 lakh to Rs 10.5 lakh, offering a larger vehicle format that many consumers now favour. Bhargava described the trend as a segmentation shift, indicating that growth is now primarily concentrated in more expensive vehicle segments, leaving cheaper cars in a precarious position.

The small car segment, which accounted for roughly 47.4 percent of the PV market in FY2017-18, saw its share plummet to around 30 percent by the first half of FY2024, according to data from the Society of Indian Automobile Manufacturers (SIAM). Sales of minicars such as the Maruti Suzuki Alto and Renault Kwid skidded sharply, with only 78,170 units sold between April and September 2024, representing a 15.56 percent slump over the last year.

The sale of SUVs, priced anywhere between Rs 8 lakh and Rs 1 crore (and above), has been growing over the last few years. In FY24, the SUV segment's market share in India was 50.4 percent, rising from 43 percent in FY23 and 40.1 percent in FY22. As per CRISIL, the it is expected to reach 54-55 percent by the end of FY25.

“We continue to see strong demand for SUVs across various price spectrums in the coming quarters. One of the key reasons is the rising income in rural areas, making people more aspirational. Furthermore, there are substantial government investments in public infrastructure like roads. Above all, normalised availability of semiconductors and increased access to credit are additional growth levers," Tarun Garg, COO of Hyundai India, told Moneycontrol before the company got listed.

One of the principal factors why small cars are failing to charm buyers is a rise in the average selling price (ASP), which has escalated from Rs 2.5-3.5 lakh to Rs 5.5-6.5 lakh due to increased production costs tied to safety and emissions regulations. Arun Malhotra, an auto industry consultant, pointed out that compliance has led to a roughly 40 percent increase in input costs for entry-level models, making them less accessible for first-time buyers.

“Just like premium models, small cars were re-engineered to comply with safety and emissions norms. That ultimately led to the hike in input costs, ultimately driving up the sticker price of the product. With on-road prices of small cars reaching Rs 4-5 lakh, prospective buyers either postpone their purchase plans or look for certified pre-owned cars in the used car market,” Malhotra, who also served as MD of Nissan Motor India, told Moneycontrol.

The used car market has also intensified competition for entry-level new cars. With pre-owned vehicles selling at an average price of Rs 4.5-5 lakh, many consumers are opting for second-hand options that fall within their budget.

Experts suggest that government interventions, such as a GST cut for cars under 3.8 metres, could help revitalise the small car segment. Without such measures, the trend of declining sales in the entry-level market is likely to continue, raising concerns about the future accessibility of affordable vehicles for Indian consumers.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.