The Reserve Bank of India (RBI) currently has no proposal for digital-only banks as suggestions on the same came with certain risks, the central bank's governor said on June 17.

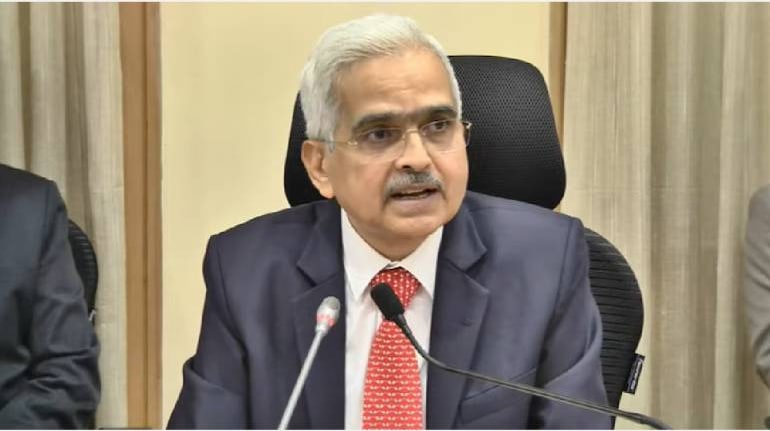

“We had received suggestions on digital bank, but we felt that the idea came with certain risks with it. So we have therefore, not accepted it at the moment,” Shaktikanta Das said at an event in Mumbai.

ALSO READ: RBI to roll out digital lending norms soon, says Governor Shaktikanta Das

There is also no proposal to regulate neo-banks currently, said the RBI head. Banks and non-banking finance companies should use technology for financial service delivery, he added.

In November, top government think-tank Niti Aayog had suggested a three-step process for neo-banking platforms to finally acquire a full-stack digital banking licence and said these entities can eventually be allowed to offer lending, deposits and other banking services to medium, small and micro enterprises (MSMEs).

The suggestions followed recommendation from a working group under the Reserve Bank of India (RBI) to regulate digital banking. The suggestions cover the new wave of neobank fintechs, which work with partner banks and serve as a technology layer for customer acquisition and banking activities for those banks.

These neo-banking platforms include start-ups such as Open, Jupiter, RazorpayX, Fi, Freo and Niyo. In the absence of a banking licence, the neobanks cannot independently undertake banking activities like deposits and lending.

ALSO READ: Entry of big fintech firms in financial services poses systemic risks, says RBI Governor

Meanwhile, although the RBI was keeping a close eye on the players involved in distributing buy-now-pay-later products, it was not keen to regulate it just yet, Das also said today.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.